Wishful Thinking and the Time Value of Money

Our most faithful readers may recall our August 2019 post about the Nordstrom family preparing a bid to increase its ownership in the eponymous publicly traded retailer.

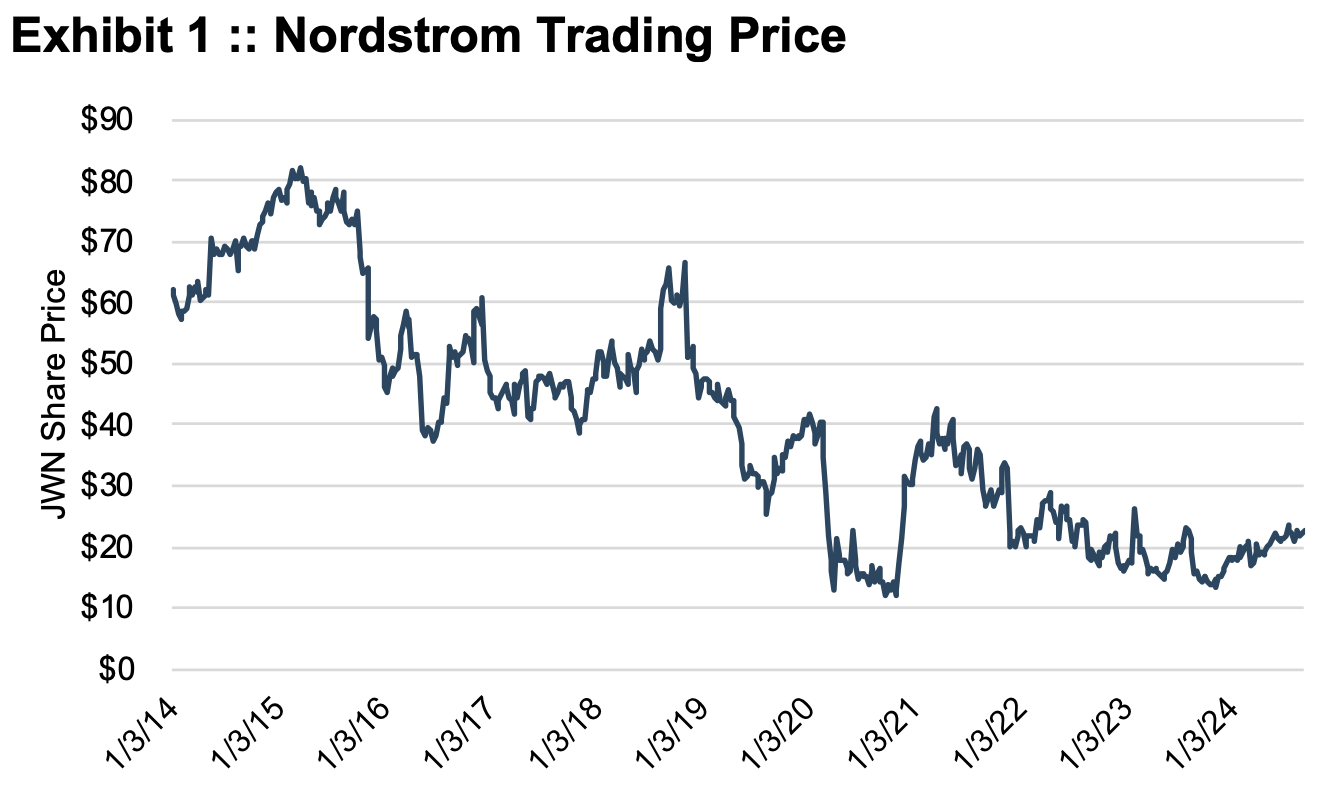

At that time, an independent board committee was evaluating a proposal under which the Nordstrom family would acquire shares to push its ownership from approximately 31% to over 50% of the outstanding shares. In October 2019, the company disclosed that the board rejected the family’s proposal. The company’s shares were trading at $25 per share when the Wall Street Journal reported the family’s proposal in August; in the wake of the reports, the shares rallied to $38 per share in late October.

