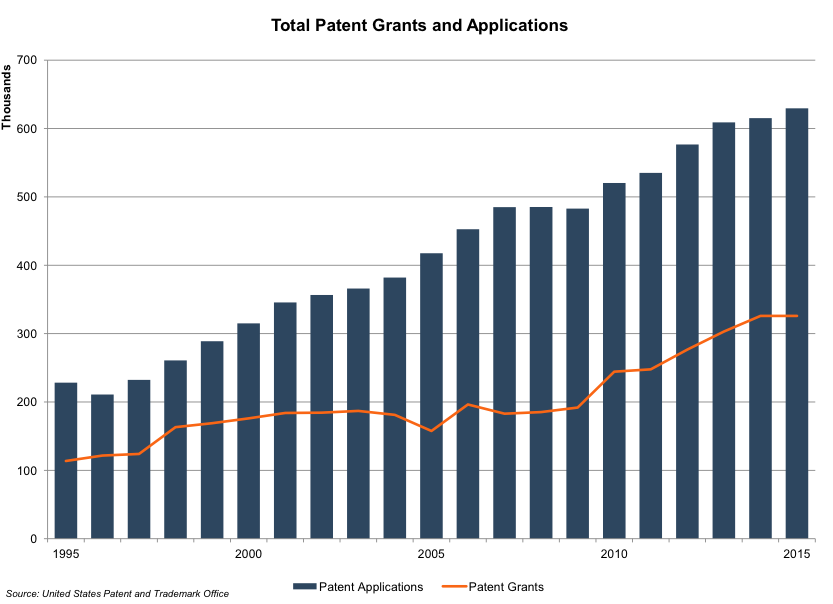

Applications for patents in the U.S. have nearly tripled over the past 20 years. Perhaps increased innovation, more cutthroat competitive practices, and an uptick in litigious activity surrounding idea ownership are to credit. One thing that is clear is that there are many implications of filing a patent beyond just its ability to enforce exclusivity of an idea – for founders and investors alike.

But first, let’s review the valuation basics. The value of a patent comes from its ability to protect or improve cash flows, or reduce risk. Internally, a patent allows the entity that holds it to reduce competition for its product or process, resulting in the potential ability to generate higher margins. Patents can also have external value to the holder by generating royalty income in exchange for allowing another entity to benefit from the exclusivity provided by the patent. There are three common valuation techniques used to analyze the value of a patent:

- Cost approach: How much it would cost to recreate the patent;

- Market approach: The price at which market participants would agree to transact the patent; and,

- Income approach: Future cash flows (likely amounts and associated risk) attributable to the patent.

Common Considerations Startups Face When Deciding Whether or Not to File a Patent

For startups, however, the decision to file a patent or not can have additional implications, with various benefits or challenges. The following presents four common considerations startups face when deciding whether or not to file a patent.

- For certain embryonic business models, keeping the details of a product or process secret may be important. When a startup’s strategy is built around surprising the market with innovative design or functionality, or it plans to enter the market at a strategic time, the requirement to share operational or design details may be a reason to delay or forgo filing for a patent.

- On the other hand, patents can serve as a layer of protection for a new or developing idea. They allow the inventor to develop a new invention during the ideation and development phase and create a buffer of time before competitors can jump into the market. Such protections are critically important in areas where gestation periods can be extremely long and expensive. For example, the period of time before biosimilars enter the market is essential for biopharmaceutical companies to recover and realize returns on the large research and development costs of a new drug.

- However, patent protection may hurt a startup’s chances of success if that success is dependent on widespread adoption. Take Tesla, for example. As a “hardware” company, one would assume patent protection is a top priority. However, in order increase adoption of its electric vehicles, the car maker likely first needs to increase general consumer acceptance of electric vehicles to justify expanding the network of charging stations (and hopefully make them the industry standard). Not patenting its products presumably creates a “network effect” that benefits Tesla from its competitors’ efforts if they develop products compatible with Tesla’s charging stations.

- From an investor point of view, patents can be an important method for mitigating potential risks. For a company that has already been operating in the market, patents can add legally enforceable protections. On the defensive side, companies seek “freedom to operate” or the continuity of business operation. LinkedIn, for example, held fewer than 30 patents when it went public in 2011. The costs – both in time and money –deterred many patent filings during the early stages of the company. Like many other startups, founders appeared to focus on proving viability of the company before choosing to work on a moat to protect the business operations. Once LinkedIn achieved a degree of product-market fit, management turned its focus to risk mitigation, specifically through patents. Investors may desire distinct attributes from businesses at different stages of development. With evidence of a functional business model and customer base, LinkedIn likely recognized that mitigation of risks would be an attractive attribute to current and potential public investors.

Valuing Patents

Our discipline views value as a function of cash flow (itself a function of revenue and profit margins), growth, and risk. Each perspective enumerated above informs value-enhancement through one or more of these core components.

In the first perspective, revenue is presumably protected by not disclosing important company details and protecting strategic elements. The second deals with cash flow improvement through potentially higher margins due to fewer competitors. In the third scenario, market size and share is potentially maximized in a shorter period – i.e. cash flows growth is higher – by opening up technologies for wider use. Finally, the fourth perspective seeks risk reduction by building product or process protections.

Valuation of patents and other intellectual property requires an in-depth analysis of a company and the patent’s ability to add future value to that company. As the market continues to focus on intangible characteristics of companies, more attention is being placed on the value of intellectual property and patents are no exception. Mercer Capital can help. Contact us to discuss your valuation needs in confidence.

Related Links

- Economics of Elon Musk’s Patent Altruism

- Perspectives from Purchase Price Allocations: Value of Intangible Assets

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.