“It is difficult to make predictions, especially about the future.” Yogi Berra – allegedly

The inauguration of a new POTUS is now behind us. Time, then, to add to the cacophony of pop-prognostications. This blog post will make broad observations regarding potential changes to select corporate tax and other pro-growth economic policies in hopes of teasing out inferences for inputs to a basic valuation framework.1

Stick-Figure Valuation

Business value is often represented as the product of some measure of ongoing cash flow and a corresponding valuation multiple.

Value = Cash Flow x Multiple

Valuation multiples have two contributory components – risk and (cash flow) growth. In practical applications, cost of capital usually represents risk.

Multiple = 1 / (Cost of Capital – Growth)

Cost of capital is generally expressed as a weighted average of the costs of equity and debt, based on the capital mix used to finance the founding, growth, and operations of a business.

Cost of Capital = Weighted Average Effective Cost of Equity and Debt

Again, in practical applications, the cost of borrow an enterprise faces (given some assumed level of borrowing) is the pre-tax cost of debt capital. The cost of equity capital is usually presented as an additive combination of 1) some measure of risk-free returns and 2) an equity risk premium. Additional risk assessments to reflect size and other idiosyncratic factors for individual businesses outside of a portfolio context may also be relevant.

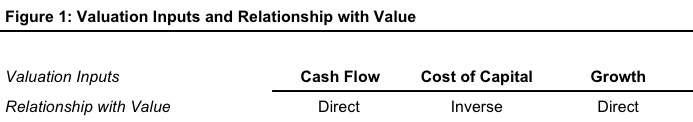

This basic framework yields directional relationships between the inputs and the valuation output – cash flow and growth have a direct or positive relationship with value, while risk or cost of capital has an inverse relationship with value.

Corporate Tax and Other Pro-Growth Economic Policies

The House of Representatives is widely expected to move first in formulating a plan to reorder the existing corporate tax regime. The chamber’s majority party is understood to favor a “destination-based cash flow tax” (#dbcft) that, perhaps to the chagrin of consultants all over the country, claims to stand on three simplifying pillars:

- Corporate tax rates would be lowered to 20% from the existing headline rate of 35%. (The POTUS reportedly favors a rate that is lower still, 15%.)

- The base on which the taxes are levied would be some measure of cash flow, not income.

- The tax would be “border adjusted.”

Much of the discussion on the proposed tax plan seems to revolve around the third item. In (much too) simplistic terms, the fundamental idea underlying border adjustments is that the tax base for a corporation equals domestic revenues less domestic costs. Foreign revenues would not be taxable, and foreign costs would not be deductible for tax purposes. So, for example, a foreign company that sells goods within the US but incurs all its costs in the home country would be liable to pay taxes on the full amount of the US revenues. On the other hand, a domestic company that incurs manufacturing costs in the US but realizes all revenues from exports would have a negative tax base (and perhaps receive a rebate). Proponents assert that adjustments in the foreign exchange markets (a rise in the US dollar) would neutralize trade impacts – positive or negative –such that the border adjustments per se would not have any effect on the balance of trade.

While the concept of border adjustment engenders interesting debate (if one is into that sort of thing) and has the potential to upend or re-organize some corporate tax planning strategies (e.g. transfer pricing), this blog post will not address it in any more detail because 1) notwithstanding the complexity of the issue (or perhaps because of it), at present it is difficult to prove or disprove that there will or will not be any (net) cash flow impact attributable to border adjustments, and 2) the POTUS has indicated that he does not favor the adjustments and views them as too complicated (i.e., on current evidence, the border adjustment mechanism is probably the least likely pillar to feature in the new tax regime).

On the other hand, the POTUS has expressed a desire to pursue the allegedly populist notion that the economy needs to grow at a faster pace. Themes supporting the pro-growth orientation go beyond an overhaul of the corporate tax regime and include 1) eliminating or loosening the vast web of federal regulations perceived to have inhibited America’s small businesses, entrepreneurs, and workers, 2) renegotiating trade deals to on-shore good-paying, American manufacturing jobs, and 2a) jawboning multi-nationals into creating domestic jobs. While it has received relatively less press of late, an additional pro-growth agenda-item is inducing private parties to partner with the public sector into making infrastructure investments.

