Incentive compensation works much like the proverbial carrot dangled in front of a horse. The lure of a future reward to employees encourages and propels momentum at the company level. But what happens when the carrot is dangled a little too closely?

The motivation behind incentive pay at the startup level is that in order for the employees to strike it rich, the company must succeed by hitting certain milestones. This aligns employees’ personal goals with the company’s overall success. A recent Bloomberg Technology article examined how a slight misalignment in structure has contributed to employee turnover at Google.

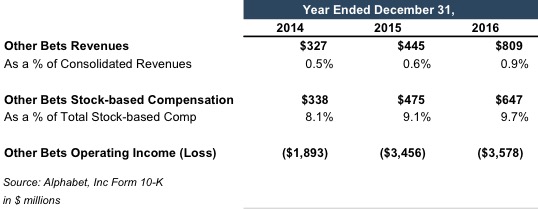

Hoping to inject some of this feverish drive into its new developments, Google holding company Alphabet separated its R&D efforts in 2015 into a subsidiary aptly called “Other Bets.” These Other Bets operate more like startups, separated from Google’s capital hordes and high value stock. Divisions like Verily, Waymo, and Fiber have attempted to take job security-seeking engineers from the main company and allow them to become risk-it-all startup employees by offering incentive compensation that ties cash and stock rewards to various division successes. The autonomous vehicle division Waymo represents such a small portion of Alphabet (and virtually none of its revenue), that it makes sense to link rewards to the value of the division itself, rather than to the larger parent company.

The policy enacted by Waymo was a system of cash and equity bonuses tied to the achievement of divisional milestones, which were measured by periodic interim valuations. Periodic valuations provided important insight into the value of the division at various points in time as the opportunities and risks changed. Multiples calculated from these valuations priced the stock bonuses. Employees were able to see how each milestone they achieved built the division’s value – and their personal wealth.

As the division made significant headway on its goals, employees racked up stock and the stock racked up value. Waymo looked like an incentive pay success story, until employees realized one caveat. The terms of this compensation arrangement allowed employees to cash in all (or at least a large portion) of their stock upon termination of employment. Exact details of the plan have not been publicly disclosed. But the arrangement appears to have essentially offered employees an at-will liquidity event. Had the plan’s structure employed a more gradual system of vesting or redemption, the option to leave might not have appeared so attractive. Because of this structure, Waymo employees found that they didn’t have to wait for the division to actually put a self-driving car on the road, produce revenue, or exit. All they had to do was decide when their stock reached a high enough value and cash in by checking out.

Related Articles

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.