Tailoring Financial Decisions to the Meaning of Your Family Business

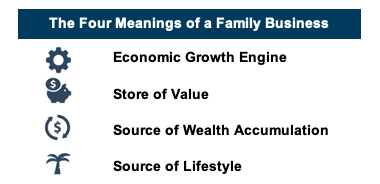

In a previous post, we identified the four basic economic meanings that a family business can have. For some families, the business is an economic growth engine for future generations. For others, the family business is a store of value. Alternatively, the family business can be a source of wealth accumulation or a source of lifestyle for family members.

As noted in our prior post, there are certain family and business characteristics that can help family members discern what meaning “fits” their circumstances best. The meaning of the family business, in turn, has implications for the dividend policy, reinvestment, and financing decisions for the family business.

In this post, we examine how the meaning of the family business influences these corporate finance decisions.

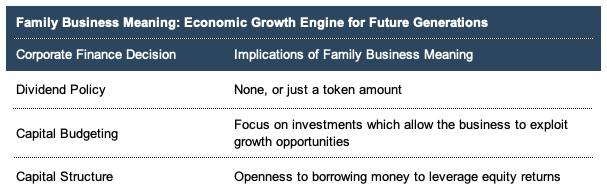

Family Business as an Economic Growth Engine

For some families, the purpose of the business is to grow the family’s wealth for the benefit of future generations. Sustaining or growing per capita business value as the family grows biologically often requires deferring current returns. The following table summarizes how this first meaning influences major corporate finance decisions.

For this meaning to “stick,” family shareholders need to be willing to fund their household expenses and lifestyle choices with other sources of income, whether in the form of wages (inside or outside the family business) or returns on other investments.

The principal risk of adopting this meaning is that, since truly attractive investment opportunities are scarce, the pressure to reinvest may result in the business making increasingly risky investments. Such investments may offer returns high enough to meet growth objectives, but only at the expense of an unattractive risk level.

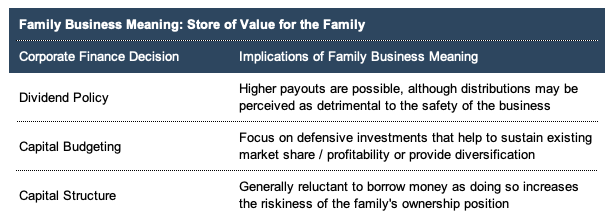

Family Business as a Store of Value

For other families, the business may serve as a store of value. By store of value, we mean that the role of the family business is to mitigate the volatility that may be present in other elements of the family’s wealth. In contrast to the public equity markets, which can experience dramatic short-term swings in value, the family business functions as a steadying force on the family’s collective balance sheet. In other words, the emphasis for these families is on preserving rather than increase the value of the family business over time.

When the business serves as a store of value for the family, the different generations of the family need to understand that the emphasis on capital preservation may result in an erosion of per capita business value over time (especially on an inflation-adjusted basis). Investing is about tradeoffs: families can’t expect to have both safety and enviable growth. There’s nothing inherently wrong with pursuing safety, but family members need to understand the (opportunity) cost of doing so.

The principal risk of this meaning is the increased likelihood that the family business may accumulate low-yielding non-operating assets that create a drag on future shareholder returns.

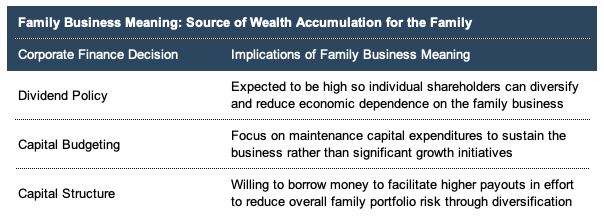

Family Business as a Source of Wealth Accumulation

Others, wary of putting all of the family eggs in a single bucket, view the family business as a source of wealth accumulation for the family. Rather than the family business itself being the direct engine of economic growth through reinvestment and capital appreciation, the family business instead provides the “seed capital” for family shareholders to accumulate wealth outside the family business. These families seek to foster an entrepreneurial culture in which the most substantial reinvestment activities occur outside the legacy family business.

When families adopt this meaning, there is a chance that the business will no longer provide a unifying center to family life. If individual family shareholders are reinvesting dividends from the legacy family business, differing investment outcomes can lead to significant wealth disparities among the various branches of the family tree over time. In an effort to counteract this potential outcome, some families elect to pursue reinvestment through a common family fund. This helps ensure that family wealth remains balanced, but also limits the ability of family members to tailor a wealth accumulation plan to their unique needs, preferences, and risk tolerances.

From the perspective of the family business, a risk of this meaning is that the business may lose existing competitive advantages if profitable reinvestment opportunities are foregone in favor of distributions.

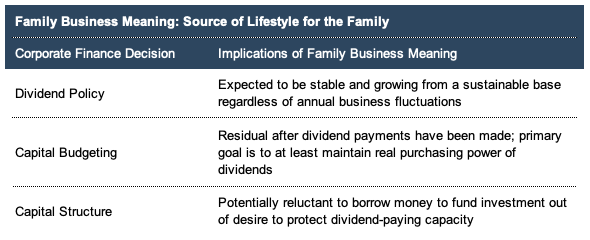

Family Business as a Source of Lifestyle

Prolonged capital appreciation may be what makes a family wealthy, but predictable dividend checks are often what make family members feel wealthy. In accord with this reality, the final meaning that a family business can have is that of an ongoing source of lifestyle for family shareholders. This does not require that dividends be sufficient to fund a source of idle leisure, but does require that dividends be regular and predictable. With predictability, family shareholders have assurance that other sources of income will be supplemented by dividends from the family business. Depending on the size of the business, these dividends may be sufficient to fund automobile, vacation, housing, or education choices that would not otherwise be attainable by family members.

Families adopting this meaning need to understand the inherent tradeoff between realizing the lifestyle benefits of the family business in the present and preserving that benefit for future generations. If the biological growth of the family is above average, it may be difficult for the family to maintain the lifestyle to which it has grown accustomed on a real per capita basis in the next generation.

Since reinvestment takes a backseat to the predictability of dividend payments, the family business faces two mirror-image risks. When the business performs well, low-yielding assets may accumulate if retained earnings exceed attractive investment opportunities. On the other hand, in lean years, the dividend may crowd out needed capital investment in the business.

Conclusion

A clear understanding of what the business means to the family is essential if decisions about dividend policy, capital budgeting, and capital structure are to be made in a coordinated, rather than disjointed, manner. Consensus regarding these critical long-term decisions will be fleeting and unpredictable without prior consensus about what the family business means to the family. Our professionals are eager to help your family discern what your family business currently means and assess whether that meaning will provide a proper “fit” going forward.

Family Business Director

Family Business Director