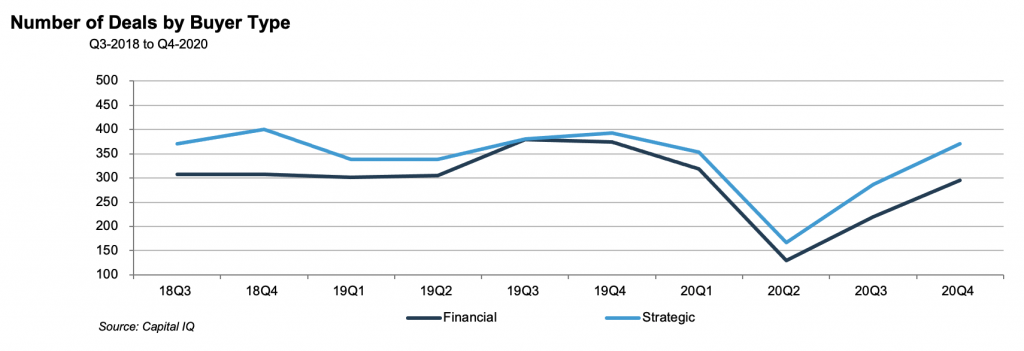

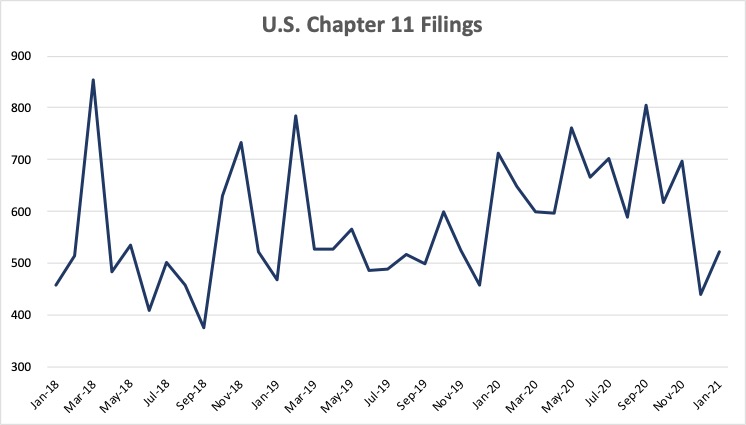

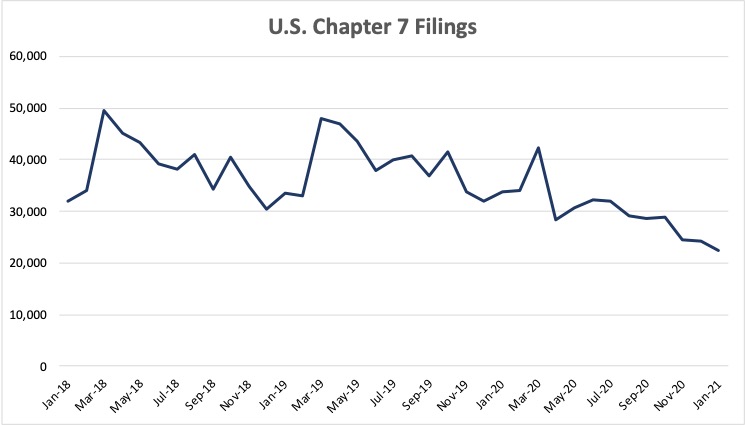

By mid-2020, traditional brick and mortar retailers, including well-known brands such as J.C. Penny, J. Crew, and Pier One, were christening what many believed to be the first wave of post COVID-19 bankruptcies. At the time, our view was that companies impacted by the COVID-19 pandemic might look for relief via M&A while opportunistic buyers might look to take advantage of lower valuations in the market. While some industries have fared worse than others, the unprecedented fiscal aid pumped into the economy seems to have warded off a wave of bankruptcies in the middle and upper market, or at least prevented a surge at the scale many were predicting. M&A deal volume recovered in the second half of 2020 after coming to a near halt in the initial months of the pandemic. Deal volume, while increasing, does generally remain below levels seen in 2018 and 2019. All the while, capital has flooded the market, with a good amount of it ending up parked in banks, resulting in bank deposits increasing over 20% in 2020.

