The Most Efficient Way to Increase the Value of Your Family Business

In last week’s post, we reviewed what EBITDA is and why not all EBITDA is created equal. In case you missed it, we ended that post with the following statement:

“…improving EBITDA margins can have a multiplicative impact on your family business’s value by both providing more EBITDA and justifying a higher multiple.”

While we suffer no qualms about making bold and sweeping proclamations, it is always convenient if there is actual data to back them up. So, is it really true that a higher EBITDA margin will also bring a higher multiple, or were we just getting carried away with our own thesis?

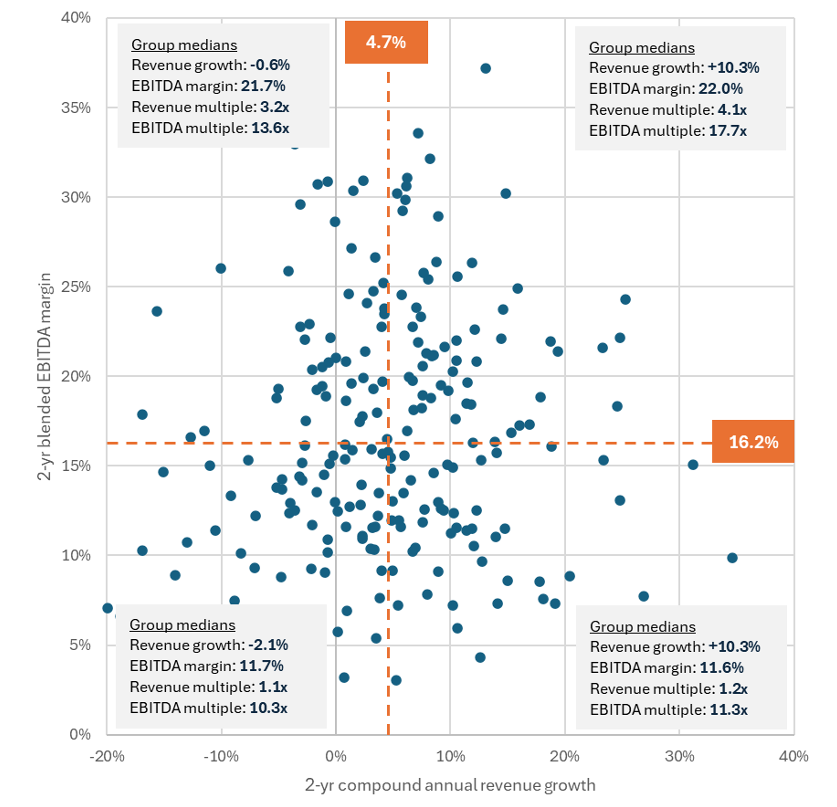

For this week’s post, we pulled some market data to test our assertion. To keep the data set manageable, we elected to consider the industrial companies from the S&P 1500 index. After a minor bit of scrubbing to eliminate twelve companies with incomplete data or negative EBITDA, we were left with a sample of 236 companies. Using data for the most recent 36 months, we calculated 2-yr compound annual revenue growth and 2-yr blended EBITDA margin for each.¹ The following chart summarizes the results of our analysis:

The median revenue growth (plotted along the horizontal axis) is +4.7%, while the median EBITDA margin (plotted along the vertical axis) is 16.2%. As shown in the chart, using these median measures, we can construct four subgroups from the data:

- Above median revenue growth and EBITDA margin (the top right quadrant)

- Above median revenue growth but below median EBITDA margin (the bottom right quadrant)

- Below median revenue growth but above median EBITDA margin (the top left quadrant)

- Below median revenue growth and EBITDA margin (the bottom left quadrant)

Fortunately for us, the data confirms the assertion with which we concluded last week’s post. Higher EBITDA margins do indeed boost EBITDA multiples.

- The median revenue growth for high-growth firms in the sample was 10.3% for both the high and low-margin However, the market clearly distinguishes between the high and low-margin groups, as the median EBITDA multiple for the high-margin subgroup (17.7x) was materially above that of the low-margin subgroup (11.3x).

- The same relationship holds on the left side of the grid (i.e., the slow-growth companies). The EBITDA multiple for the high-margin subgroup (13.6x) compares favorably to that of the low-margin subgroup (10.3x).

What does all of this mean for managers and directors interested in increasing the value of their family business? Clearly, investors like both margin and growth (i.e., the top right quadrant).² So, we certainly don’t mean to denigrate growth as a key to unlocking value. However, accelerating revenue growth often requires significant capital investment, either through new facilities or M&A. Directors fluent in return on invested capital (and if you’re not, you should be) know that putting additional capital to work in the family business raises the bar for performance.

In contrast, our experience tells us that for many family businesses, incremental margin often represents lower-hanging fruit than incremental growth. While capital investments may help unlock incremental margin, such investments are often less significant than those required to fuel faster revenue growth. As a result, focusing on margin enhancement will indeed be the most efficient way for most family businesses to grow in value.

Where are the obvious places to look for margin enhancements? We can think of four primary opportunities:

- Processes. By no means are we all in on AI, but it does seem that the most productive use of the technology is not in creating original content (such as a sophomore English paper) out of whole cloth but rather in assisting in the automation of the routine processes that keep your family business running. Whether AI is an appropriate tool or not, have your processes kept up with your business? If not, you may be leaving margin (and value) on the table.

- Purchases. Whether harnessing the power of bulk purchasing or simply ensuring that you aren’t buying things you don’t need, spending discipline is critical to finding incremental margin for your family business.

- People. Your family business probably changes faster than your org chart does. This is not a call for wholesale job cuts but simply a reminder to evaluate whether you have the right people in the right places doing the right things. Using your human capital in the right way is essential for your company’s culture and margin.

- Pricing. Finally, are you charging enough for your own products or services? This is probably the most overlooked source of margin enhancement for most family businesses. Of course, raising prices will test your company’s strategy: do your customers buy from you because of the value you deliver or because you are the cheapest option? If the former, you likely have room for at least some targeted price increases, but if the latter, raising prices will likely be more difficult.

Don’t let margin get lost in your boardroom. It may be the shortcut to building the value of your family business.

¹ We calculate 2-yr blended EBITDA margin as total EBITDA for the past 24 months divided by total revenue for the same period.

² Astute readers will note that investors are also risk averse. We checked the betas of the companies in each quadrant, and there were no significant differences amongst the subgroups.

Family Business Director

Family Business Director