When and how do externally-driven events affect company value? Suppose, for example, that a competitor in your industry announces weak financial results and lowers their company’s forward earnings guidance. Then, the following day, a different competitor is acquired at a 27% premium to the previous day’s closing price (and at a multiple about 25% higher than industry average). Do events like these constitute meaningful data points from a valuation perspective? Are they benchmarks or outliers?

Much has been written about Amazon’s $13.4 billion acquisition of Whole Foods Market that was announced on Friday, June 16. There are all sorts of theories about Amazon’s strategy and the brilliance (or folly) of combining the powerhouse online retailer with a traditional retail grocery chain. But for purposes of this post, we’re going to take a step back and look at the impact of the two externally-driven events on the stock prices of other players in the industry.

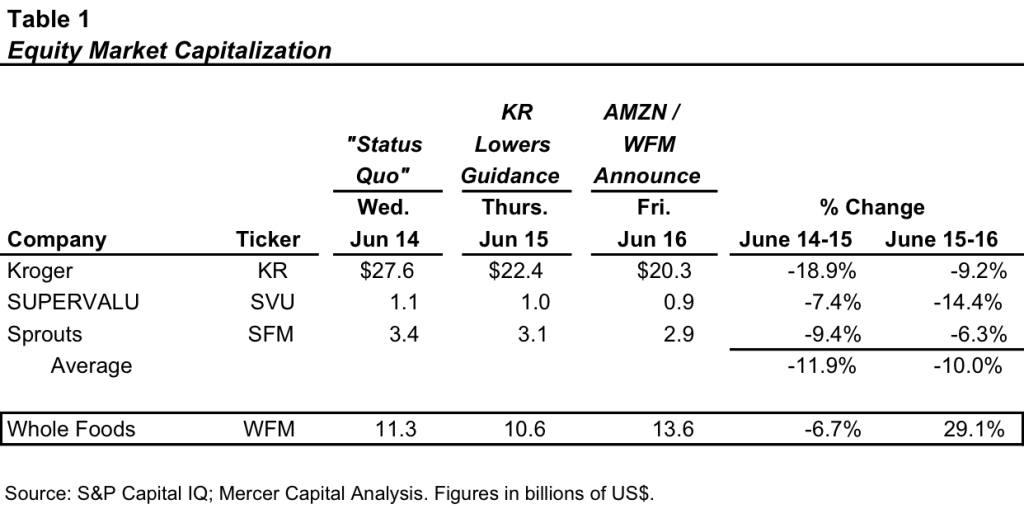

On Thursday, June 15th, just one day before the Amazon / Whole Foods announcement, Kroger announced that its same-store sales fell for the second straight quarter and lowered its forward earnings guidance for the year. Table 1 below shows the change in equity market capitalization for several major U.S. grocers before and after the Kroger earnings announcement.

A few observations from the table above:

- Kroger’s stock price took a 19% hit after the lower earnings report, lowering its equity market capitalization from $27.6 billion to $22.4 billion.

- As might be expected, the other major U.S. grocers all declined in concert with Kroger’s weaker outlook. Even Whole Foods was down 6.7% (or nearly $760 million in lower market capitalization).

- The following day, Amazon announced its acquisition of Whole Foods. The announced value of the transaction ($42/share) represented a 27% premium to the prior day’s closing price (per S&P Capital IQ).

- Interestingly, and perhaps counter-intuitively, the stocks of the other grocers declined even further after Amazon’s announcement, ranging from -6.3% for Sprouts to -14.4% for Supervalu.

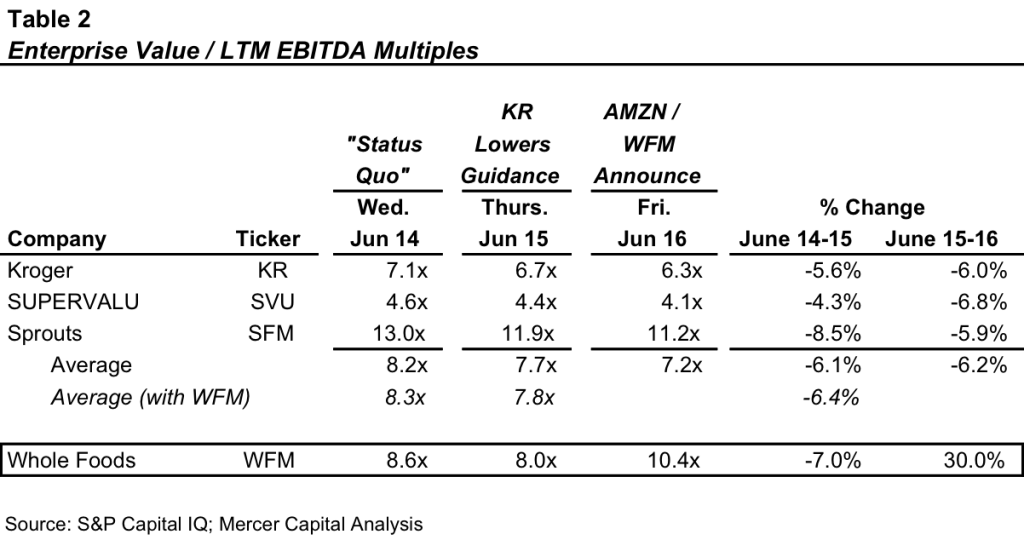

Why the further decline for the other companies? Sometimes the acquisition of a competitor at a high multiple can serve as a valuation “barometer” or a benchmark transaction, suggesting that companies in the segment might be undervalued in the market. But in this case, the markets clearly viewed the Whole Foods transaction as a negative for the remaining independent grocers. Table 2 below shows the impact of the transaction on the publicly traded grocer group from a valuation perspective (specifically, the changing EV/EBITDA multiples).

- As shown above, the group’s average multiple of last twelve months’ EBITDA was 8.3x (including Whole Foods) immediately prior to Kroger’s lower earnings guidance announcement.

- That news sent the average multiple down half a turn to 7.8x (an average decline of 6.4%). Kroger’s outsized share price decline relative to the others (from Table 1) was primarily due to its higher financial leverage.

- Despite the differences in size/growth among the companies cited here, the Amazon / Whole Foods announcement resulted in an additional 6.2% average decline in the EV/EBITDA multiple (in a fairly tight range of -5.9% to -6.8%) to 7.2x.

- The implied multiple on the Amazon / Whole Foods deal is about 10.4x LTM EBITDA.

In other words, Whole Foods gets acquired at 10.4x EBITDA (a 30% premium to its prior multiple) – and the stock prices and valuation multiple of the other industry participants go down. Perhaps this says more about the underlying industry than it says about Whole Foods in particular. Or perhaps investors (in selling off the other grocers) believe the future growth opportunities for Whole Foods will come at the expense of other incumbents’ market share.

Bottom line, externally-driven events can have a material effect on your company’s value, though not always in the direction that you might expect.

Related Links

- Five Variations on a Theme: Analyzing Transaction Premium Data (Part 1)

- Pulling the Trigger: Interim Goodwill Impairment Testing

- What’s the Control Premium?

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.