The new revenue recognition standard has been called “historic in its breadth and impact across industries.” It’s probably also been called a few other things which aren’t suitable for publication here. The standard itself was introduced back in 2014 with the FASB’s issuance of Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers (Topic 606). Since that time, accountants and preparers have grappled with preparing for the new guidance. The focus of this post is not to comprehensively explain the new rules. Instead, we examine one public company’s experience with the transition (Workday) and then highlight a few areas that may be of interest to analysts, finance managers, and interested onlookers – from a valuation perspective.

The Rules

The core principle of Topic 606 is that an entity should recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Stated more simply, a company will recognize revenue when the customer can use or benefit from the goods or services provided. The standard lays out five steps to achieve the core principle of Topic 606:

- Step 1: Identify the contract with a customer

- Step 2: Identify the performance obligations in the contract

- Step 3: Determine the transaction price

- Step 4: Allocate the transaction price

- Step 5: Recognize revenue when or as the entity satisfies a performance obligation

Topic 606, along with its additional clarifying ASUs issued by the FASB in 2015 and 2016, applies to all entities: public, private, and not-for-profit. Public companies are required to adopt the new standard for reporting periods beginning after December 15, 2017 (generally beginning January 1, 2018 for entities with a Dec-31 fiscal year end). All other entities have an additional year to comply (generally beginning January 1, 2019 for entities with a Dec-31 fiscal year end).

When adopting the new standard, companies must also decide on a transition method – either a full or modified retrospective application. The first option requires a recast of prior-period financial statements. The modified approach does not require prior recasting of financial statements but does require certain adjustments to retained earnings for the cumulative effect of the application.

Impact on Revenue

Evaluating how the new rules will actually impact revenue is obviously the big question. Jack Ciesielski’s Analyst’s Accounting Observer commented on this last week, noting that the upcoming cycle of quarterly MD&A disclosures will be of particular importance to investors. The post examines the recent 10-K disclosure on the topic from Intel Corporation.

While Intel has not yet adopted the new standard, language in its 10-K describes how it expects the standard will impact its financial statements. For example, for component sales made to distributors, Intel expects to recognize revenue sooner. Intel will also begin recognizing certain cooperative advertising expenses in the period in which they occur (rather than the period the customer is entitled to participate in the programs, which coincides with the period of sale).

As a result, the new rules could have the effect of accelerating revenue for certain products and shortening/lengthening the time over which cooperative advertising expenses are recognized, which could lead to margin differences.

Workday’s Early Adoption

According to a March 23, 2017 CFO.com article, just five companies in the S&P 500 have elected to early-adopt the new revenue recognition rules: Alphabet, Raytheon, UnitedHealth, General Dynamics, and Workday.

Workday, whose 2017 fiscal year ended on January 31, decided to early adopt the new standard in the first quarter of its fiscal 2018 (beginning on February 1, 2017), with the full retrospective adoption method (FY16 and FY17 restated). The company also issued a detailed document entitled “ASC605 to ASC606 Transition” on the investor relations section of its website. Workday noted the following with respect to the revenue and expense impact on its financial statements:

- Revenue Impact – Revenue recognition is no longer limited by invoicing. Some revenue will be reclassified between professional services & subscription in either direction, depending on the facts & circumstances of each particular situation.

- Margin Impact – Increased capitalization of contract acquisition costs with a longer amortization period.

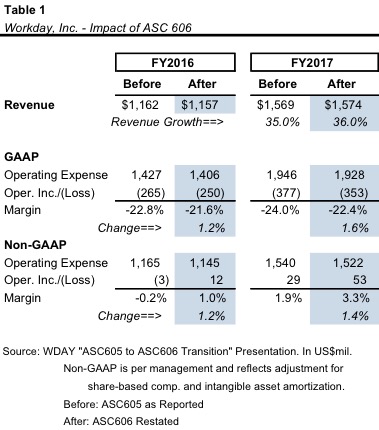

Table 1 below illustrates the impact on revenue and expenses for fiscal 2016 and 2017.

A few observations regarding the impact of ASC 606 on Workday’s financial statements:

- Even for a software-as-a-service (SAAS) firm like Workday, the proposed changes appear to only affect a relatively small portion of revenues. Year-to-year growth, regardless of accounting treatment, is about the same at 35%/36%.

- ASC 606 results in a greater impact on operating expenses, presumably due to a longer amortization period over which to expense contract acquisitions costs. In fiscal 2016, implementation of the new rules “improves” operating margin by 1.2%.

- In 2017, the margin “improvement” is 1.4% to 1.6%, depending on whether one looks at reported or adjusted figures. While Workday presents a comparison of both reported and “adjusted” figures, we offer no comment here on which is preferable. To GAAP or Non-GAAP has been addressed extensively on this blog in the past.

- The “improved” margins don’t exactly tell the whole story. The presentation also includes a discussion of balance sheet impact, with expected increases in deferred cost assets that should correspond to the newly capitalized contract acquisition expenses.

- Workday also notes that operating cash flow and free cash flow in 2016/2017 are unaffected by the new accounting rules.

Impact on Financial Analysis

So if the new accounting changes merely change the optics of the financial statements but don’t impact net cash flow, then do they have an effect on valuation? In theory, they shouldn’t. But in practice, depending on how a particular valuation is constructed, there may some areas that warrant a little extra scrutiny in the near future.

- Revenue Growth Rates – In the case of Workday, the adjusted revenue growth rates were not radically different post-ASC 606. But some industries could experience larger differences. How should an analyst consider future growth (post-ASC 606) in the context of historical trends? What about comparisons to peers, who may or may not have similar issues?

- Industry Growth Comparisons – One source of growth benchmarking is comparison to published revenue growth estimates from equity analysts (such as those aggregated by Bloomberg or S&P CapitalIQ). Again, do these estimates consider the current run-rate post-ASC 606? Are they consistent with each other, or with other peer companies in the sector?

- Margin Analysis – It may be surprising to learn that the new revenue recognition rules impact both revenue and expense. As with Workday, the margin impact on the expense side may be larger than the revenue impact. They could offset – or not. In any event, analysts comparing post-ASC 606 margins to unadjusted historical figures or projected margins may be comparing apples and oranges. The CFO of Workday was even quoted as saying that the only thing the margin increase does is “raise the bar for us going forward.”

- Working Capital Considerations – If certain expenses will be capitalized and amortized in the future rather than expensed upfront, this can affect both the income statement and balance sheet. Legacy working capital assumptions and conventions may need to be revisited in order to align with the new pattern of expense recognition.

- Revenue-based Valuation Multiples – In industries that are valued with reference to revenue-based multiples, like EV/Revenue, the denominator of the equation may be changing. Blind application of a peer group median, when the peers and the subject company recognize revenue differently, can lead to problems.

It’s important to remember that the new revenue recognition rules, while perhaps monumental in breadth and complexity, don’t change the underlying business model or future prospects of a firm. Financial statements simply record the financial activities and position of a business, even if the rules for how those items are recorded periodically evolve. Our job as analysts is to understand and interpret the numbers for our clients. We will continue to monitor the rollout and adoption of the new revenue recognition rules and their effect, if any, on valuation.

Related Links

- 5 Things to Know about Revenue Recognition

- Non-GAAP Measures: Here-to-Stay?

- 7 Things to Know About the New Lease Accounting Rules

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.