The first three quarters of 2017 were active for U.S. markets. Major indices were characterized by low volatility and upward momentum against a backdrop of tightening monetary policy and strong economic indicators. Private equity saw steady deal flow despite challenging market conditions, and record levels of venture capital deployment were seen amidst declining deal volume as capital continued to gravitate to the unicorns. With one quarter left, we take a look at market activity during the first three quarters of 2017.

Public Markets

The S&P 500 index marched higher during each of the first three quarters of 2017, amidst a backdrop of strong earnings growth and low volatility. Year to date, the index is up 11.6%, led by gains in the technology and healthcare sectors.

The rise marks a continuation of a now eight-year bull market, which has led some to worry that things may be getting a bit lofty. Just last month, Yale economist and Nobel Laureate Robert Shiller published an article warning of a coming bear market, citing supernormal cyclically adjusted price-to-earnings (“CAPE”) ratios and, somewhat counterintuitively, low volatility and strong earnings growth, which has historically tended to accompany the onset of bear markets.

Shiller and others are right to point out supernormal CAPE ratios and other valuation metrics as potential warning signs, as regression towards the mean can be a powerful force. So powerful, in fact, that an analogy to gravity is often made to describe the phenomenon of mean reversion. What goes up must come down. The analogy fails, however, with respect to predicting the timing of a market fall. As Shiller notes, regardless of what the metrics say, ultimately the timing of an end to the current bull market is difficult to predict.

IPO Activity

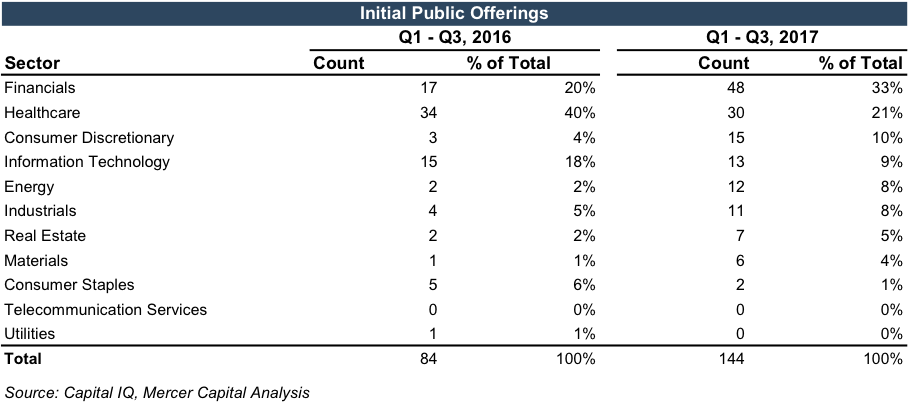

Low volatility and high valuation metrics in the public equity markets make initial public offerings (“IPOs”) more attractive to private companies seeking to raise capital. The number of private companies going public has increased in 2017, with 144 IPOs during the first three quarters of 2017, compared to 84 during the same period last year. The financial sector has been particularly active with 48 total IPOs, or 33% of the companies that went public during the first three quarters. After an active 2016, the healthcare sector saw continued IPO activity during the first three quarters of 2017, with 30 IPOs (21%).

M&A Activity

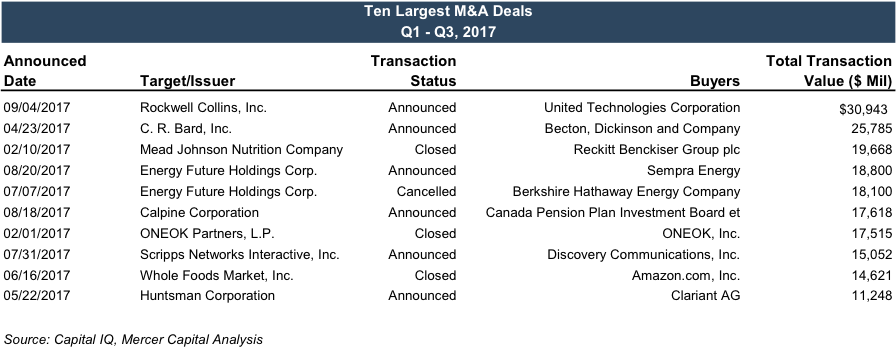

M&A activity has been generally subdued in 2017. According to data from Pitchbook, the first half of 2017 saw an average of 635 deals per month, well off the 1,000 deals per month seen during 2015. Nevertheless, there have been some noteworthy deals:

- In the largest deal announced so far this year, jet engine manufacturer United Technologies announced in September an agreement to acquire aircraft parts manufacturer Rockwell Collins for $31 billion in cash and stock in a deal that is expected to generate cost synergies in excess of $500 million.

