Tax Court Sides with Family Business in Cecil

In a recent decision (Cecil v. Commissioner, T.C. Memo. 2023-24), the Tax Court tackled the thorny issue of how to value a minority interest in an operating business with valuable underlying assets.

Although the decision does not directly address the appropriate “premise of value” in its decision, that is ultimately what the case was about. The Court’s ruling was a resounding victory for the taxpayers and will likely provide critical support for future family businesses facing similar fact patterns.

Background

The Cecil decision addresses conflicting opinions of the fair market value of minority interests in the Biltmore Company (“TBC”) during stock transfers made in November 2010. The Biltmore Company operates a hospitality business in and around the famous Biltmore House in Asheville, North Carolina.

The Biltmore house was built in the late 1800s by George W. Vanderbilt, and ownership of the house passed to his only child Cornelia Cecil (nee Vanderbilt), upon Mr. Vanderbilt’s death in 1914. The Biltmore Company was formed as a business in 1932, owning the house and surrounding acreage, and began operating as a hospitality company.

TBC has continued to operate as a multi-generation family business since 1932.

TBC has continued to operate as a multi-generation family business since 1932. The 2010 transaction that is the subject of this decision involved the transfer of shares from Mr. William Cecil and his wife to their children and grandchildren. William Cecil is Ms. Cecil’s son and Mr. Vanderbilt’s grandson. At the valuation date, Mr. Cecil’s children, Bill Cecil and Dini Pickering, served as CEO and vice chairman of TBC, respectively.

After offering simple tours of the house and adjoining gardens for decades, TBC adopted a long-range plan to become a “multiday destination” in 1995. At the valuation date, following the execution of this plan, the Company operated at least 17 lines of business and employed more than 1,300 individuals. In short, TBC was an operating business with a long history.

Meanwhile, the TBC shareholders engaged in a series of actions to perpetuate the business operation under family ownership.

- In June 1999, the shareholders entered into a voting trust agreement with the express purpose of “secur[ing] continuity and stability in the Company’s policies and management….”

- In 2003, the Company embarked on a “Family Business Preservation Program.” This program encompassed numerous activities designed to, among other things, prepare the next generation (Mr. Vanderbilt’s great-great-grandchildren) to assume leadership of TBC’s management.

- In December 2009, the shareholders executed a shareholders’ agreement. The purposes of the agreement included providing for continued ownership and control of all issued and outstanding TBC shares. Under the agreement, share transfers were generally limited to lineal descendants of the then-current shareholders.

Key Valuation Issue

While the Tax Court’s decision addresses multiple issues, including methods for tax affecting S corporation earnings, non-voting discounts, the effect of block size on fair market value, and the magnitude of minority and marketability discounts, we discuss the primary issue of the weight assigned to different valuation indications.

There are three basic approaches to the value of a business:

- Income approach. Valuation methods under the income approach are oriented toward the future: what cash flows are expected to be generated by the business, and what is the present value of those cash flows today?

- Asset-based approach. Valuation methods under the asset-based approach are focused on the subject company’s balance sheet: what assets does the business own and what are those assets worth?

- Market approach. Valuation methods under the market approach look to the observable behavior of other investors: based on prices paid by investors for similar businesses, what would an investor pay for this business interest?

The taxpayer retained two valuation experts to testify at trial, while the IRS hired one business valuation expert and one art appraisal expert.

TBC was profitable except for a loss during the Great Recession in 2008. Each of the three business valuation experts developed indications of value for TBC under the income approach. All three experts agreed that the value of the operating business under the income approach was on the order of $15 million on a marketable minority interest basis¹.

The taxpayer’s valuation experts also applied methods under the market approach, which generally corroborated the indications derived under the income approach. However, the Court took a rather dim view of those analyses, so we will not address them here.

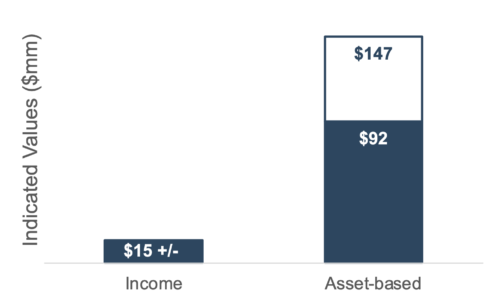

The business valuation expert retained by the IRS also developed an indication of value under the asset-based approach. Relying on real estate and fine art appraisals of certain assets owned by TBC, the expert derived an indicated value of $92 million under the asset-based approach ($147 million before minority interest discount).