The Hard Task of Governing – Policy Effects on Valuation Inputs may be Less Clear Cut

The first pillar of #dbcft enumerated in the prior section is relatively straightforward. Lowering the tax rate should increase the net cash flows available for the two fundamental corporate finance actions – distributions to capital providers, and re-investments in the business. Even so, the amount of tax relief is likely lower than the headline rates would suggest. First, the effective tax rate US companies currently pay is less than the headline figure of 35%. For further perspective, the US collects corporate taxes equal to slightly more than 2% of GDP, a lower proportion than British collections at a headline rate of 20%.

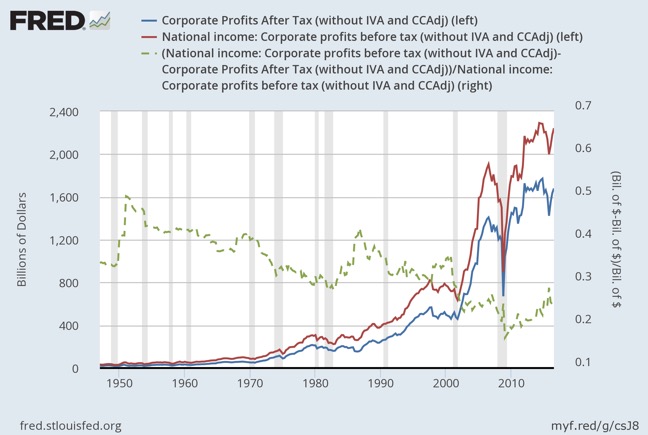

Corporate profits before and after taxes follow the left axis, while the dotted line representing effective tax rates follows the right axis.

Source: U.S. Bureau of Economic Analysis, National income: Corporate profits before tax (without IVA and CCAdj) [A053RC1Q027SBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; January 23, 2017.

Second, and perhaps more subtly, the base on which the tax is levied would also change under the new tax regime. As envisioned, the #dbcft tax base would be a measure of cash flow, not income (which is the current practice). On the one hand, the ability to set off the full amount of capital expenditures against the tax base in a given year (rather than using a longer-term depreciation schedule), should enable corporations to realize accelerated tax benefits. On the other hand, it is likely that interest payments will no longer be deductible. The inability (or at least the diminished ability) to deduct interest payments would create a hitherto non-existent tax liability for corporations.

On balance, while yet to be definitely proven, it is probably safe to assume that the first two pillars of #dbcft will lower total corporate taxes, which should have a positive impact on ongoing cash flows of US businesses in the aggregate. After all, what would be the point of reforming a tax regime perceived to be onerous if there is no relief? This conjecture does come with a caveat, however. Not all businesses are likely to uniformly benefit from prospective corporate tax breaks. A manufacturing concern with large, regular capital expenditures and minimal debt on its balance sheet that is currently paying taxes at close to the headline rates would likely benefit from #dbcft. On the other hand, a private equity-backed professional services firm that carries a significant debt load (or a highly-levered real estate investment vehicle) may see its effective tax burden increase under #dbcft. Along the same lines, the net impact on financial institutions whose business models rely on interest rate disintermediation is also unclear.

If a boost to the level of ongoing cash flows represents a short-term benefit of the new policy regime, the flip side is the possibility of a higher growth rate for the broader economy. On this score, despite all good intentions, the eventual outcome is a bit more uncertain. In theory, higher cash flows available to corporations, and the prospect of lower future taxes, should induce more capital reinvestments into their businesses. A corporate sector that is freed from costly regulatory entanglements should want to engage in greater risk-taking, which should in the aggregate deliver bigger returns (on investments). On the labor side of the equation, more jobs should mean more effort ploughed into the economy, which should boost output and growth. At least, that is the postulate.

Increasing inputs to a production function should, all else equal, increase (one-time) output. The rate of change of the output – or growth – however, is a somewhat different matter. Higher utilization of the factors of production may or may not result in the broader economy getting on a steeper growth path – capital and labor are generally not thought to be exempt from diminishing returns to scale. Total factor productivity, as the residual obtained from growth accounting exercises, is not understood well. And yet, TFP is probably the most reliable factor underlying consistent, sustainable, long-term economic growth. By some accounts, TFP has been on the decline in the US for some time now, for reasons that are not wholly known. Global growth prospects, and US potential growth within that context, may have fundamentally trended lower over time for reasons that are not quite clear (and thus, there are no known solutions yet).

