You Can’t Spend the Same Dollar Twice

In our conversations with family business managers, directors, and shareholders, one of the common themes we discuss is the role of capital allocation in shaping investment returns for family shareholders.

In large, multi-generation family businesses with dozens of family shareholders, we often observe the existence of multiple “clientele” within the shareholder base.

- Some shareholders are likely to be highly dependent on distributions from the company to fund lifestyle expenditures — as a result, they are naturally focused on the dividend-paying capacity of the family business. For these shareholders, the quarterly dividend check is the best barometer of how the family business is run.

- Other shareholders — by virtue of having lucrative careers, marrying well, or other factors — fund their ongoing lifestyle needs from other sources. As a result, they are likely to be more focused on the rate at which the value of their investment in the family business grows. For these shareholders, the change in the value of their shares from year to year is the best gauge of success for the family business.

A key element of shareholder education for such families is the concept of capital allocation. In other words, family capital is a scarce resource that can either be put to work inside the business or distributed to provide liquidity to shareholders, but not both. Or, in other simpler words: You can’t spend the same dollar twice.

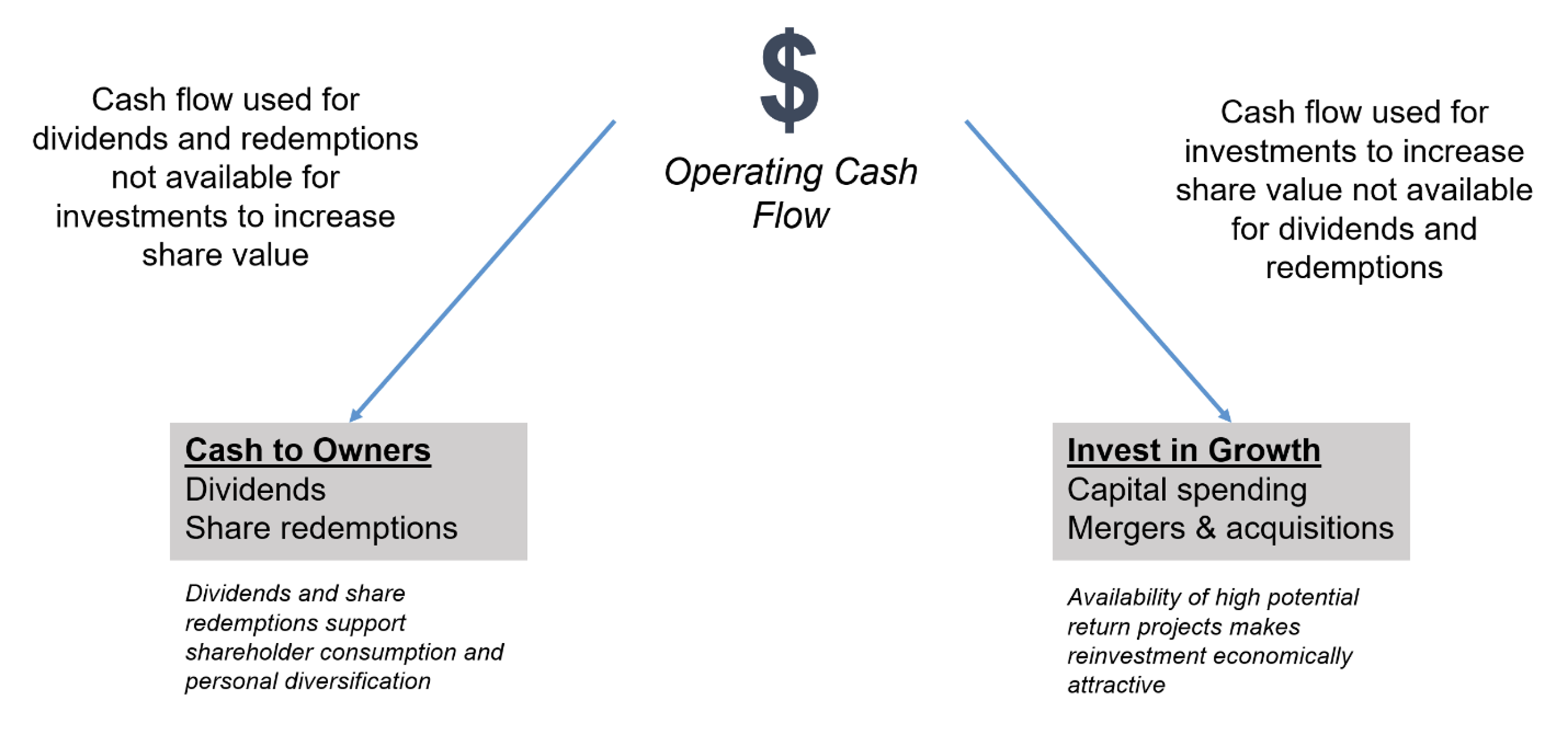

The following exhibit illustrates this concept:

