We had the privilege this past weekend of presenting at the annual family meeting for one of our great family business clients. The topic of the day was valuation, so we took some time to review the six valuation principles that family business directors (and shareholders) should know. In case you don’t have five minutes to watch the video, the six principles are:

The Principle of Expectations. Value is based on the future, not the past.

The Principle of Growth. All else equal, a business with growing earnings is worth more than a business that is not expected to grow.

The Principle of Risk and Reward. Investors want return, but it only comes in exchange for risk.

The Present Value Principle. Timing matters—a dollar today is worth more than a dollar tomorrow.

The Principle of Alternative Investments. Investors are, as a rule, not a sentimental or loyal bunch, so they always compare investments, pursuing those that offer the most appealing tradeoff between risk and return.

The Principle of Rationality. There is an underlying rationality to market transactions, even when it is not obvious. The exceptions to this principle are inevitably short-lived and ultimately prove the rule.

[Hat tip to Mercer Capital founder Chris Mercer, who came up with this list decades ago.] So, what is the hardest thing to do in business? Stand still. Businesses are either growing or shrinking. Since shrinking businesses aren’t generally worth a lot (see Principle #2 above), family business directors should intentionally pursue growth. Your financial statements will tell “how much” your business has grown, but they don’t tell “why” it has grown. Setting aside the revenue growth resulting from raising prices (which is not to be overlooked, as price increases fall straight to the bottom line), your family business has three primary avenues of growth.

New Products and Services

Some businesses are fortunate to operate in industries with growing demand for their core product or service. Others, however, are facing the risk—or reality—of obsolescence. A growth mindset requires steady attention to identifying customer needs that can be met through new products or services.

Does your family business “need” new products or services? In the long run, all businesses do, but in the short run, the need is more pressing for some than others. What is the best strategy for identifying promising and profitable new products or services for your family business? Does your family business have a disciplined process for identifying, vetting, funding, and executing new products & services?

New Customers

Existing customers are a wasting resource. Even the most longstanding customers have a nasty habit of being acquired, going out of business, or being lured away by competitors.

What is your family business’s strategy for attracting new customers? Do you provide superior quality and service for a premium price? Or do you offer cost savings to potential customers by being an efficient operator? Or do you offer a comprehensive, end-to-end, turnkey solution that frees up customers to focus on what they do best? There is no single strategy that is best for all companies, but the imperative is to be intentional. As we heard a client say many years ago: “It may not be perfect, but my plan is probably better than the one you don’t have.”

New Territories

Very few family businesses operate on a truly global scale. As a result, most family businesses have the potential to grow by extending into new territories. Companies can enter new territories organically (by “building”) or through acquisition (“buying”). Building requires taking share away from entrenched players in the market while buying introduces its own challenges: negotiating an attractive price, winning the “culture” war, and retaining the customers of the acquired business.

Does your family business have a disciplined and consistent process for making “build” and “buy” decisions? How do you evaluate the financial returns from investments? What hurdle rate distinguishes financially feasible projects from those that just don’t make sense? Do you have a clear strategy for selecting equally attractive investments from a financial perspective?

Two for One?

