Winter M&A Update for Family Businesses

In this week’s post, we look back at middle market (defined as total enterprise value of $100 – $500 million) transaction activity in 2024 and look ahead to what may be on the horizon for middle market M&A in 2025. Data and commentary were sourced from Mercer Capital’s Middle Market Transaction Update, which is published quarterly by Mercer Capital’s Transaction Advisory group.

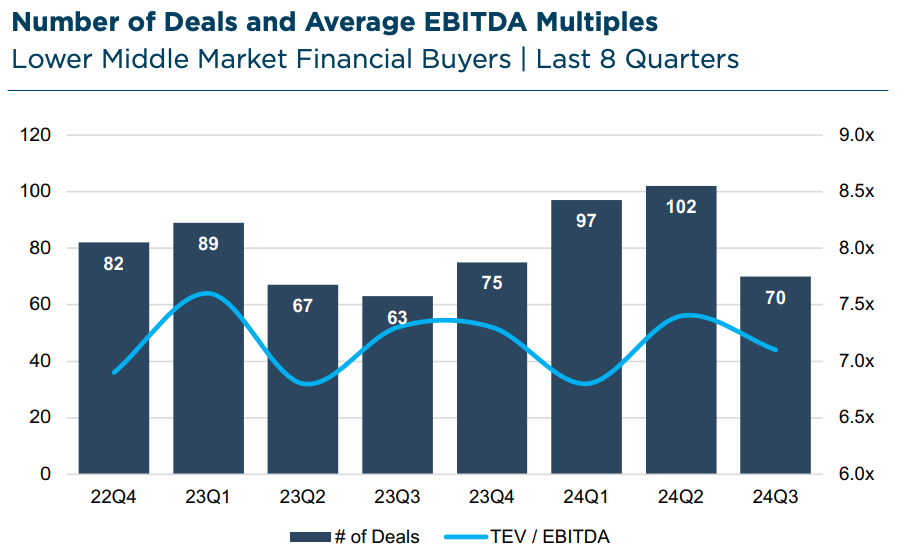

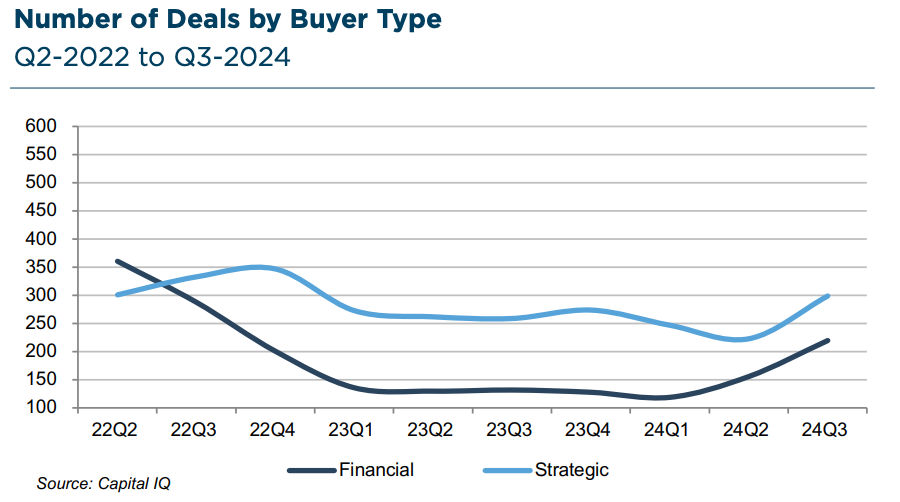

Middle market M&A activity in the third quarter of 2024 showed signs of the “summer slowdown,” as fewer PE deals were reported compared to the first two quarters of the year.

