A while back, I shared a dinner with a group of friends that included a small business owner who runs a young trucking company. At one point, my friend wondered out aloud what price his company would fetch in the marketplace. A quick-witted pal amongst us suggested a number on the order of 1.01 times the book value (as a proxy for the value of the tangible assets). The business owner was a bit peeved – he was hoping for a higher figure, of course – but the quick-thinking friend was merely opining that this particular business did not yet have any intangible assets that a market participant acquirer would find valuable.

Businesses large and small, new and old often find identifying the value of their development (marketing and R&D) activity difficult because measuring top line or bottom line impact on the income statement is not straightforward, and historical cost based accounting does not capture the fruits of these efforts on the balance sheet. Purchase price allocations (PPAs) under GAAP, however, can provide a view into the value of various components of a business beyond the collection of tangible assets after a transaction has occurred.

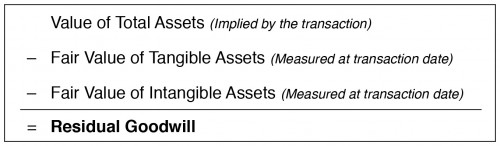

Following an M&A transaction, acquirer companies conduct PPAs to measure the fair value of various tangible and intangible assets of the acquired business. Any excess of the total asset value implied by the transaction over the fair values of identified assets is ascribed to the residual asset, goodwill.

Intangible assets commonly identified and measured as part of PPA analyses include:

- Trade name. Trade name intangibles are valuable because they enhance the expected future cash flows of the firm, either through higher revenue or superior margins. The relief from royalty method, which seeks to simulate cost savings due to the ownership of the name, is frequently used to measure the value of trade names.

- Customer relationships. Customer relationships can be valuable because of the expectation of recurring revenue.

- Technology. Technologies developed by the acquired business are valuable because the acquirer avoids associated development or acquisition costs. Patents and other forms of intellectual properties provide legal protection from competition.

- IPR&D. Ongoing R&D projects can give rise to in-process research and development intangible assets, whose values are predicated on expected future cash flows.

- Contractual assets. Contracts that lock in pricing advantages – above market sales prices or below market costs – create value by enhancing cash flow.

- Employment / Non-competition agreements. Employment and non-competition agreements with key executives ensure a smooth transition following an M&A transaction, which can be vital in reducing the likelihood of employee or customer defection.

The value of an enterprise is often greater than the sum of its identified parts, and the excess is usually reflected in the residual asset, goodwill. GAAP goodwill also captures facets of the company that may be value-accretive, but do not meet certain criteria to be identified as an intangible asset. Notably, fair value measurement presumes a market participant perspective. Goodwill may also include entity-specific synergistic or strategic considerations that are not available to market participants. Consequently, goodwill has tended to account for a significant portion of the allocated value.

A PPA analysis is primarily an accounting (and compliance driven) exercise, but it is also a window into the objectives and motivations behind the transaction, at least within the context of the prescribed standards. More broadly, the precepts and techniques underlying fair value measurement of certain intangible assets can also serve as a starting point to estimate the worth of marketing and development efforts, even as adjustments may be necessary to capture strategic considerations not usually reflected in GAAP fair value.

The PPA framework of recognizing a transaction price as a composite of the values of tangible and intangible assets also provides a perspective for my business owner friend – the price for the trucking operation can exceed book value to the extent the firm is able to build and cultivate intangible assets that potential buyers will find valuable.

Mercer Capital has extensive experience valuing intangible assets for purchase price allocations (ASC 805), impairment testing (ASC 350), and fresh-start accounting (ASC 852). Call us – we would like to help.

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.