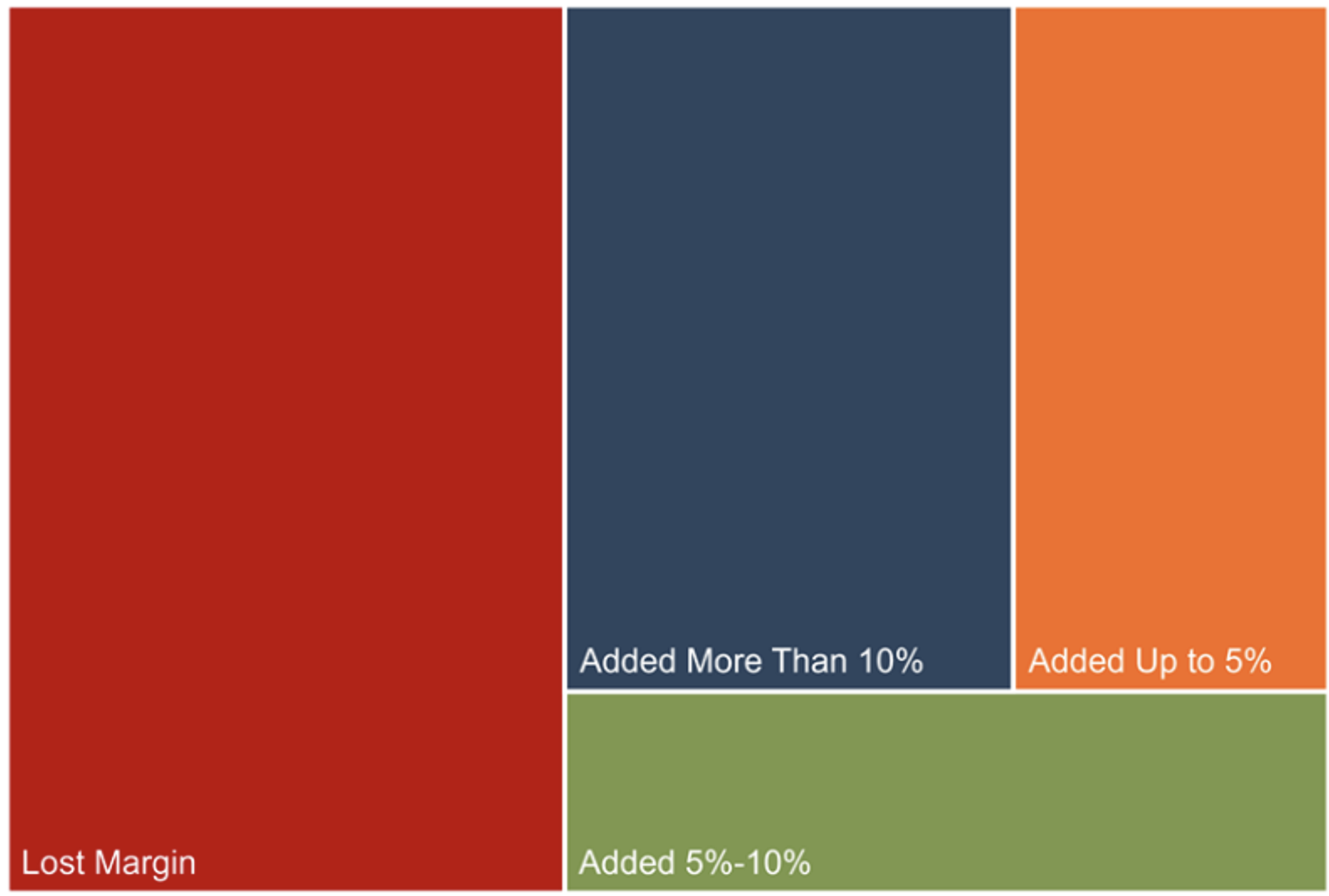

We released our 2023 Benchmarking Guide for Family Business Directors last week. You can download your complimentary copy here. Page 12 of the Guide illustrates one of the tangible benefits of maintaining a growth posture in your family business. While real life is never as clean-cut as the examples in textbooks, economies of scale are real. As illustrated on page 12 of the Guide, we identified 358 companies that doubled revenue between 2018 and 2022 (a compound annual growth rate of at least 19% or so). About 60% of those companies achieved economies of scale, meaning that they not only recorded more revenue but earned more EBITDA per dollar of revenue earned. And the margin improvement for these companies was not trivial: nearly 70% of those companies added more than 500 basis points to their EBITDA margin.

We’ll do the math for you. When revenue grows from $1,000 to $2,000 and margin increases from 10% to 15%, earnings grow from $100 to $300. But what about those other companies—the 40% that doubled revenue but saw margins deteriorate? Those companies illustrate the importance of the questions posed earlier in this post. Growth can be reckless: new products can be unprofitable, new customers can be gained by conceding price and terms, and new territories can be entered by overpaying for acquisitions.

The good news is that the hardest thing to do in business, standing still, is something you don’t want to do anyway. Our valuation and family business professionals have decades of experience evaluating corporate growth strategies. Over that time, we’ve seen plenty of examples of both reckless and responsible growth. For a fresh set of eyes on your growth strategy, call one of our senior professionals today to discuss your plans in confidence.