Data per Epic Aacer, Available online at: https://www.aacer.com/blog/january-2021-bankruptcy-filings-continue-historic-slide

While nothing is for certain, it appears that the worst of the economic risks tied to the pandemic could be behind us. Estimates range widely, from as early as July 2021 to as late as 2022, but the U.S. now has a path to reaching herd immunity through the administration of multiple vaccines. As it stands in March 2021, over a quarter of the U.S. population has received at least one dose of a vaccine. The public markets have viewed the rollout favorably, and while one explanation for the market’s strong 2020 performance might be summed up by a blend of a low-risk free rate amidst asset inflation, it is undeniable that valuations in the public markets are pricing in some level of a continued post-pandemic recovery.

As the public health crisis continues to improve, one would expect deal volume to increase in tandem. Prior to the pandemic, many market observers had concluded that small to middle market M&A activity was poised for an uptick, as a generation of baby boomers was expected to retire and in turn monetize their stake of private company ownership. That generational trend remains in-tact post COVID. The Biden administrations’ efforts to increase the capital gains tax rate may also accelerate some M&A activity in the immediate short-term, as sellers seek to position transactions to be taxed at current tax rates.

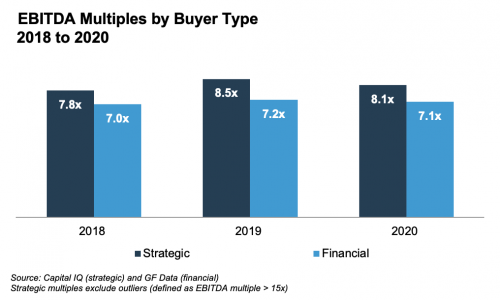

While the middle market M&A environment has not witnessed the downward shift in values that one might have expected following the economic shutdown of the early pandemic period; neither has it seen the run-up in values that was exhibited in the public markets throughout the second half of 2020 and into early 2021. If the public markets provide a meaningful measure for general economic expectations, then how long until these higher expectations are priced into middle market M&A values? At a minimum, the downside pandemic-related risks that were initially so prevalent appear to have diminished. As with most things in this environment, risks are very industry specific and there are many industries that have exhibited (and will likely continue to exhibit) dramatic negative shifts in valuations. Overall, however, transaction multiples appear to have declined only a small amount from pre-pandemic levels.

As my colleague Jeff Davis concluded in a recent piece for this blog, the availability of debt financing for most family businesses in 2021 should be favorable, likely with a low cost of credit and lenient terms by historical standards. Jeff noted some exceptions, such as hotels, retail CRE, restaurants, and tourism-related businesses, but on the whole banks are eager to invest. Loans in the commercial banking system declined for the first time in a decade in 2020 and for only the second time in 28 years while deposits remain historically high. In the current low-rate environment, revenue pressures are high for banks as cash and bonds yield little to nothing. Without a competitive alternative, banks and investors flush with capital are under pressure to compete for lending opportunities to produce a return while loan demand is weak as the U.S. market rounds what many believe to be the very beginnings of a new economic cycle.

For family business directors, 2021 should be an opportune time to consider making an acquisition. General indications on valuation suggest that the private company M&A market has not been priced-up at anywhere near what has been seen in the public markets. While this difference may be caused by a public market over-valuation issue that is “corrected” in the short-term, it suggests that there could be positive momentum in private company valuations as the economy continues to move through subsequent stages of the post-pandemic recovery. A good M&A deal can be made even better with favorable financing, which should be available to many borrowers in the current environment.

We can’t predict the future, but those who take a buyer’s view of the M&A market now might be rewarded with enhanced returns. With pent up demand and a high availability of capital, we anticipate a rise in M&A activity over the next year with the best valuations and financing deals likely favoring the early bidders.