When it comes to money, “enough” is the hardest word to define in the English language. The challenge of defining “enough” extends to corporate managers deciding what cash balance is appropriate.

- Cash balances can provide a cushion against unanticipated adverse events in the business. The moment companies need cash is usually the worst time to try to raise capital. Having sufficient cash on hand to weather an unexpected downturn in the business can help shareholders avoid dilutive capital raises at inopportune times.

- On the other hand, cash is a very low-yielding asset. Large allocations to cash weigh down the returns to invested capital. If capital providers recognize the risk-reducing attributes of cash and reduce their return expectations accordingly, the effect of a large cash balance on value is probably negligible. If, instead, investors view the cash investment no differently than any other capital allocation, and fail to reduce their return expectations, then a large cash balance will be detrimental to value.

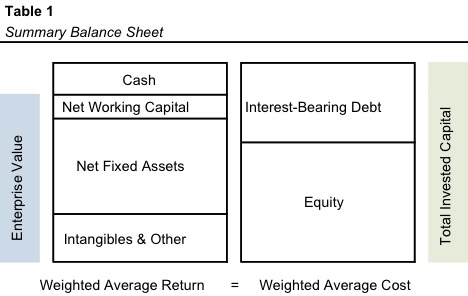

As shown in Table 1 above, investors provide debt and equity capital (the right side of the balance sheet), which the company then allocates to a portfolio of assets (the left side of the balance sheet). The enterprise value of the business represents the “engine” that generates operating cash flow (of which EBITDA is often considered a proxy). Since cash balances do not generate EBITDA, cash and other short-term investments are excluded from enterprise value.

In the current yield environment, the investment return on cash balances is nil. As a result, cash balances represent a drag on the weighted average return on the company’s assets. In both private and public companies, minority investors do not have any direct control regarding the allocation of the capital they provide. Corporate managers and directors need to evaluate the effect of large cash holdings on both the returns provided to capital providers and the required returns demanded by capital providers. In the balance of this post, we examine data from public markets to assess shareholder preferences with regard to cash holdings.

Summary of the Data

We examined data pertinent to this question for non-financial companies in the S&P 1000 at the end of 2016. The S&P 1000 index is a combination of the S&P MidCap 400 and the S&P SmallCap 600. At December 31, 2016, the companies in the S&P 1000 index had market capitalizations ranging from about $200 million on the small end up to approximately $10 billion.

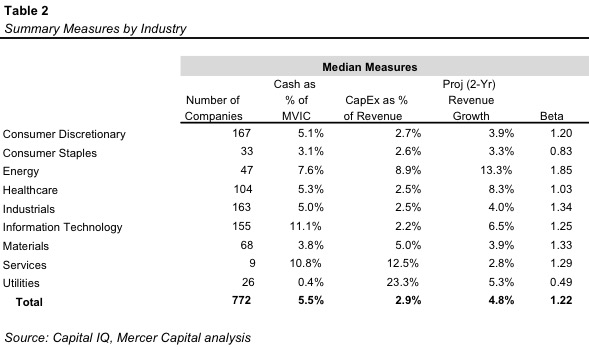

Table 2 summarizes pertinent data by industry.

Measured as a percentage of market value of invested capital (MVIC, or the sum of equity market capitalization and total debt), median cash balances for the various industry groups range from a low of 0.4% for utilities, to a high of 11.1% for information technology.

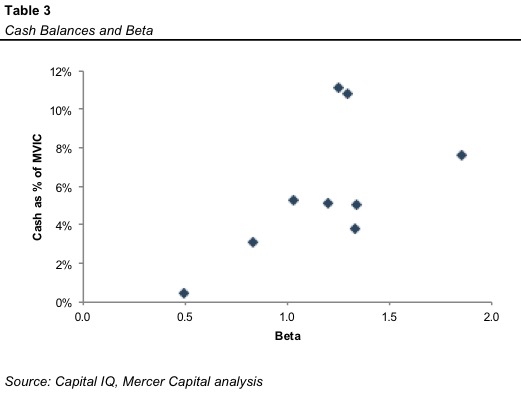

We considered a number of characteristics that may contribute to industries allocating more or less of their capital to cash. The relationships between cash balances, capital expenditure intensity and expected revenue growth are not very compelling. In contrast, as shown in Table 3, there does appear to be a degree of correlation between cash balances and beta. Correlation is not causation, of course. However, what the data does begin to suggest is that higher-risk companies tend to hold more cash than lower-risk companies (if risk is measured using beta).

This observation is consistent with the risk-reducing properties of cash mentioned above. Companies in riskier industries may hold more cash as a buffer against unexpected adverse changes. While this is intuitive from the perspective of corporate managers, the question remains as to whether shareholders perceive value in the allocation of capital to cash.

What is Cash Worth?

Analysts typically calculate valuation multiples relative to enterprise value – in other words, on a “cash-neutral” basis. The principal merit of this approach is the recognition that, all else equal, a company with greater cash reserves should be worth more than a company with lesser cash reserves. This approach also recognizes that cash balances do not contribute to the generation of operating cash flow. Implicit in this approach, however, is the assumption that shareholders give full dollar-for-dollar credit for cash held on the balance sheet.