The 2019 offer to increase the family’s ownership came on the heels of a June 2017 announcement that members of the Nordstrom family were preparing a bid to acquire 100% of the outstanding shares and take the company private.

- In October 2017, the family announced that it was temporarily suspending its effort to take the company private.

- In March 2018, the family offered $50 per share for the proposed going-private The offered price represented a 25% premium to the $40 share price at the time of the June 2017 announcement of the family’s intention. In the wake of that announcement, the company’s shares traded from $40 per share to $54 per share.

- A special committee of the board announced that it had rejected the family’s offer later that month.

Nordstrom was in the news again this week, with the company disclosing that — once again — members of the Nordstrom family were offering to take the company private, this time for $23 per share. As of the writing of this post, the Nordstrom board had formed an independent committee to evaluate the offer. The $23 per share offer compares to an average trading price for Nordstrom shares of approximately $22 per share during August 2024. Prior to the reporting of a potential buyout offer in April 2024, the shares were trading in the neighborhood of $18 per share.

It’s certainly not our place to second guess the Nordstrom board, but in hindsight, JWN shareholders undoubtedly regret the refusal of the $50 offer in March 2018 and the (unspecified) purchase offer in the fall of 2019. Exhibit 1 depicts Nordstrom’s share prices since 2014.

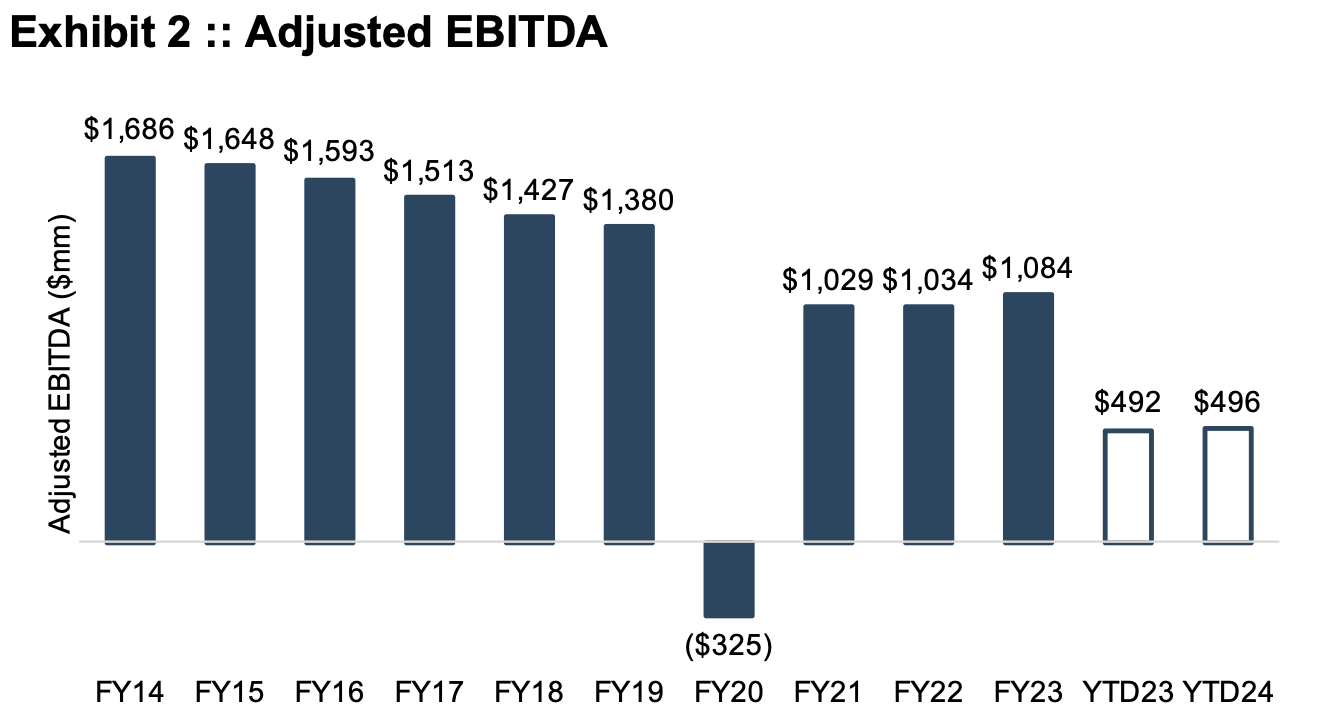

No board of directors is blessed with a crystal ball, and certainly no one anticipated a global pandemic in 2019. At the same time, however, the rise of e-commerce and the challenges facing traditional brick-and-mortar retailers were not exactly secrets. Undoubtedly, the board believed the company had a compelling strategy to counteract these threats (i.e., building its own e-commerce platform and growing its discount “Nordstrom Rack” concept, among others). As Exhibit 2 demonstrates, however, these efforts secured only a flat top line and deteriorating margins.

