What Does Your Family Business Mean to Your Family?

Mission statements, vision statements, corporate responsibility statements and lists of corporate values abound as managers and corporate directors seek to provide consistent direction for business decisions. While such statements doubtless have their place, they often ignore what we see as a more fundamental question for family businesses: What does the business mean to the family?

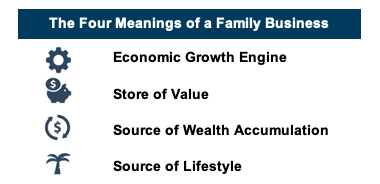

In our experience, families tend to assign one of four basic meanings to their family business. Identifying what the business means to the family provides managers and directors with a roadmap for long-term strategic decisions regarding the family business.

Failing to achieve consensus around what the business means to the family can lead managers and directors to make decisions regarding long-term strategic decisions on an inconsistent, piecemeal, or even contradictory manner. Corporate finance and strategy textbooks tell directors how to make these types of decisions if their shareholders are economically rational robots that evaluate investment decisions from a strictly quantitative perspective. In other words, the long-term strategic decisions are easy unless family shareholders are people who view their investments through a mix of economic, emotional, and practical considerations. And they are. Add family dynamics to that mix, and the easy textbook answers fade to irrelevance.

The Four Meanings

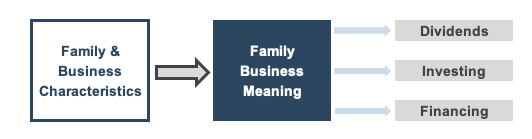

The meaning of a family business is a function of both family and business characteristics. As shown below, the meaning of the family business, in turn, influences the dividend policy, investing, and financing decisions of the company. In this week’s post, we will identify the four potential meanings and correlate family & business characteristics with those meanings. We will explore how the meaning of the family business informs dividend policy, investing, and financing decisions in a subsequent post.

Based on our observations over decades of working with family businesses, we have identified the following four potential meanings for a family business.

1. Economic Growth Engine

For some families, the business exists to drive economic growth for future generations. For these families, the emphasis is not on generating distributable income for the current generation of shareholders, but rather on pursuing growth opportunities so that the business grows along with the family.

- Family Characteristics: Growing family with each subsequent generation larger than the preceding generation by a factor of two or three (or more). The family has multiple members with entrepreneurial instincts and experience.

- Business Characteristics: The family business operates in an industry with ample attractive investment opportunities that can be used to spur growth. The management team has experience growing businesses organically or through acquisition. The business has access to financing to make investments when advantageous opportunities arise.

- Example: A new restaurant concept that is pursuing a rapid geographic expansion strategy to meet consumer demand for its unique combination of flavors, atmosphere, and experience.

When the family business is an economic growth engine for the family, shareholders know that the emphasis is on the future, and make personal financial decisions accordingly.

2. Store of Value

Other family businesses serve as a mechanism by which to preserve the family’s capital. In contrast to the often dramatic swings experienced in the public equity markets, the family business is a stabilizing component of the family’s overall balance sheet.

- Family Characteristics: Family has relatively few shareholders or is growing slowly. The family business makes up a significant portion of the family’s overall wealth.

- Business Characteristics: The family business operates in a mature or counter-cyclical industry with few attractive reinvestment opportunities. The business owns tangible assets (real estate, manufacturing facilities) with alternative future uses.

- Example: A manufacturer of generic over-the-counter medications with a mature product portfolio for which sales growth largely tracks population growth.

If the family business functions as a store of value, family shareholders take comfort in the durability of the business, and can make long-term personal financial plans with relative certainty that the family business represents a stable foundation for their overall investment portfolio.

3. Source of Wealth Accumulation

A family business can also be a source of wealth accumulation. Families that adopt this meaning focus on diversification as a means of managing financial risk. The business is managed to provide significant current distributions that family shareholders are expected to allocate to unrelated investments. The objective is for the legacy family business to constitute a decreasing portion of total family wealth over time.

- Family Characteristics: Family exhibits diversity with regard to interests, geography, and risk tolerance. The family business may represent a significant portion of the family’s overall wealth at present, but the family’s express desire is for that relative allocation to go down.

- Business Characteristics: The family business operates in a mature industry and has limited investment requirements. While growth opportunities are limited, the business earns attractive margins attributable to an entrenched strategic advantage.

- Example: A producer of branded snack foods with a strong regional following that can operate with well-maintained, but old, production equipment.

When the family business acts as a source of wealth accumulation, family shareholders adopt an outward focus, allocating time and resources to evaluating potential investment opportunities.

4. Source of Lifestyle

Finally, a family business can also be a source of lifestyle for family shareholders. These families value the stability of dividend payments as a supplement to wages and other sources of household income. The business is managed to protect the company’s dividend capacity. The objective is for the family business to predictably augment the family’s aggregate income from other sources to help facilitate travel, philanthropy, education, or other pursuits important to the family.

- Family Characteristics: While the senior generation may be able to rely on dividends as the primary source of income, family members in younger generations rely on wages or other sources of primary income.

- Business Characteristics: The family business operates in a maturing industry with modest investment opportunities. A primary goal of capital investment activity is to generate some measure of real growth in distributions over time.

- Example: A developer of a niche enterprise software platform for veterinary practice management.

If the family business is a source of lifestyle, family shareholders may appreciate the financial backstop provided by the value of the business, but ultimately gauge the success and health of the business by the stability, predictability, and growth of the dividend. The predictable dividend may free some family members to pursue meaningful careers that are not especially rewarding financially.

So What?

Every family business plays a unique variation on one of these themes. The meaning of a family business may shift over time as the family and business evolve. What is the meaning of your family business today? Do your family shareholders agree on the meaning of the family business?

In family businesses, alignment and consensus regarding the meaning of the family business can prevent most of the disputes that breed resentment, open conflict, and litigation. Give one of our family business professionals a call today for help with discerning the meaning of your family business.

Family Business Director

Family Business Director