When Does Valuation Matter to Family Businesses?

Why should family business leaders care about the value of their business? If the family is not contemplating a sale of the business, why does valuation matter?

Clearly, valuation matters a lot when it is time to sell. But valuation matters at other times as well. In this post, we describe four common valuation applications in family business.

Ownership Succession and Tax Compliance

Enterprising families prioritizing sustainability of the family business over decades need a strategy for ownership succession from generation to generation. Ownership transfers within a family unit can occur either during the present owner’s lifetime or upon death. In either case, compliance with tax laws require that the shareholders determine the fair market value of the shares being transferred.

Family shareholders occasionally confuse fair market value with what they believe the shares to be worth to them. Fair market value is the statutory standard of value that emphasizes the actions of “hypothetical willing” buyers and sellers of shares in the family business. Revenue Ruling 59-60, which provides guidance for valuation of closely held companies, presents a working definition of fair market value:

2.2 Section 20.2031-1(b) of the Estate Tax Regulations … define fair market value, in effect, as the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of the relevant facts. Court decisions frequently state in addition that the hypothetical buyer and seller are assumed to be able, as well as willing, to trade and to be well informed about the property and concerning the market for such property.

In other words, fair market value is not defined by what a particular family shareholder feels like the shares are worth to them or “what they would be willing to pay,” but is rather defined by a more rigorous process that considers the behavior of rational, willing, and well-informed parties to a hypothetical transaction involving the subject block of shares.

Shareholder Redemptions

Not all family shareholders need the same things from the family business. A share redemption program can help provide interim liquidity for shareholders and provide a release valve in the event relationships among the shareholders deteriorate to the point that it becomes advantageous for some shareholders to be bought out completely.

In contrast to tax compliance valuations that must conform to fair market value, there is more flexibility in pricing shareholder redemptions. In other words, enterprising families can seek to execute shareholder redemptions at a price considered to be “fair” or that otherwise advances the goals of the share redemption program.

Regardless of the underlying goals or valuation philosophy selected, it is important for the transaction price to be the product of a disciplined valuation process. Doing so helps to ensure that the share redemptions do not detract from broader family goals or undermine other estate planning objectives of family shareholders.

Performance Measurement, Evaluation, and Compensation

Whether family members or outside “professionals,” the managers of the family business are stewards of family resources. Family shareholders should be entitled to periodic reporting on the effectiveness of that stewardship. While there are a variety of “internal” measures of corporate performance that are helpful in this regard (return on invested capital, etc.), periodic “external” measures that reflect the change in the value of the family business over time are also essential.

Most observers acknowledge the benefit of aligning the economic interests of managers and family shareholders. The most common strategy for doing so involves using some form of equity-based compensation, and the most common equity-based compensation programs require periodic valuations for administration. Many family businesses have installed employee stock ownership plans, or ESOPs, to provide a broad-based ownership platform for employees, and ESOP administration requires an annual independent valuation of the ESOP shares.

Corporate Finance Decisions

Finally, valuation is an essential component of the most important long-term corporate finance decisions made by family business directors and managers.

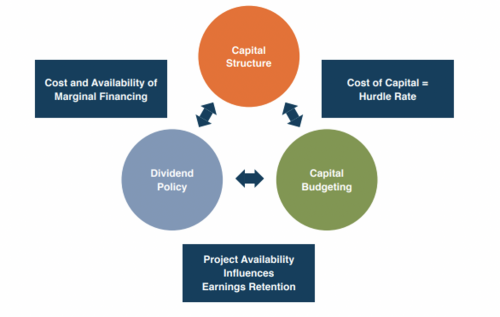

The graph below depicts the inter-relationships between the capital structure, dividend policy, and capital budgeting decisions facing family businesses.

The capital structure and capital budgeting decisions are linked by the cost of capital. There is a mutually reinforcing relationship between the value of the family business and the cost of capital, as each one influences, and is in turn influenced by, the other. The cost of capital depends on both the financing mix of the company and the riskiness of capital projects undertaken. The cost of capital also serves as the hurdle rate when evaluating potential capital projects.

The availability of attractive capital projects is also reflected in the value of the family business and is the point of intersection between capital budgeting and dividend policy. If attractive capital projects are abundant, family business leaders will be more inclined to retain than distribute earnings.

Finally, the cost and availability of marginal financing is also affected by the value of the family business. The resulting cost of capital influences both the value of the family business and the decision to distribute or retain earnings or to borrow or repay debt.

In short, the value of the family business is inextricably bound up with these critical corporate finance decisions and is an important consideration in making those decisions.

This week’s post is an excerpt from section 1 of What Family Business Advisors Need to Know About Valuation whitepaper. If you would like to read the full version click here.

Family Business Director

Family Business Director