- In the energy sector, bankrupt electric utility Energy Future Holdings announced plans in early July to be acquired by Berkshire Hathaway. The deal fell through in August, however, as California-based utility provider Sempra Energy bested the Berkshire bid and won out on the acquisition.

- In April this year, medical device manufacturer Becton Dickinson agreed to acquire fellow medical device company C. R. Bard for $26 billion in cash and stock. The deal represents the latest in a string of notable deals in the medical device industry, which has seen slowing revenue growth and pricing pressure driven by consolidation among downstream healthcare providers.

- And, of course, Amazon bought a grocery store.

Private Capital Markets

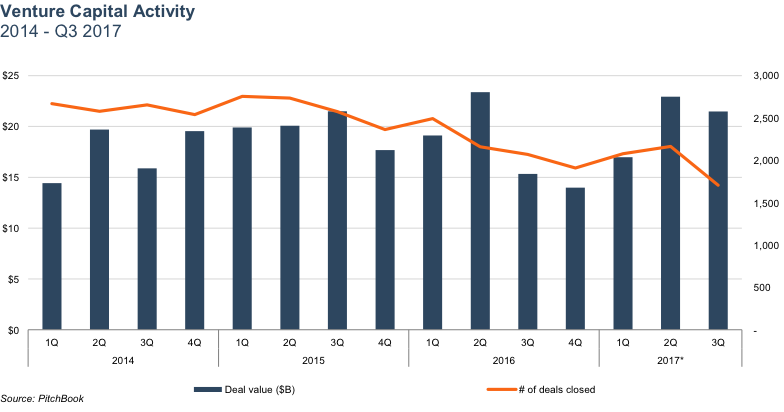

Private capital markets (venture and private equity) have seen an influx of investor funding during the first three quarters of 2017. According to the National Venture Capital Association (“NVCA”), venture capital deployment is on pace to reach record highs during 2017. In Q3 2017, $21.5 billion in venture capital was deployed, bringing the total for the year to $61.4 billion.

Despite record levels of capital deployment, deal volume has actually declined as investors have gravitated towards mega-deals and unicorn companies. An influx of nontraditional investors pouring capital into unicorn companies has amplified this trend and contributed to the lofty valuations seen in later financing rounds.

Partly as a consequence of the availability of private funding, IPOs for venture-backed firms have dropped off significantly, both in terms of total number and total value, despite a generally favorable IPO climate in 2017. According to NVCA, 2017 exit value for venture-backed firms is on track to be the lowest since 2013. This trend has deprived many venture capital firms of what is typically seen as the optimal exit route. Interestingly, many private equity firms have stepped in to fill the IPO-sized hole. According to PitchBook, 2017 has seen a record level of private equity buyout transactions, at $5.2 billion.

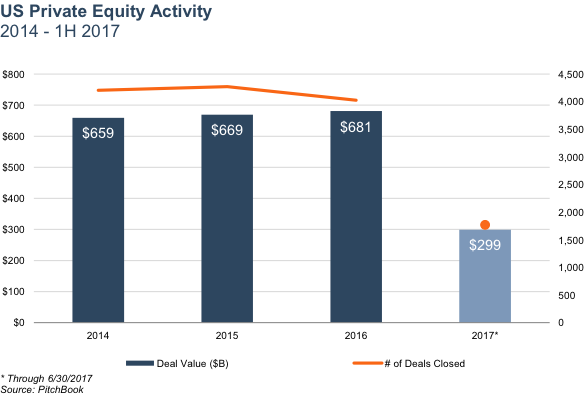

For private equity generally, lower high-yield credit spreads and ample dry powder contributed to steady deal flow during 2017, despite multiples hovering near seven-year highs. Through the first half of the year, 1,770 deals were completed totaling $299 billion in value. Technology has been a particularly attractive sector for PE firms in recent quarters, accounting for 19% of deals through June 2017. PE fundraising during the first half of 2017 was the highest in nearly a decade, with $113 billion committed to 117 funds during the first half of 2017, according to PitchBook.

Conclusion

As we enter the last quarter of the year, as always, it is difficult to predict how markets will continue to perform. The outcome will likely depend greatly on the outcomes of various political and economic uncertainties faced in the U.S. and globally. How industries/sectors perform will also affect the activity and financial reporting needs of individual companies. For industries that demonstrate continued growth and attractiveness, we could see an increase in acquisition and investment activity. For those that continue to be challenged, the potential for goodwill impairment charges and restructurings looms. At Mercer Capital, we work with companies on both ends of the spectrum, and it will be interesting to see what the homestretch of 2017 has in store.

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.