Family business managers and directors must decide how to dispose of every dollar the family business generates through its operations. At the most basic level, a dollar of operating cash flow can be returned to owners in the form of dividends and share redemptions (thereby making the first group of shareholders happy) or reinvested in the business in the form of capital expenditures or M&A (thereby making the second group of shareholders happy). But, sadly, a single dollar of operating cash flow can’t do both. Choices must be made.

Choices Have Consequences

The choices family business directors make when it comes to capital allocation have consequences for family shareholders.

- When operating cash flow is used to pay dividends or redeem shares, those cash flows are not available to make the kinds of investments that fuel growth in share value over time.

- Conversely, dollars allocated to capital expenditures and M&A are not available to provide for the liquidity and consumption needs of family shareholders. It’s great to be rich (with a high share price), but sometimes family shareholders justly feel that having some money would be even better.

In view of these consequences, what should family business directors do? In our experience, the most successful family businesses balance what the business needs with what the family shareholders need.

What the Business Needs

For enterprising families, the family business is the proverbial goose that lays golden eggs. Keeping the goose healthy is essential for the long-term sustainability of the family enterprise. When the family business can access many investments offering high returns, reinvestment will be more attractive. However, if there aren’t many attractive investment options out there, over-feeding the goose could prove fatal. Retaining capital in a business that can’t use it well drives down returns and can imperil the future of the family enterprise.