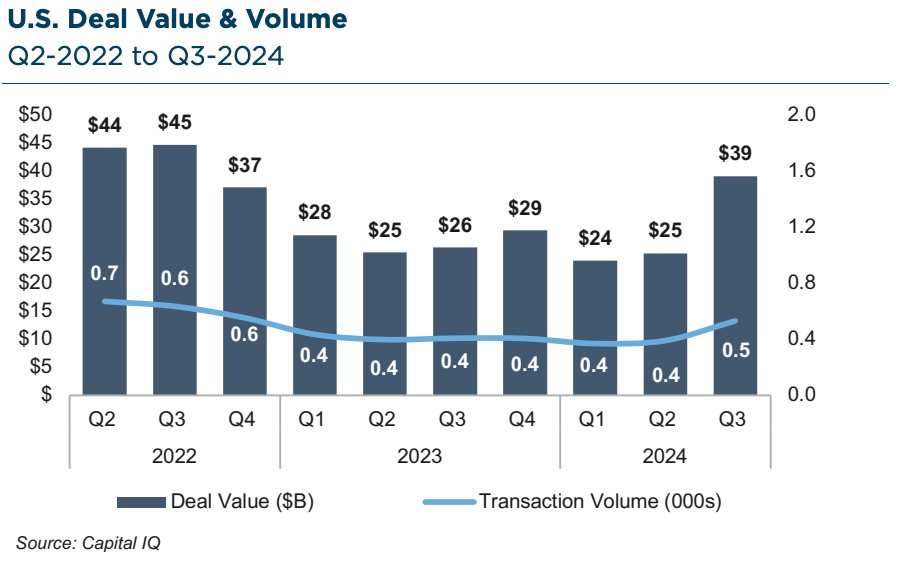

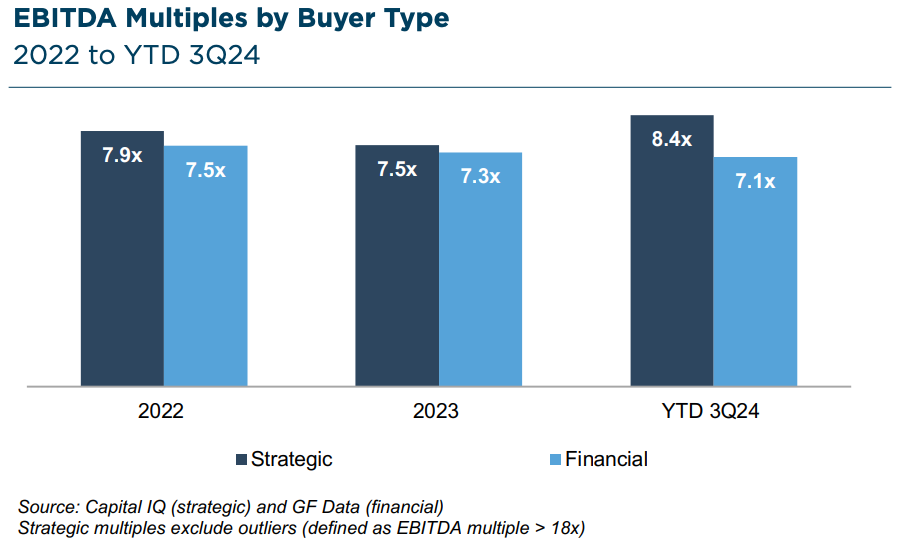

Reported multiples for PE deals also declined 0.3x TTM EBITDA from the second quarter. That being said, overall deal value and transaction volume were up quarter over quarter, with total deal value reaching its highest level since the third quarter of 2022.

The economy continues to show resilience, posting real GDP growth of 2.1%. As predicted, the Fed cut interest rates by 50 basis points in September, easing monetary policy for the first time in four years. The Fed emphasized that inflation was much closer to its target of 2%, and the labor market showed signs of improvement. There are continued signs of private equity funds and strategic buyers with disposable capital, all factors that show the market should be primed for a recovery in M&A activity leading into 2025.