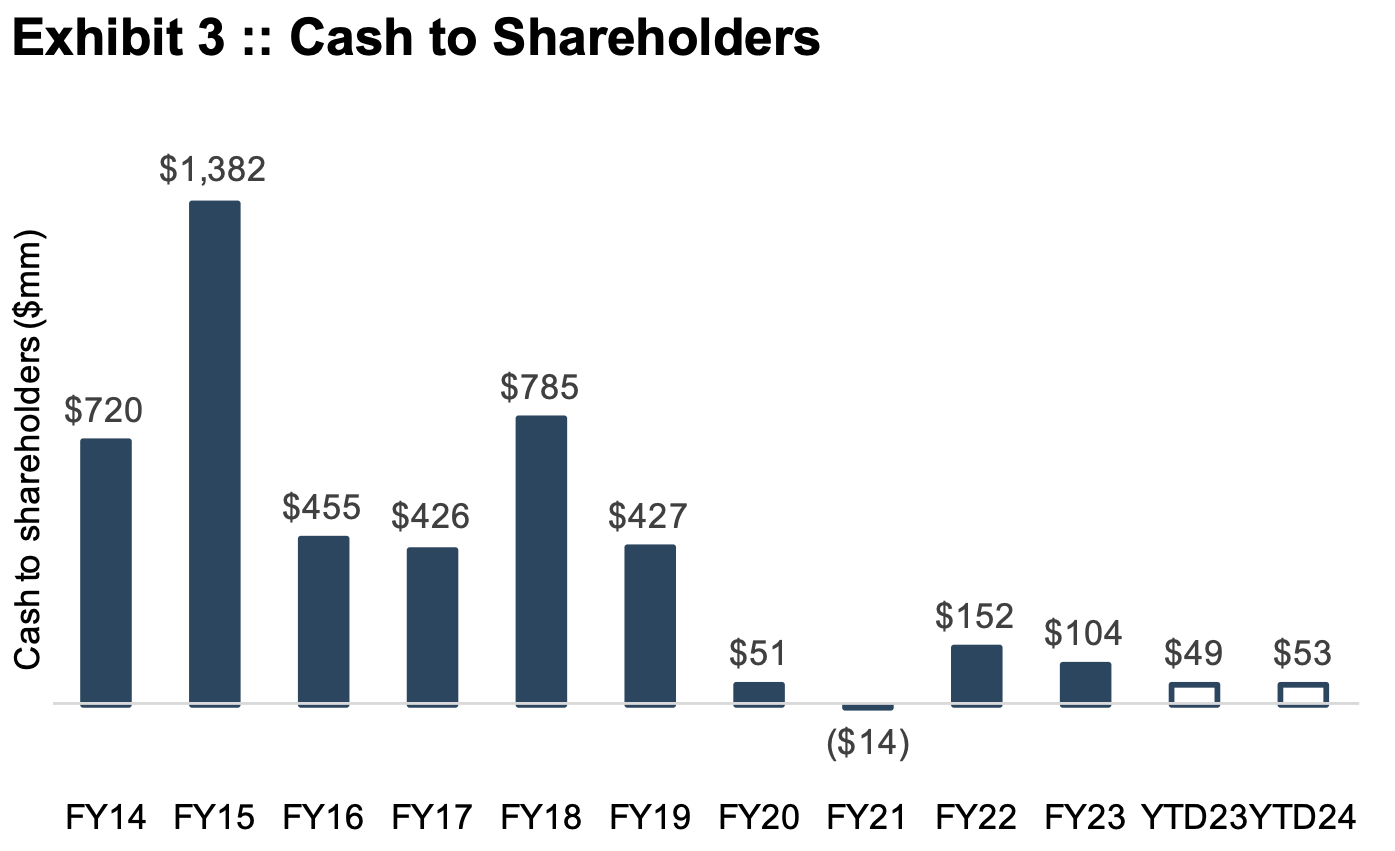

In short, the downtrend was evident at the time of the $50 per share offer in March 2018. While EBITDA has stabilized in the wake of the pandemic, the new “ongoing” level of EBITDA for the company is 21% below the pre-pandemic level. Moreover, against ongoing capital investment needs, cash flows distributed to shareholders (whether through dividends or net share repurchases) have dwindled even more dramatically over the period, as shown in Exhibit 3.

What lessons can family business directors glean from the Nordstrom saga? We will consider three in this post:

Lesson #1 – Be Realistic about Macroeconomic and Industry Trends.

Of course, you want to believe and support management’s strategy for the future. But directors should be wary of falling prey to the behavioral bias of ignoring data that contradicts your view (confirmation bias). When evaluating major decisions, do you and your fellow directors consider — much less actively seek — contrary evidence, or do you only focus on the data points that confirm management’s plans?

The Nordstrom management team may well be composed of highly talented retailers, and the strategy they formulated for Nordstrom may have been the best possible strategy for the company at the time. But even the best corporate strategy will struggle to overcome much larger contrary macroeconomic trends. As investors like to say, “Don’t fight the Fed.”

