What Do Your Customers Pay For?

This post is part of our “Talking to the Numbers” series for family business leaders. In this series of posts, our goal is to help family business directors ask the right questions when reviewing financial statements. Asking better questions will lead to better financial and business decisions.

It may be a tiresome cliché, but your family business really does make money buying low and selling high. Gross margin measures the degree to which your family business is able to sell its goods or services for a price in excess of the costs to acquire the inputs needed to produce the product or service. As we move down the income statement, the line below revenue is cost of goods sold, which defines itself quite nicely. Gross profit is the amount of revenue left over after deducting cost of goods sold. Gross margin is the ratio of gross profit to revenue. It’s important to think about gross margin, because it tells you how much of a “mark-up” your customers are willing to pay for your good or service. The higher the “mark-up” the more revenue will be available to cover operating expenses and generate an operating profit.

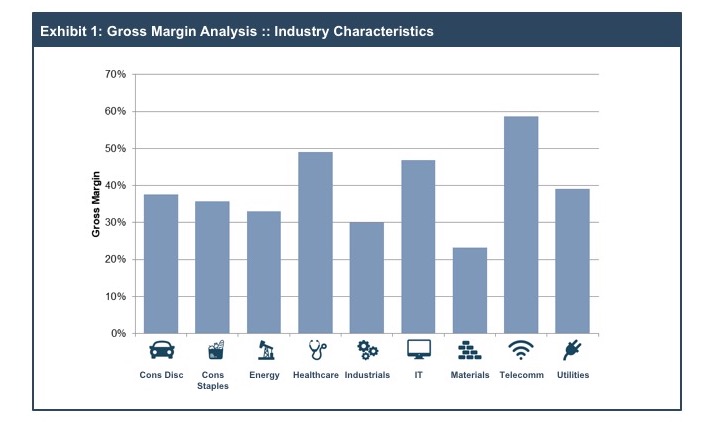

Exhibit 1 summarized median gross margins for each industry sector during 2017:

Exhibit 1 and the supporting data confirm several intuitions regarding what customers are willing to pay (i.e., your family business’s ability to buy low and sell high).

It’s important to think about gross margin, because it tells you how much of a “mark-up” your customers are willing to pay for your good or service.

Customers Are Willing to Pay for Innovation

Among the industry sectors, healthcare and information technology are the most fertile fields for innovation. So it should not surprise us that these two industry sectors boast two of the highest gross margins.

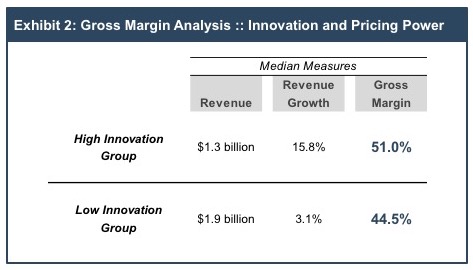

Digging a bit deeper into the data confirms the importance of innovation to customers. Since revenue growth is a decent proxy for innovation, we sorted the companies in the IT sector by compound annual revenue growth (2013 through 2017). Exhibit 2 summarizes the size, growth, and gross margin attributes for the high and low innovation groups. The median gross margin for the fast-growing high innovation group (51.0%) exceeded that of the slow-growth low innovation group (44.5%).

Family businesses cannot afford to neglect innovation.

- Is your family business investing in research & development to promote innovation that benefits customers?

- Is your family business listening to customers to discern where innovative solutions are most needed?

- Is your family business evaluating acquisition opportunities that would bring innovative product offerings to customers?

Customers Are Willing to Pay for Access

The telecommunications sector boasts the highest gross margins. In other words, customers are willing to pay prices far in excess of the marginal cost to the telecom companies of providing the service. This reflects in large measure the high fixed costs of providing telecom services and customers’ willingness to pay for access to those networks and the benefits they bring.

While only a small proportion of family businesses operate in the telecom sector, the underlying principle is applicable to a broader range of companies.