- This is undoubtedly true at the time of a transaction for a private company, as purchase agreements inevitably include target working capital levels with dollar-for-dollar adjustments to the negotiated purchase price for excess or deficit working capital relative to the target.

- However, it is not necessarily the case that minority investors facing a potentially lengthy holding period have the same perspective. Such investors may view large cash balances as no more than negative net present value capital projects that diminish value.

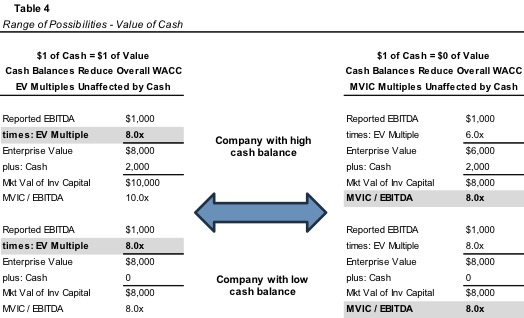

Table 4 below summarizes the two potential extreme positions.

- In the scenario on the left, investors assign the same enterprise value multiple to the high and low cash companies. This behavior is consistent with the notion that allocating resources to cash results in a corresponding reduction to the cash-hoarding company’s weighted average cost of capital. In other words, investors value the risk-mitigating properties of cash.

- In the scenario on the right, investors are unimpressed by management’s ability to hold onto cash. Since return expectations are not modified by the large cash balance and the cash balances do not generate any material cash flow, the ratios of MVIC to EBITDA are identical for the two companies.

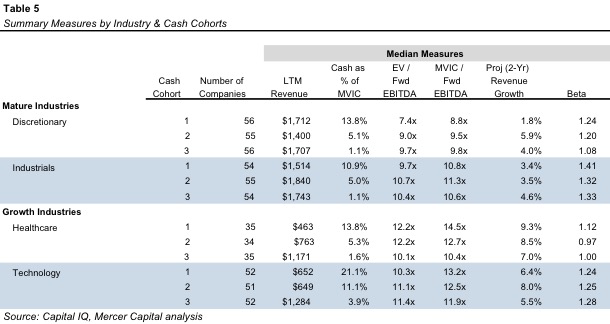

In an effort to screen out potential noise associated with industry factors, we examined the data summarized in Table 2 further by industry to discern which of the two possibilities more closely reflects investor attitudes toward corporate cash balances. In order to avoid unduly small sample sizes, we examined the four most populous industries (consumer discretionary, healthcare, industrials, and information technology). We sorted the companies within each industry by cash balance (measured as a percentage of MVIC), dividing each industry into cohorts of equal thirds. Table 5 summarizes key results for each industry.

Consideration of the data summarized in Table 5 yields a number of observations.

- Within the more mature consumer discretionary and industrials segments, cash balances are unrelated to company size, as the revenue for companies in Cohort 3 (least cash) is comparable to that of the companies in Cohort 1 (most cash). In contrast, cash balances in the faster-growing healthcare and information technology segments are inversely related to company size. The cash-rich healthcare and IT companies are approximately one-half the size of the low-cash companies in the respective industries.

- While differences in beta within the industry segments are modest, the observed data points are generally consistent with the relationship between risk and cash holdings noted with respect to Table 2. Perhaps cash balances are viewed as a counter-weight to greater operating risk.

- Projected revenue growth is inversely related to cash balances for companies in the consumer discretionary and industrials segments. For companies in the healthcare and IT industries, however, the companies with the highest cash balances have the highest growth expectations. Perhaps in these industries, cash balances are perceived by investors as “dry powder” for future positive-NPV projects.

- While differences in expected growth obscure direct observations regarding the impact of cash balances on WACC, data for the consumer discretionary and industrials segments more closely approximate the right side of Table 4, suggesting that investors in mature companies are unimpressed with large cash balances. For healthcare and IT, the data is more closely aligned with the left side of Table 4, suggesting that investors view cash accumulation as a reasonable strategy in industries in which positive-NPV projects are presumably abundant.

Conclusion

One of the primary tasks of corporate managers and directors is capital allocation. While cash balances can provide a safety net that allows corporate managers to sleep better at night, for shareholders, the risk-mitigating benefit of corporate cash balances is balanced by the corresponding drag on returns. Based on the market data summarized in this post, the perceived availability of positive-NPV projects seems to influence investor preferences regarding cash stockpiles.

Positive-NPV projects are presumably abundant in higher-growth industries such as healthcare and IT. For firms in those industries, investors appear more likely to view cash as “dry powder” for future value-enhancing investments, and are more willing to bear the cost of lowered returns until such investments are identified and made.

In more mature segments such as consumer discretionary and industrials, positive-NPV projects are presumably scarcer. The value of large cash holdings among firms in these industries seems to be discounted by investors.

For corporate managers and directors, cash balances should not be treated simply as a residual, but rather actively evaluated in conjunction with the firm’s capital budgeting and distribution policies. Cash may be king, but shareholders aren’t necessarily monarchists.

Related Links

- Corporate Finance in 30 Minutes

- Capital Structure in 30 Minutes

- Capital Budgeting in 30 Minutes

- Distribution Policy in 30 Minutes

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.