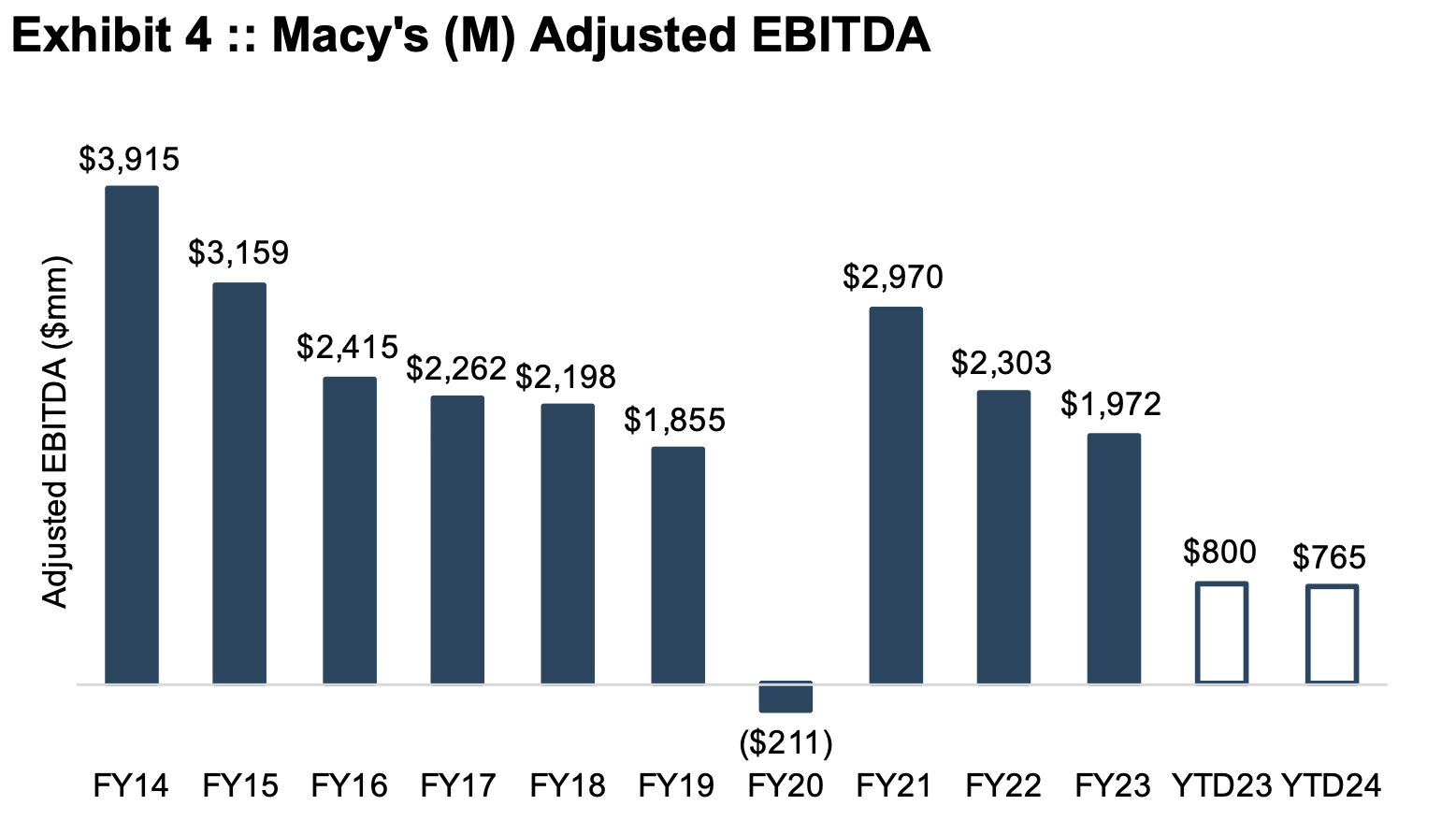

Sure enough, Nordstrom’s ongoing struggles are mirrored in the results for competitor Macy’s over the same period (Exhibit 4).

In short, directors must be on guard against wishful thinking (we will be able to overcome large and adverse shifts in buyer behavior or other industry and economic factors) and regularly expose such thinking to the solvent of hardnosed realism.

Lesson #2 – Consider the Consequences of Failing to Act (i.e., Time Is Not Always on Your Side).

The concept of the time value of money is simple: a dollar today is worth more than a dollar tomorrow. One implication of this fundamental finance concept is that family business directors and managers are always “on the clock.” The corrosive effect of time on the value of money means that deferring decisions to the future always carries a cost. Unless the incremental benefit available from deferring a decision exceeds the relevant discount rate, shareholders suffer. Deferring difficult decisions can be another variant of wishful thinking (if we wait, things will get better).

The current going private offer for Nordstrom is $23 per share; in March 2018, the offer price was $50 per share. Viewed simplistically, refusing the March 2018 offer “cost” the Nordstrom shareholders $27 per share. However, the time value of money means that the decision was even costlier for JWN shareholders.