A further note for those keeping an eye on real growth – a significant portion of the growth from these economic policies may be attributable, ex post, to inflation inasmuch as said growth is directly dependent on the increased use of production factors. For example, policies and actions geared towards re-shoring manufacturing jobs, to the extent they take hold, are likely to be inflationary.

Finally, much like changes to corporate taxes, not all sectors of the economy, not all industries within the sectors, and not all companies within the industries are likely to uniformly benefit from a higher economic growth rate.

The Reverse Side Also Has A Reverse Side

If short-term changes (increases) in the level of ongoing cash flows, and longer-term growth prospects of the economy represent two sides of the corporate tax and other economic policies, the third valuation input – cost of capital – is a potential reverse side to both.

Assuming the policies are successful in their aims of simplifying and reducing the corporate tax burden and precipitating higher economic growth, what are the likely knock-on effects on cost of capital? As with much of the rest of the discussion presented in this blog post, the answers are not clear cut. However, the following fall within the realm of the possible:

- Currently, interest deductibility makes debt a relatively cheap form of capital. If tax deductibility of interest expenses is disallowed (or restricted), the effective cost of using debt within any given capital structure would increase. In addition, at the margin, as the cost of (using) debt rises, companies could want to substitute into (using) more equity in a bid to find the optimal capital structure. Equity capital is generally a more expensive relative to debt. The net effect should be an increase in the overall cost of capital.

- Changes in the tax rules could also have a more circuitous impact on prospective costs of capital. To the extent tax changes contribute to bigger budget deficits and such changes are structural, the cost of borrow the government faces in financing unfunded expenditures could rise. A rise in the US government’s cost of borrow, usually assumed to be the risk-free rate in practical applications, probably has the knock-on effect of increasing the costs of both debt and equity capital.

- Deploying a greater amount of capital back into business operations – in the absence of real, fundamental growth prospects – could result in a longer-term inefficient allocation of resources, irrespective of the short-term confidence on the part of business owners and managers. Over time, inefficient allocation of capital could result in a higher equity risk premium.

- Finally, cost of capital is related to nominal growth, regardless of whether the underlying growth is primarily attributable to real growth or inflation.

Conclusion

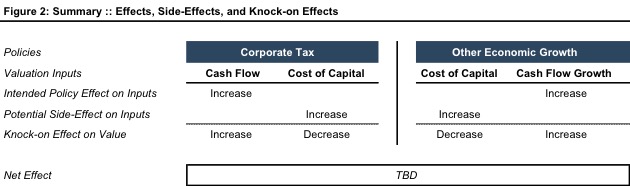

Notwithstanding the lengthy foregoing discussion, let us assume that the prospective corporate tax and other economic policies are successful in achieving their pro-growth aims. Even then, the valuation impact of these policies is not unambiguous.

If markets represent expectations of participants, the general movement of the broader stock indexes immediately after the election suggests many anticipated a scenario in which the valuation-positive effects would overwhelm the valuation-negative ones. A pause in the upward movement of stock indexes since mid-December is perhaps suggestive of a more contemplative stance on the part of the market participants.

While the basic framework provides us with three valuation inputs to consider, sentiment around these inputs are ever-changing. Expectations eventually turn into observations (or not), and new expectations are formed. Accordingly, as time passes, valuation multiples can go up and valuation multiples can go down. Given the breath of potential policy changes, proactive corporate managers are likely to benefit from some advance thought and planning around corporate finance decisions. As valuation analysts, we will continue to wonder about the various possible states of the future and update our mental models as new information on market participant assumptions come to light.

As they allegedly say in China, may we live in interesting times.

Related Links

- Gravity Matters, Especially for Financial Investors

- Market Participant Perspectives

- Corporate Finance in 30 Minutes

End Note

1 This blog post is merely a sketching exercise and is not exempt from inaccuracies and (eventual) predictive failures.

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.