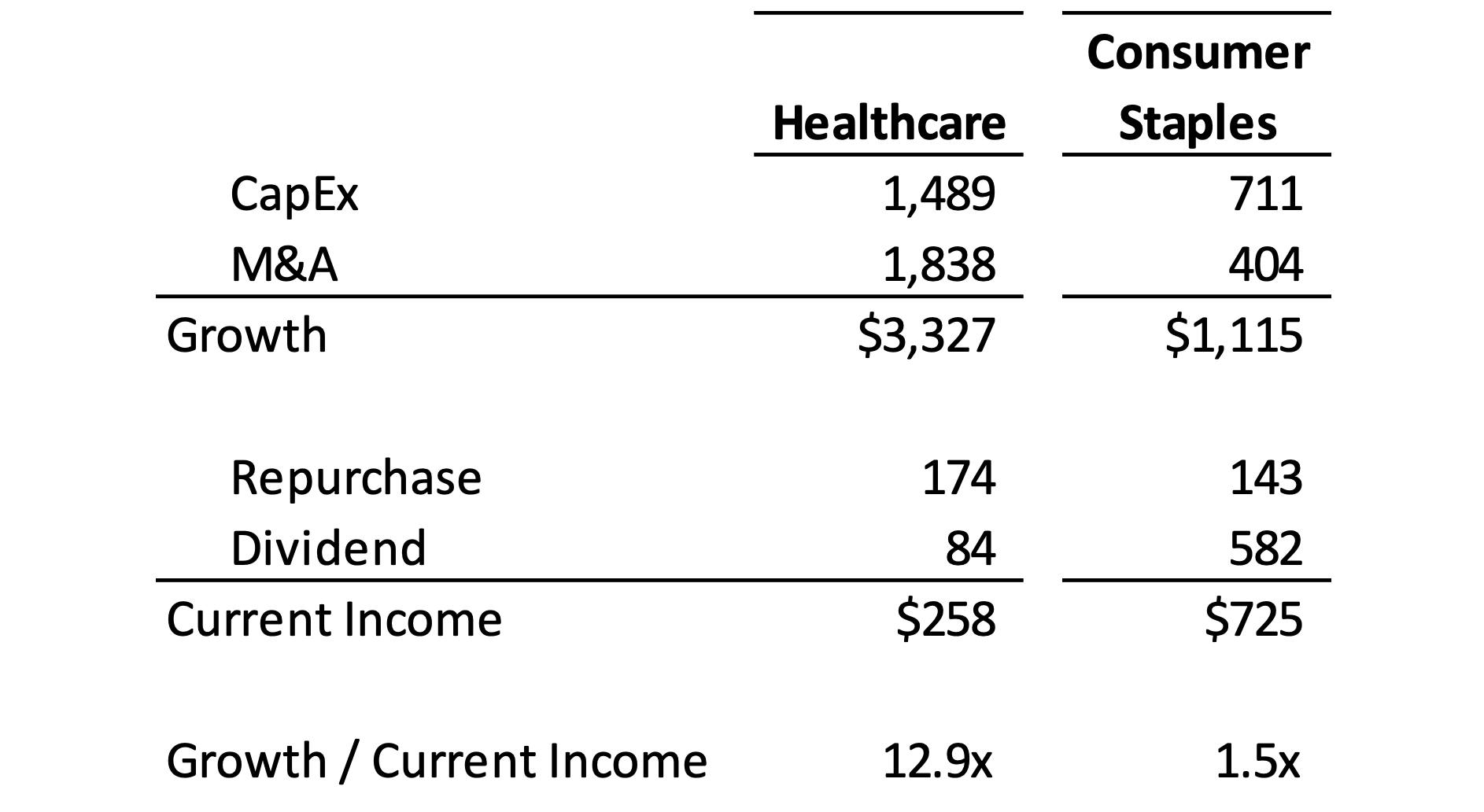

We pulled data from small-cap public companies to illustrate this concept.

- With the aging population and rising global access to care, the healthcare sector offers attractive growth opportunities for companies in the industry. As a result, the 70 healthcare companies in our sample allocated $12.90 to growth investments for every $1.00 allocated to providing current income to shareholders.

- In contrast, the consumer staples sector is mature, and growth opportunities are more limited. In response, the 27 companies in our sample allocated just $1.50 to growth investments for every $1.00 allocated to providing current liquidity.

The moral of the story is that you can’t ignore the opportunities available to the family business when allocating capital.

What the Family Needs

Public company directors can essentially ignore the characteristics of their shareholders. After all, if a public company investor desires more or less capital appreciation than the company provides, they can simply rebalance their portfolio accordingly.

However, family business directors can’t be so cavalier with respect to their family shareholders’ preferences. Those shareholders can’t just pick up the phone and reallocate their investment portfolio with a short call to their broker.

As a result, family business directors need to listen to their shareholders:

- What are the liquidity needs of family shareholders?

- How much risk are family shareholders willing to bear in pursuit of capital appreciation?

- How important is the family’s legacy?

- Are family shareholders well-diversified from an investment perspective?

- How do family shareholders feel about debt?

- Etc., etc.

Speculating on the answers to these questions can be dangerous for directors. Shareholder circumstances and attitudes are constantly evolving, so even if you had a good feel for what the family needed a decade ago, you may not know what they need today.

When discerning what the family needs, there’s no substitute for asking. We often administer confidential shareholder surveys for our family business shareholders to solicit frank input and feedback from family shareholders.

Armed with an objective assessment of what the business and the family need, directors can begin to make the tradeoffs inherent in the capital allocation process in a disciplined and informed manner. Knowing you can’t spend the same dollar twice encourages one to think carefully before spending that dollar. If you’d like a fresh perspective on the capital allocation challenges facing your family business, give one of our professionals a call to discuss your situation in confidence.

Family Business Director

Family Business Director