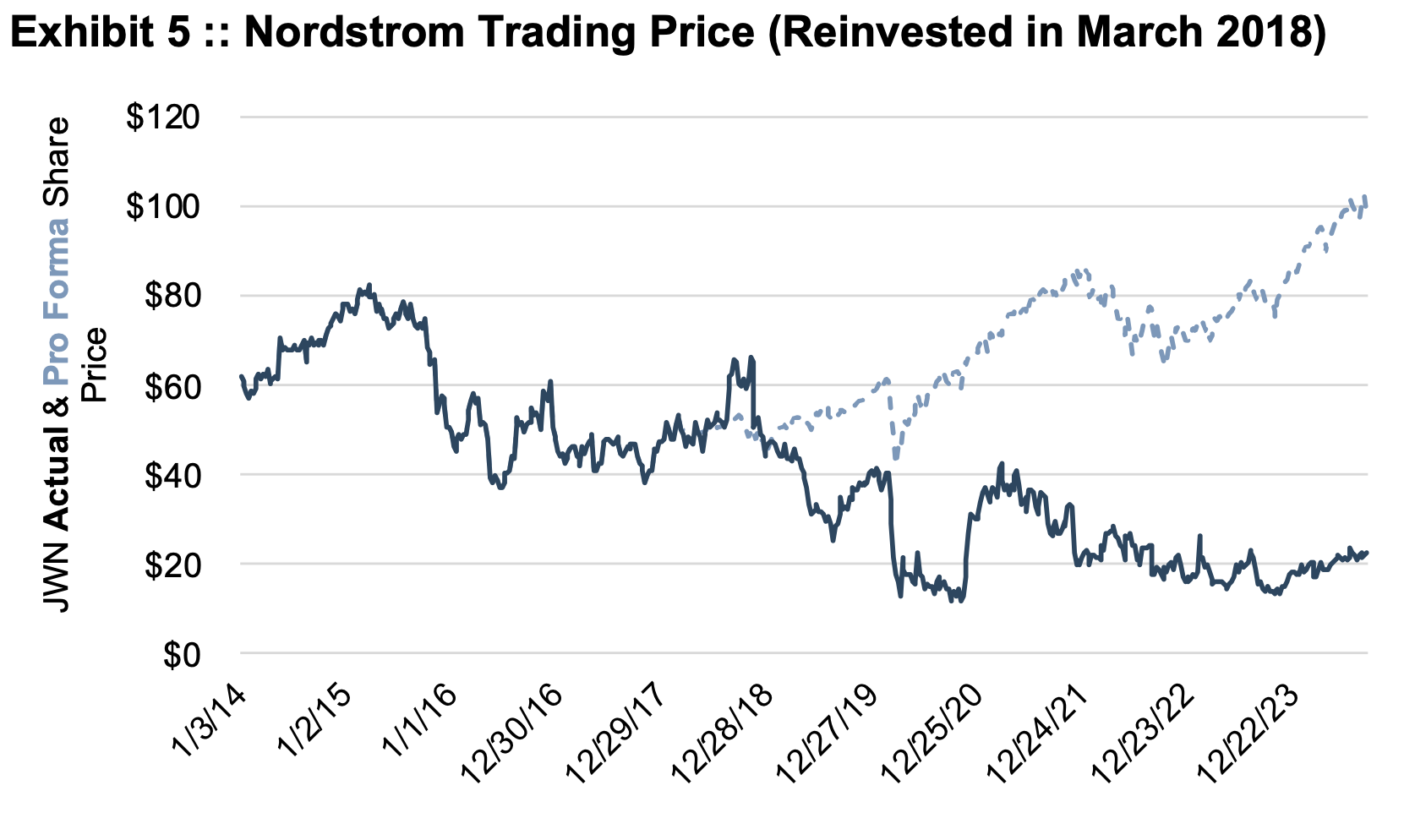

Exhibit 5 illustrates the effect of the time value of money on the decision to defer accepting the going private offer in March 2018.

Assuming JWN shareholders reinvested the proceeds from a pro forma March 2018 going private transaction at $50 per share in the S&P 500, those proceeds would have grown to $98 per share in September 2024 (the light blue dotted line). Viewed from this perspective of incorporating the time value of money, the real “cost” to the shareholders was $75 per share.

Lesson #3 – The Stakes Are Higher for Family Business Directors.

If we roll the tape back to March 2018, we can see that any JWN shareholders who believed the independent committee of the Nordstrom board erred in declining the $50 per share going private offer could have simply sold their shares in the open market, which at that time was approximately… $50 per share. As a result, investors holding JWN shares continuously from March 2018 through the present can’t place all the fault for their economic misfortune on the shoulders of Nordstrom directors. By virtue of Nordstrom being a public company, no one was forced to hold JWN shares through that period — if an investor thought $50 was a fair price, they could have elected to receive it by exercising their right to sell their shares in the market.

Alas, family business directors can’t apportion blame to shareholders in the same way. For the most part, family shareholders are “stuck,” which makes being a family business director even more challenging. Only in rare cases can family shareholders who may disagree with a board’s decision elect to sell their shares in protest. Instead, the fortunes of family shareholders are tied to the decisions directors make. This raises the stakes for family business directors and highlights the “measure twice and cut once” nature of significant corporate decisions. Given that reality, family business directors need to carefully evaluate decisions and seek out the best legal, accounting, and financial advice to assist them.

We will be watching the Nordstrom saga closely to see whether it has reached its climax or whether the current take-private offer is just one more episode in a continuing drama. Stay tuned.

Family Business Director

Family Business Director