Taking Stock: Taking a Strategic Inventory of Your Family Business

Tactics win battles, strategy wins wars. – Pierce Brown

For family businesses, 2020 has been, first and foremost, a battle against the COVID-19 pandemic. As a result, directors and managers have rightly focused on tactics: what steps do we need to take today, next week, and next month to ensure the health of our employees and customers and ensure our family business survives?

As glimmers of hope emerge that the pandemic will eventually end, December is a natural time to catch up on some of the strategic thinking that has been put on hold by the coronavirus. While focusing on tactics has been essential to surviving 2020, many family businesses would do well now to turn their attention to strategy. If tactics are about short-term viability, strategy is about long-term sustainability.

My wife and I were recently discussing the mix of personalities, temperaments, skills, and interests represented in our extended family. She astutely observed that each person contributes something unique to the family, and that the characteristics that one sometimes finds irksome are often paired with corresponding strengths that would otherwise be missing in the family. This observation readily applies to family businesses. So the first step in your strategic thinking may need to be taking an “inventory” of the assets of the family business.

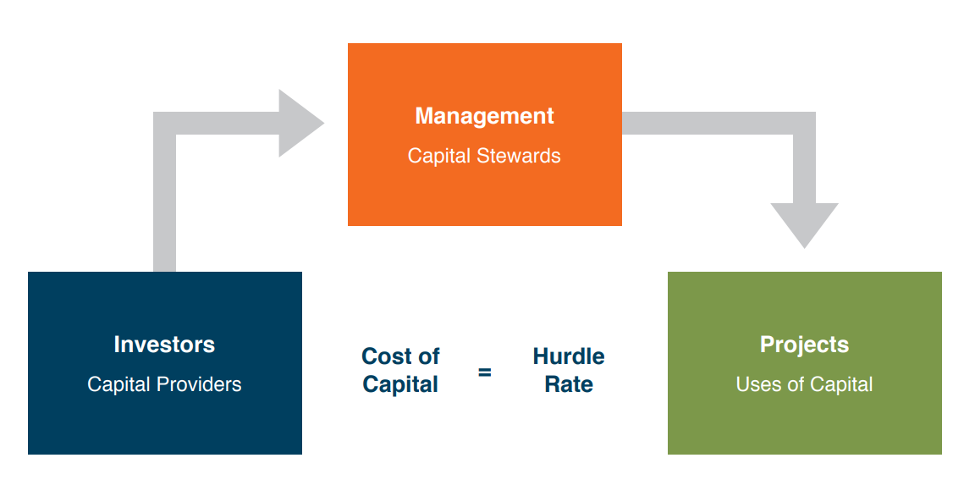

This inventory process fits well with our preferred “asset manager” perspective on family business, depicted below.

Under this perspective, directors and managers are stewards of family capital. Much like professional asset managers select investments on behalf of their clients in order to meet the financial objectives of those clients, family business directors and managers are tasked with allocating family capital to a mix of operating assets that will provide an appropriate combination of risk and return for family shareholders.

One way to re-start a strategic planning process for your family business is to take an inventory of just what assets your family’s capital is currently allocated to, and thinking about what those assets bring to the family business in terms of risk profile and reward potential.

We find that four questions can help spur strategic thinking about your business:

- What assets are currently in our portfolio?

- What are the return and risk attributes of each asset?

- How do the different assets our family business owns correlate to one another?

- What assets should be in our portfolio to help ensure the long-term sustainability of our family business?

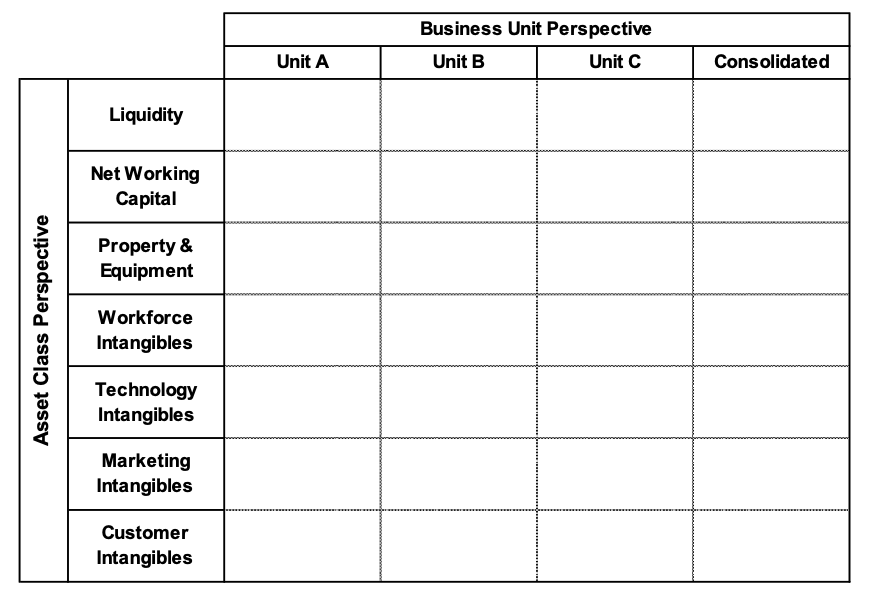

You can answer the first question from either of two complementary perspectives. First, you can think about your existing asset allocation with respect to broad asset classes (working capital, property & equipment, etc.). Or, you can address the asset allocation question from the perspective of business units or segments: what collection of divisions, segments, or branches comprise our family business today? The following table summarizes these perspectives.

As illustrated above, these perspectives are complementary because the asset class perspective can be readily applied to individual business units. In next week’s post, we will consider the asset class perspective, and the following week we will adopt the business unit perspective.

As the year winds down, we recommend setting aside time to look beyond survival tactics and re-engage in some strategic thinking about your family business. Much like an asset manager would review the portfolio they have constructed with their client, family business directors should review the current asset allocation in their family business. Doing so can help uncover fresh insights and challenge conventional thinking that is due for an update.

Family Business Director

Family Business Director