Click here to expand the image above

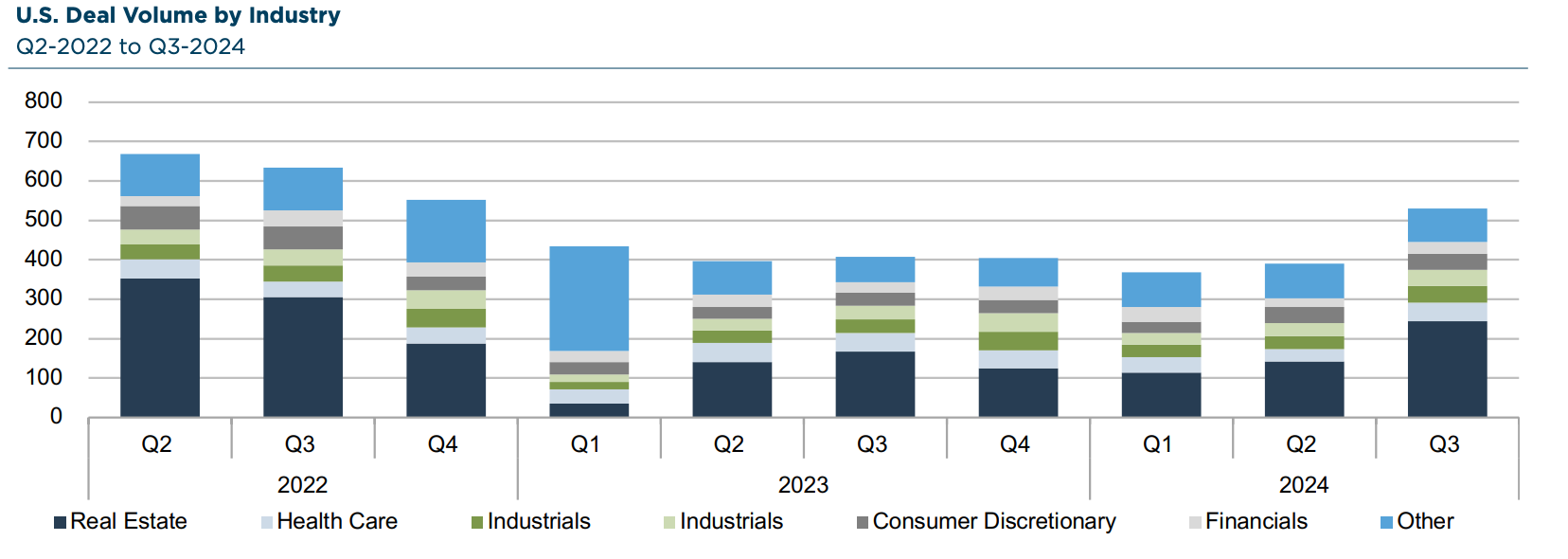

As shown in the chart below, overall U.S. deal activity, as compiled by Capital IQ in the third quarter, increased from the depressed levels observed in recent periods, reaching its highest level since the third quarter of 2022.

GF Data reports that US PE middle-market activity, defined as deals with an enterprise value of less than $1 billion, decreased 31% to 70 deals in the third quarter of 2024, returning to levels seen in 2023.

The data suggests a trend we have seen over the past several years — the third quarter of the year is typically the quarter with the fewest middle-market, private equity-backed deals. The summer slowdown appears to have slowed some activity despite improving debt markets and lower interest rates.

