What Time Is it for Your Family Business?

It is harvest time in rural America. Farmers are working long hours gathering the crops that have been planted, fertilized, watered and worried over since springtime. While the cycle of planting and harvesting is an annual one on the farm, for family businesses, the cycle can span decades or even generations.

There are many different ways to classify family businesses, but one simple distinction that we find ourselves coming back to often is that between planters and harvesters.

- Planters are family businesses that are currently investing more cash flow in future growth than their existing operations generate. Since these companies are focused on sowing the seeds for future growth, family shareholders should expect near-term returns to come primarily in the form of capital appreciation.

- In contrast, harvesters generate more cash flow from current operations than they are investing for future growth. While there likely will still be some degree of expected capital appreciation for these firms, they offer their family shareholders the potential for greater current income.

So what time is it for your family business? Is it planting season or harvesting season? You can easily tell by taking a look at the statement of cash flows. This generally underappreciated financial statement has three sections.

- The operating section summarizes the sources of cash flow from existing operations (principally earnings, depreciation and other non-cash expenses, net of changes in working capital).

- The investing section details the cash flows allocated toward corporate investments, the most significant components of which are capital expenditures and business acquisitions.

- The financing section reveals whether the company is a net borrower or lender, has issued or repurchased equity shares, and whether or not it pays dividends to shareholders.

We can classify family businesses as either planters or harvesters by simply comparing the first two sections of the statement of cash flows. For planters, total investing outflows exceed operating inflows. Harvesters, on the other hand, generate more operating inflows than investing outflows.

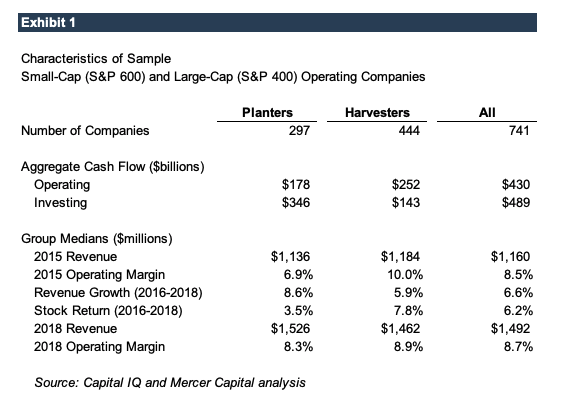

Once you determine whether your family business has been a planter or harvester in the past, it is time as a director to determine whether a change is appropriate in the future. To help us think about the characteristics of planters and harvesters, we examined statements of cash flow for companies in the S&P 600 (small-cap) and S&P 400 (mid-cap) indexes. After screening out financial and real estate businesses, we were left with a sample of 741 companies having median revenue in 2018 of about $1.5 billion. We classified each firm based on aggregate cash flows from 2013 through 2015; 40% of the companies were planters and 60% were harvesters. Exhibit 1 summarizes some characteristics of each group.

In the aggregate, planters invested $1.94 per $1.00 of operating cash flow, compared to $0.57 for harvesters. Harvesters tended to be more profitable, with a median operating margin of 10.0%, compared to 6.9% for planters. The net effect of more aggressive investing was a combination of faster revenue growth and improving profit margins for planters. Of course, return is the ultimate test for shareholders, and over the following three years (2016 through 2018), harvesters generated higher returns than planters (7.8% compared to 3.5%).

Peril and Promise

It is easy to determine whether your family business has been a planter or harvester in the past. The real question for directors is assessing whether it should be harvest time or planting time for your family business now. Neither planting nor harvesting is inherently superior to the other. Directors need to read the calendar for their family business, understanding the peril and promise of each time.

Planting Time: Promise

The promise of planting time is the opportunity for a greater future harvest. As families grow over time, directors should evaluate the appropriate relationship between family and business growth. Planting time offers the promise that the growth of the business can keep pace with, or potentially exceed, the growth of the family, fueling per capita growth in family capital. What’s more, prudent planting can create opportunities for family members to assume roles of increasing responsibility in the business and promote shareholder engagement.

Planting Time: Peril

Business would be easy if planting decisions could be deferred until harvest outcomes are known. Sadly, that is simply not the case. You have to plant before you harvest. As a result, the principal peril of planting time is the risk that the harvest will turn out to be less attractive than expected. Referring back to Exhibit 1, the planters’ investments did contribute to faster revenue growth and improving margins. However, it is not clear that the incremental benefits from investment were truly sufficient relative to the investment made. The weaker observed stock returns for planters suggest that – for many of the companies – the harvest was not as robust as planned. In other words, the market concluded that at least some of the companies in our sample misread what time it really was, planting when they should have been harvesting.

Harvest Time: Promise

It is nice to be rich, but it’s even better to have money. The promise of harvest time is that the family will finally reap the benefits of the risks and investments of previous generations, turning the “paper” wealth of illiquid business value into liquid, readily diversifiable wealth. Harvest time can facilitate the transition from being a business family to an enterprising family. Harvest time can allow families to reduce their economic risk profile by moving at least some of their hard-won eggs into new baskets. As families grow, diversifying family wealth can be a critical component of overall family harmony and sustainability.

Harvest Time: Peril

One of the biggest perils of harvest time is complacency. An over-emphasis on harvesting can starve the family business of needed investment. If the family business does not keep up with the growth of the family, the resulting pressure on per capita wealth and earnings can add stress to family relationships and erode shareholder engagement. Even from the perspective of the family business, the positive impact of investing for growth can be easily overlooked. As shown on Exhibit 1, the harvesters experienced some margin decay over the following three year period, suggesting that at least some harvesters allowed their competitive advantages to wither during the harvest. Directors need to take a balanced view of the long-term reinvestment needs of the business.

Conclusion

While there is some persistence in companies’ investing behavior over time, the companies in our sample did evolve. We reclassified each of the companies in our sample based on cash flow data for the three years from 2016 and 2018. Approximately half of the original planters became harvesters in the succeeding period. Harvest time is not a final destination, however, as about 30% of harvesters turned into planters. From this evidence, we conclude that your family business is never “stuck.” Family business directors need to regularly check what time it is for their family business, and not assume that the characteristics of the past year or decade are appropriate today. So, what time is it for your family business?

Family Business Director

Family Business Director