- Is your family business where your customers need it to be? Are there opportunities for geographic expansion that would make it easier for key customers to do business with you?

- Does your family business think about capital investment strategically? Do you have a plan to deploy capital assets in a way that increases customers’ willingness to pay for the product or service you are offering? How can your family business use capital expenditures to build and maintain a strategic competitive advantage?

It is important to think about adding incremental value to the company’s product or service.

Customers Are Willing to Pay for Added Value

The lowest gross margins noted on Exhibit 1 are in the materials sector. Companies in the materials sector sell production inputs to manufacturing firms in the industrials and consumer (discretionary and staples) sectors. The companies in these sectors add value to raw materials, converting them into industrial and consumer goods. The gross margins for the industrial and consumer companies are higher than those in the materials sector, reflecting their superior position in the value chain.

Regardless of where your family business sits on the value chain, it is important to think about adding incremental value to the company’s product or service.

- Is there an adjacent product or service that your family business can provide to customers that will allow you to increase the value added by the business?

- Are there opportunities for vertical integration (whether through acquisition or direct capital investment) that would enhance the competitive position of your family business?

Customers Are Willing to Pay for Brands

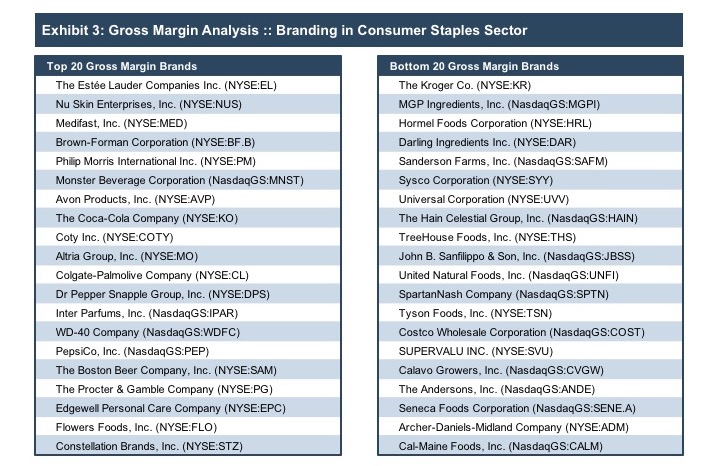

The role of brands in customer behavior is critical in the consumer staples sector. These companies sell basic consumer goods (food, cleaning supplies, personal care products, etc.) and rely heavily on marketing and branding to drive sales. We sorted the consumer staples companies in our sample by gross margin, listing the twenty companies with the highest gross margins and the twenty companies with the lowest gross margins on Exhibit 3.

There are undoubtedly a host of factors at work beyond just branding in the two lists noted above (for example, whether a company is a manufacturer or retailer). Yet, on balance, the high margin group consists of more well-known and readily identifiable brands than the low margin group. And the difference is not trivial: the median gross margin for the top 20 companies is 61% compared to 16% for the bottom 20 companies.

For many family businesses, the family name doubles as the company brand. But even when that is not the case, the health of the brand is important.

- Is your family business investing appropriately in marketing and branding? Successful branding initiatives require sustained investment.

- Does your branding strategy align with the story of your family business and the business’s competitive strengths?

- Does your family business’s risk management process take into account potential threats to the company’s brand? A quality brand takes years to build but only days to destroy.

While our discussion in this post has focused on the price side of gross profit (what are customers willing to pay?), family businesses cannot neglect the cost side of gross profit (how much are we paying for inputs?). A diligent procurement function can contribute to gross margin as much as the customer-focused strategies discussed above. The most obvious buying efficiencies come from scale, which evident when we compare the median gross margin for the large cap (S&P500) companies of 42.1% to the 33.7% gross margin of the small cap (S&P 600) companies.

From a customer-facing perspective, innovation, access, value added, and brand are critical components of corporate strategy influencing gross margin. Family businesses should evaluate opportunities for enhancing gross margin along these dimensions while not ignoring opportunities for improved purchasing.

Family Business Director

Family Business Director