What Do the Midterm Elections Mean for You & Your Family Business?

The 2022 midterm elections are here, and, as usual, one of the most significant differences between Democrats and Republicans is tax policy. While voters are contemplating significant issues ranging from inflation, immigration, abortion, and gun control, the election outcome will also influence which tax priorities Democratic and Republican lawmakers will pursue over the next few years.

These tax issues could involve tax deductions and other incentives that directly impact your finances. The party controlling the House and Senate will dictate which tax policies are proposed and potentially passed into law. In this post, we focus on three main tax dilemmas that will be most important to your family business this midterm election season.

Individual Tax Rates

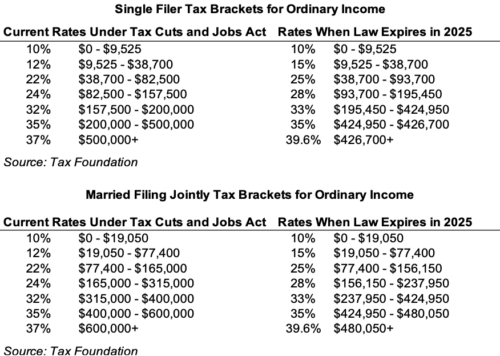

There are a number of tax provisions set to expire in 2025 that were passed as part of the Republican’s Tax Cuts and Jobs Act (TCJA). This 2017 legislation significantly reduced the corporate tax rate and temporarily cut individual rates. If Republicans take control of Congress, protecting previously passed policies will be among the party’s top priorities, despite the potential impact on inflation. One of the tax breaks set to revert to the pre-2017 levels if the TCJA is not extended is the individual income tax rate, which would return the top marginal rate to 39.6% from the current 37%.

Below are the current single-filer and married filing jointly tax brackets, as well as the changes if the TCJA does expire in 2025.

In an interview on C-Span, Nebraska Rep. Adrian Smith said that if the GOP regains Congress, advancing legislation for permanent individual tax rate cuts would be his first priority. However, many economists have debated that the GOP tax plan goes against the promise to combat inflation and reduce the federal deficit. Howard Gleckman, a senior fellow at the Tax Policy Center, states that extending these tax cuts promulgated from the TCJA may further fuel inflation by stimulating consumer spending.

What if Congress remains Democrat-controlled? While Democrats campaigned on rolling back provisions from the TCJA, actually doing so has proven politically more difficult. Earlier this year, Democrats tried to increase the corporate tax rate and raise taxes on the wealthy to pay for the Inflation Reduction Act but failed. Meanwhile, President Biden’s 2023 Budget Proposal calls for reducing the federal deficit by $1 trillion over the next year in part by raising the corporate tax rate from 21% to 28%. The proposal also contains a new 20% minimum tax on households worth more than $100 million, which accounts for the top 0.01% of earners.

Estate Taxes

On October 28, 2021, President Biden announced a framework for the Build Back Better Act. This Act invests in family care, health care, and combatting the climate crisis. It will also implement key reforms to make the tax system more equitable by ensuring that the wealthiest Americans and most profitable corporations shoulder a more significant portion of the overall tax burden. Specifically, these proposals included a reduction of the federal estate tax exemption (amount of assets that can transfer to an heir free of estate tax) to $3.5 million per person, as well as eliminating the tax basis step-up at death. These proposals were dropped from the legislation as the Build Back Better Act stalled in the Senate.

Regardless of the fate of these specific proposals, effective January 1, 2026, under current law, the estate tax exemption will be reduced to $5 million per person or $10 million for a married couple – subject to inflation increases. Currently, each U.S. citizen has a $10 million exemption from estate taxes, and for a married couple, that amount is doubled. As the exemption is indexed for inflation, in 2022, the exemption is $12.06 million per person. Persons whose estates may be subject to estate tax under the projected 2026 exemption levels should consult with legal counsel and advisors to review their current estate plans and evaluate possible strategies for preserving their wealth and planning for future generations.

Qualified Business Income (QBI) Deduction

The IRS defines Qualified Business Income (QBI) as the net amount of qualified income, gains, deductions, and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and certain trusts. The Tax Cuts and Jobs Act introduced a new deduction taking effect in 2018 for noncorporate taxpayers in respect of their qualified business income. This deduction is up to 20% of their QBI, plus 20% of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. Income earned by a C corporation or from providing services as an employee is not eligible for the deduction.

Prior to the TCJA, the corporate income tax rate was 35%, and dividends were taxed at a top rate of 23.8%, resulting in an aggregate tax rate of about 50% on distributed corporate business income. Contrast this to a pass-through entity, for which earnings are passed through and taxed in the hands of the owners. Before 2018 the top ordinary income tax rate was 39.6%, and thus, there was an approximate 10% tax rate advantage operating a pass-through entity rather than a corporation. The TCJA included a permanent reduction to the corporate tax rate from 35% to 21% and reduced the top individual rate to 37%. Without any further changes, the tax rate advantage in operating a business as a pass-through entity would have decreased from roughly 10% to less than 3%. The 20% QBI deduction was the TCJA’s answer, as only 80% of certain pass-through entity income is subject to tax for qualifying taxpayers.

With the control of Congress up in the air and general gridlock in Washington, it is uncertain if the 20% QBI deduction will be a tax advantage for much longer, as the deduction would ultimately expire if the TCJA is not extended past 2025.

Conclusion

Voters are weighing many different policy questions at the ballot box this November, and the election results will set the stage for determining which major concerns are addressed first, as well as determine which tax priorities Democratic and Republican lawmakers will pursue over the subsequent few congressional sessions. The topics mentioned above highlight some of the most important individual, estate, and business owner tax implications that family business owners need to be aware of and evaluate as the election returns roll in.

Family Business Director

Family Business Director