The following chart illustrates the disparity in indicated values under the income and asset-based approaches in the case.

This fact pattern in the Cecil case throws the challenge of assigning weight to various valuation methods in deriving an indication of value into stark relief.

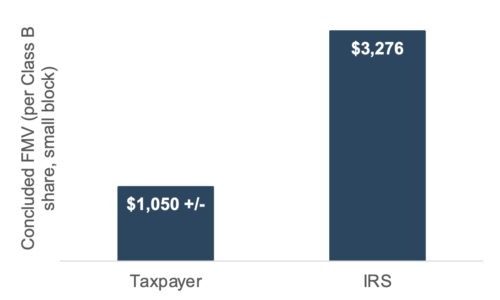

Setting aside the other valuation questions presented by the case, the valuation experts for the taxpayer relied exclusively on the income approach to value. In contrast, the valuation expert for the IRS assigned some weight to the indicated value under the asset-based approach. The following chart summarizes the resulting indications of fair market value for one of the subject blocks of TBC shares².

The Tax Court’s Conclusion

Faced with the large disparity between the indicated values of TBC under the income and asset-based approaches, the Tax Court focused on characterizing TBC as an operating business rather than a holding company. The Tax Court concluded that, as an operating business, “TBC’s earnings rather than its assets are the best measure of the subject stock’s fair market value.”

The Tax Court went so far as to suggest that the IRS’s valuation expert’s partial reliance on the asset-based approach was inconsistent with the Uniform Standards of Professional Appraisal Practice (“USPAP”), citing USPAP Standards Rule 9-3. Standards Rule 9-3 indicates that a “liquidation value” is applicable in a valuation if the subject equity interest possesses the ability to cause liquidation. The Tax Court noted that the shares transferred in this case clearly did not have that ability.

Fair market value reflects the perspective of a hypothetical willing buyer or seller of the shares, not that of any specific individual

The Tax Court noted that the realization of a value approximating under the asset-based approach would occur only upon the liquidation of TBC. Fair market value reflects the perspective of a hypothetical willing buyer or seller of the shares, not that of any specific individual, such as the existing owners of TBC shares. From the perspective of a hypothetical willing buyer, the Tax Court concluded that the Company’s assets would be liquidated only upon the occurrence of one of three events:

- The hypothetical buyer acquired additional shares, which would convey to them the ability to force liquidation,

- The hypothetical buyer convinced the other shareholders to vote for liquidation, or

- The other TBC shareholders (or their heirs) decided to liquidate TBC.

Based on the facts in this case—the long operating history and the various actions taken by the TBC shareholders over the decade leading up to the valuation date to assure continuity of family ownership—the Tax Court concluded that the occurrence of any of these three liquidating events was unlikely.

As a result, the Tax Court declined to assign any weight to the indicated value under the asset-based approach, handing the taxpayer a clear victory.

While the decision does not specifically refer to the “premise of value,” the correct premise is ultimately what the case is about. The International Glossary of Business Valuation Terms defines premise of value as “an assumption regarding the most likely set of transactional circumstances that may be applicable to the subject valuation.” There are two premises of value:

- Liquidation – assumes the business is terminated and the assets are sold piecemeal, can be either “orderly” or “forced.”

- Going concern – assumes the business is an ongoing enterprise expected to generate future earnings.

In Cecil, the Tax Court concluded that the indicated value under the asset-based approach was effectively a liquidation premise of value, which was not appropriate because the subject interest could not compel a liquidation. Rather, the fair market value of the shares was, in the Court’s view, more properly determined under a going concern premise of value as manifest in the income approach.

Judicial opinions are always fact-specific, and numerous facts, in this case, proved persuasive regarding the premise of value. Those facts are specifically the long operating history of the subject business and the active efforts of the current generation of shareholders to pursue long-term continuity of ownership. Taxpayers in similar circumstances should be heartened by the Tax Court’s conclusions in Cecil.

As the sunset provisions of the Tax Cut and Jobs Act of 2017 draw nearer, family shareholders will find the coming months an opportune time to advance their broader estate planning objectives. Give one of our valuation professionals a call today to discuss your valuation needs in confidence.

[1] The valuation expert for the IRS added the value of certain “non-operating” assets to the indicated value derived in the market approach.

[2] In this case, the fair market value of the smaller block of Class B non-voting shares. Other blocks were assigned different values for reasons beyond the scope of the present article.

Family Business Director

Family Business Director