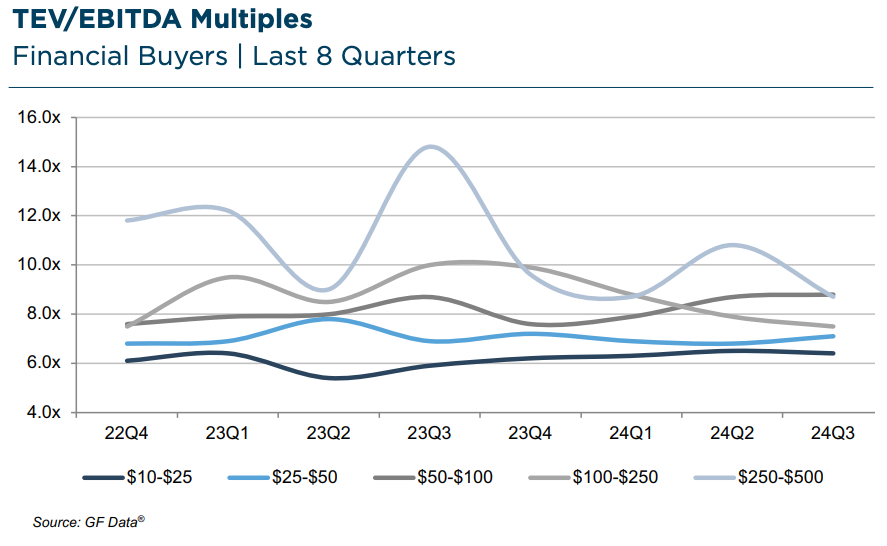

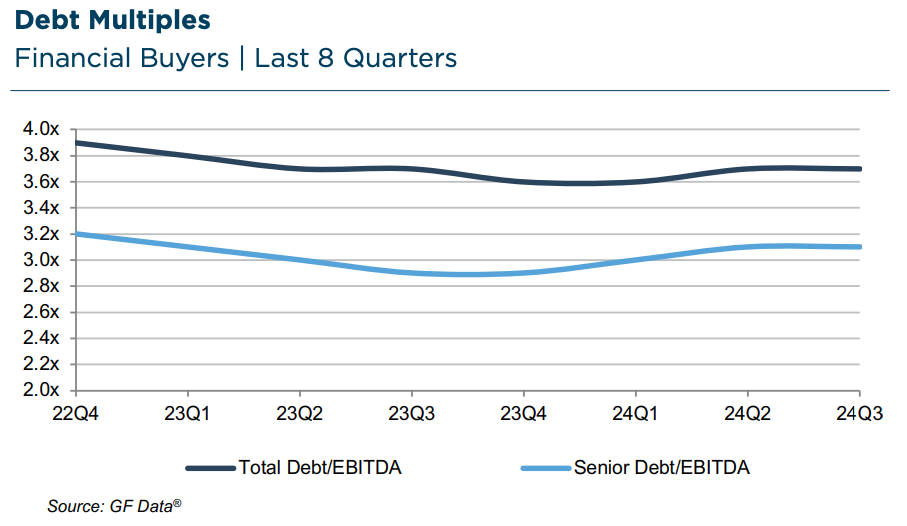

Lower middle-market activity (defined as enterprise values of $10 million to $500 million) as compiled by GF Data® provides several notable observations regarding PE-backed transactions:

- Similar to the overall U.S. transaction level, lower middle market activity remains depressed relative to 2022 and especially 2021, when financing costs were historically low;

- The average EBITDA multiple for all sub-groups declined to 7.1x in the third quarter compared to 7.4x in the prior quarter and 7.3x in the third quarter of 2023;

- The average EBITDA multiple for the trailing 12 months on a rolling quarterly basis remained at 7.2x quarter over quarter. The same multiple was observed for the trailing 12 months ended September 30, 2023;

- The average EBITDA multiple for the trailing 12 months by sub-group ranged from 6.8x for deals with an enterprise value of $25-$50 million to 8.5x for deals in the $100-$250 million range;

- The year-to-date average multiples by industry ranged from 6.1x for retail to 8.9x for healthcare services; and

- Buyer transaction costs excluded from the multiples cited above add about 0.3x to all-in costs.

Deal volumes in both strategic and financial deals during the third quarter present a similar picture. The chart below highlights overall deal value and volume, including strategic deals.

The third quarter of 2024 represents a significant uptick in deal value (50%) and volume (30%) over the last four quarters. Deal value increased 56% quarter-over-quarter and is down only 7% from second quarter 2023 metrics.

Middle Market M&A Outlook — 2025

As deal activity begins to revert to pre-2023 levels, the outlook for 2025 points to signs of optimism, while some hurdles remain on the horizon.

Several key factors could break open the logjam in middle-market M&A activity going into 2025. Lower rates, tighter credit spreads, enhanced leverage capacity, and a potentially merger-friendly regulatory environment could propel activity in this space. Early signs related to the United States election results indicate an increase in deal flow and a continuation of favorable capital gain tax rates.

Deal structures have been evolving continuously to accommodate the current M&A landscape. Equity rollovers are becoming more prevalent, particularly with private equity-backed acquirers. This approach could align the interests of the parties and incentivize sellers to remain committed to the continued growth of the business.

In the private equity world, hold periods on private equity investments, which are the period between acquisition and exit, have increased in recent years. Per Pitchbook, the median exit period is currently 6.4 years, up from 5.1 years in 2021. The lengthening of this hold period has increased the need for PE funds to return capital to return-hungry investors, which could spur a flurry of exit activity in 2025.

One possible challenge for owners looking to sell in 2025 is the potential for adverse effects on deal pricing and terms if a surge of M&A activity does materialize in the new year. With a scarcity of deal activity in the past two years, well-positioned businesses coming to market have, in many cases, been able to dictate more favorable terms and healthy multiples, given the lack of alternatives for buyers and increased competition among buyers in bidding situations. If seller activity ticks up appreciably in 2025, buyers may have more negotiation leverage, potentially dampening the deal-starved multiples seen over the past two years.

Conclusion

On balance, middle market M&A conditions are poised to improve amid expectations of reduced regulation, lower taxes, and an improving economy. While there are risks and hurdles to overcome, strong economic growth and a business-friendly environment should show signs of improvement in the middle market in 2025.

Since 1982, Mercer Capital has offered M&A advisory services to a diverse range of public and private companies, leveraging extensive valuation and investment banking experience to guide clients through complex transactions. While our team provides objective advice, we also advocate for our clients while navigating the competitive marketplace of private equity groups, family offices, and strategic buyers. We facilitate informed decision-making with a tailored, multi-phased approach to planning and executing transactions. For confidential consultation on your transaction-related needs, contact us today.

Family Business Director

Family Business Director