The Financial Costs of Family Members Behaving Badly

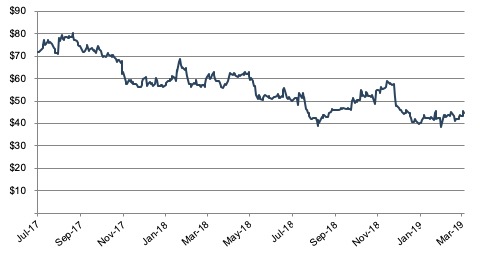

This rather depressing stock price chart is delivered to you courtesy of Papa John’s (PZZA).

The ongoing drama surrounding the behavior of Papa John’s founder John Schnatter has been a mainstay of the financial press over the past fifteen months, but in case you missed it, here’s a brief timeline:

- December 21, 2017 (share price $59.23): Schnatter steps down as CEO after remarks blaming slumping pizza sales on national anthem protests by NFL players.

- July 11, 2018 (share price $48.33): Schnatter resigns as chairman of the board after using an offensive racial slur on a conference call.

- February 4, 2019 (share price of $41.97): Papa John’s announces $200 million cash infusion from hedge fund Starboard Value. Starboard received convertible preferred stock in the company with a conversion price of $50.06 per share. On an as-if converted basis, the convertible preferred shares represent approximately 11% of the total common shares outstanding. The shares are redeemable following an eight-year term. The stock closed at $41.97 per share, up 9% from the prior day’s closing price.

- March 5, 2019 (share price of $45.56): Schnatter agrees to resign from the board, and will be replaced by an independent director. Mr. Schnatter further agrees to drop pending lawsuits against the company in exchange for access to certain corporate records, although Mr. Schnatter reserved the right to bring new litigation based on his review of the corporate records provided.

Papa John’s has been publicly traded since 1993 but still retains many attributes common to family businesses. Mr. Schnatter remains the company’s largest shareholder, with a 30% stake. Furthermore, the company’s brand was closely associated with him personally, as he was a ubiquitous presence in the company’s advertising and marketing campaigns.

Despite the old truism, not all publicity is good publicity.

So what is the takeaway for family business directors from the Papa John’s saga? The most important lesson is this: the bad actions of family shareholders can have significant financial repercussions for the family business, and by extension, all the family shareholders. Mr. Schnatter did not lose his job, board seat, and a massive amount of money because of some managerial mis-step or ill-fated business decision, but instead because of a pattern of boneheaded and obnoxious public comments. Despite the old truism, not all publicity is good publicity.

Papa John’s shareholders have suffered from Mr. Schnatter’s behavior in three ways.

1. Reduction in Value of Shares

Value is a function of investor expectations regarding cash flow, risk, and growth. When investor perceptions of risk go up, stock prices come down. The negative headlines surrounding Mr. Schnatter over the past 15 months have pushed the Papa John’s stock price down by about 30% since December 2017. That’s about $630 million of value that’s gone because a family member made offensive public comments.

2. Declining Business Performance

Mr. Schnatter’s behavior not only spooked investors but also alienated customers. The company released fourth quarter and full year 2018 earnings on February 26, 2019, and the operating results generally confirmed the investor fears that precipitated the stock price decline.

- Same-store sales in North America fell 8.1% in the fourth quarter, and 7.3% for the year.

- The company incurred more than $50 million of direct costs in attempting to mitigate the damage from Mr. Schnatter’s comments, including re-branding, financial assistance to franchisees negatively affected by the fallout, additional ad spending in an attempt to rehabilitate the brand, and incremental legal and advisory costs. The company reported that it expects to incur an additional $30 million to $50 million in such charges in 2019.

- Reported pre-tax earnings for 2018 fell to $5.9 million in 2018 from $140.3 million in 2017. Free cash flow was also negatively affected, falling from $82.4 million in the prior year to $30.8 million in 2018.

- Total indebtedness increased from $467 million at December 31, 2017 to $621 million at the end of 2018. As a result of financial covenants with lenders, the company has been forced to suspend its share repurchase program.

3. Shareholder Dilution

Bailout money is never cheap and inevitably comes with strings attached.

The combination of poor operating results, mounting debts, and sinking share price meant that the company needed a capital infusion at a time when its negotiating leverage with potential capital providers was low. While the company did secure $200 million of financing, the cost to existing shareholders was high. Bailout money is never cheap and inevitably comes with strings attached. Without going too far into the details, we can simply observe that the company’s financial rescuer, Starboard Value, now has significant influence over the company in the form of the new CEO and board chairman. In addition, the hedge fund did not purchase common shares, but received a new class of convertible preferred shares instead. What this means is that Starboard enjoys all of the upside potential of the company, but does not share any of the downside risk borne by the common shareholders.

While the cost of the rescue financing for Papa John’s was high, the fact that it is a public company probably did give the directors a measure of negotiating leverage that a privately-held family business in similar circumstances would lack.

Conclusion

The financial consequences of bad family behavior can be high. In our social media age, Cousin Jimmy’s next tweet could prove costly for the family business. This is true even if Cousin Jimmy doesn’t work in the business. Family business directors need to make sure that family shareholders understand the consequences of their personal actions on the business. Increasing numbers of families are drafting and implementing formal social media policies to help mitigate this risk.

Once a family member has misbehaved, it is the board’s responsibility to quickly assess the damage and take appropriate corrective measures to secure the long-term sustainability of the family business and minimize the potential economic dilution. Our family business advisory professionals can help you evaluate strategic alternatives. We hope you’re never in that situation, but if you are, you can call us.

Family Business Director

Family Business Director