Golden parachute payments have long been a controversial topic. These payments, typically occurring when a public company undergoes a change-in-control, can in some cases draw the ire of political activists and shareholder advisory groups. Golden parachute payments can also lead to significant tax consequences for both the company and the individual. Strategies to mitigate these tax risks include careful design of compensation agreements and consideration of noncompete agreements to reduce the likelihood of additional excise taxes.

When planning for and structuring an acquisition, companies and their advisors should be aware of potential tax consequences associated with the golden parachute rules of Sections 280G and 4999 of the Internal Revenue Code. A change-in-control (CIC) can trigger the application of IRC Section 280G, which applies specifically to executive compensation agreements. Proper tax planning can help companies comply with Section 280G and avoid significant tax penalties.

Golden parachute payments usually consist of items like cash severance payments, accelerated equity-based compensation, pension benefits, special bonuses, or other types of payments made in the nature of compensation. In a CIC, these payments are often made to the CEO and other named executive officers (NEOs) based on agreements negotiated and structured well before the transaction event. In a single-trigger structure, only a CIC is required to activate the award and trigger accelerated vesting on equity-based compensation. In this case, the executive’s employment need not be terminated for a payment to be made. In a double-trigger structure, both a CIC and termination of the executive’s employment are necessary to trigger a payout.

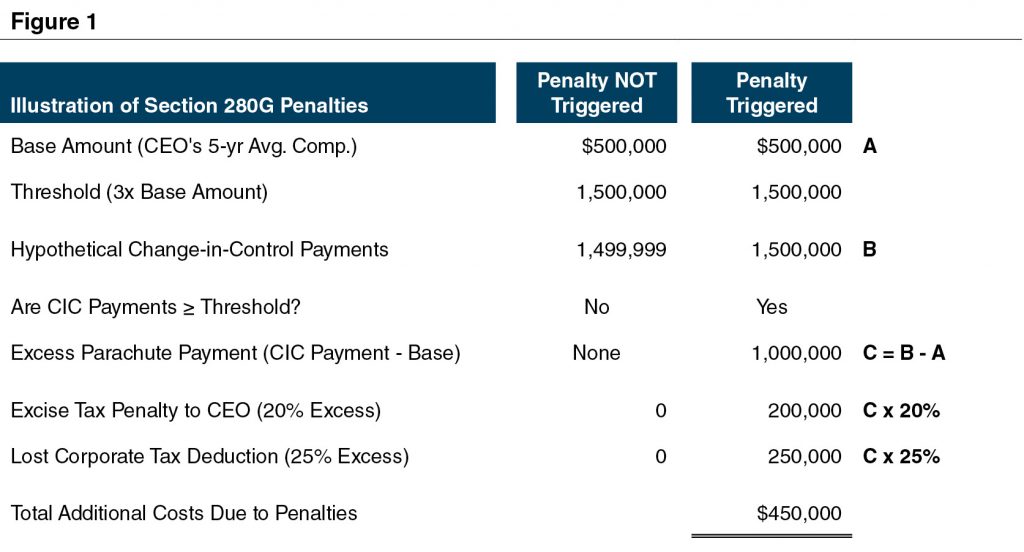

Adverse tax consequences may apply if the total amount of parachute payments to an individual exceeds three times (3x) that individual’s “Base Amount”. The Base Amount is generally calculated as the individual’s average annual W-2 compensation over the preceding five years.

As shown in Figure 1, if the (3x) threshold is met or crossed, the excess of the CIC Payments over the Base Amount is referred to as the Excess Parachute Payment. The individual is then liable for a 20% excise tax on the Excess Parachute Payment, and the employer loses the ability to deduct the Excess Parachute Payment for federal income tax purposes.

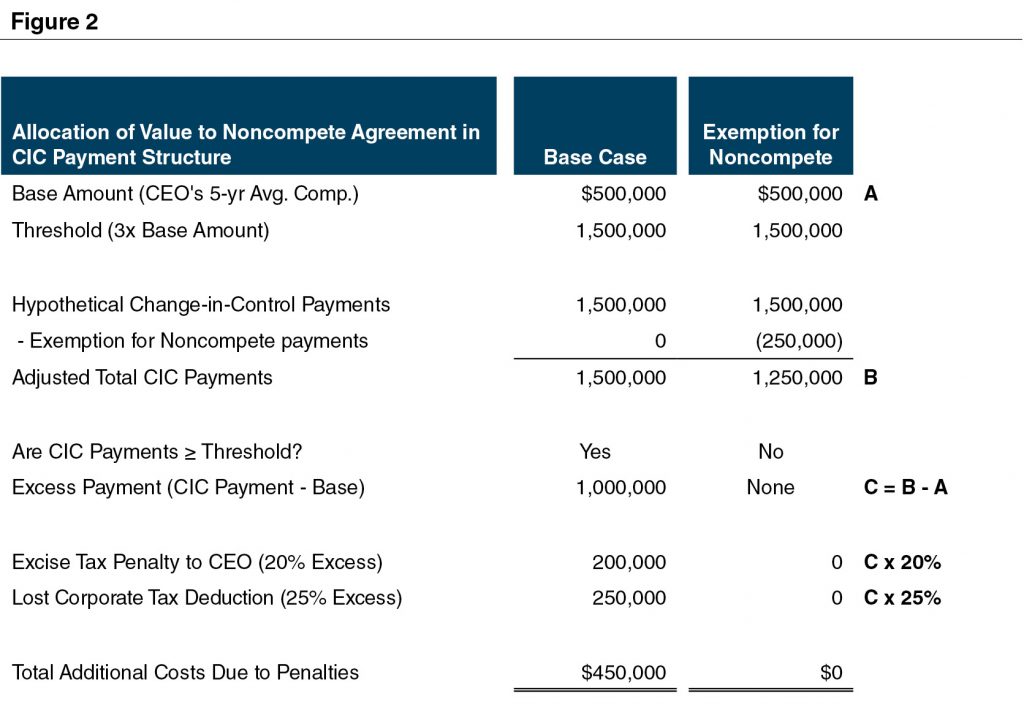

Several options exist to help mitigate the impact of the Section 280G penalties. One option is to design (or revise) executive compensation agreements to include “best after-tax” provisions, in which the CIC payments are reduced to just below the threshold only if the executive is better off on an after-tax basis. Another strategy that can lessen or mitigate the impact of golden parachute taxes is to consider the value of noncompete provisions that relate to services rendered after a CIC. If the amount paid to an executive for abiding by certain noncompete covenants is determined to be reasonable, then the amount paid in exchange for these services can reduce the total parachute payment.

According to Section 1.280G-1 of the Code, the parachute payment “does not include any payment (or portion thereof) which the taxpayer establishes by clear and convincing evidence is reasonable compensation for personal services to be rendered by the disqualified individual on or after the date of the change in ownership or control.” Further, the Code goes on to state that “the performance of services includes holding oneself out as available to perform services and refraining from performing services (such as under a covenant not to compete or similar arrangement).”

Figure 2 illustrates the impact of a noncompete agreement exemption on the calculation of Section 280G excise taxes.

How can the value of a noncompete agreement be reasonably and defensibly calculated? Revenue Ruling 77-403 states the following:

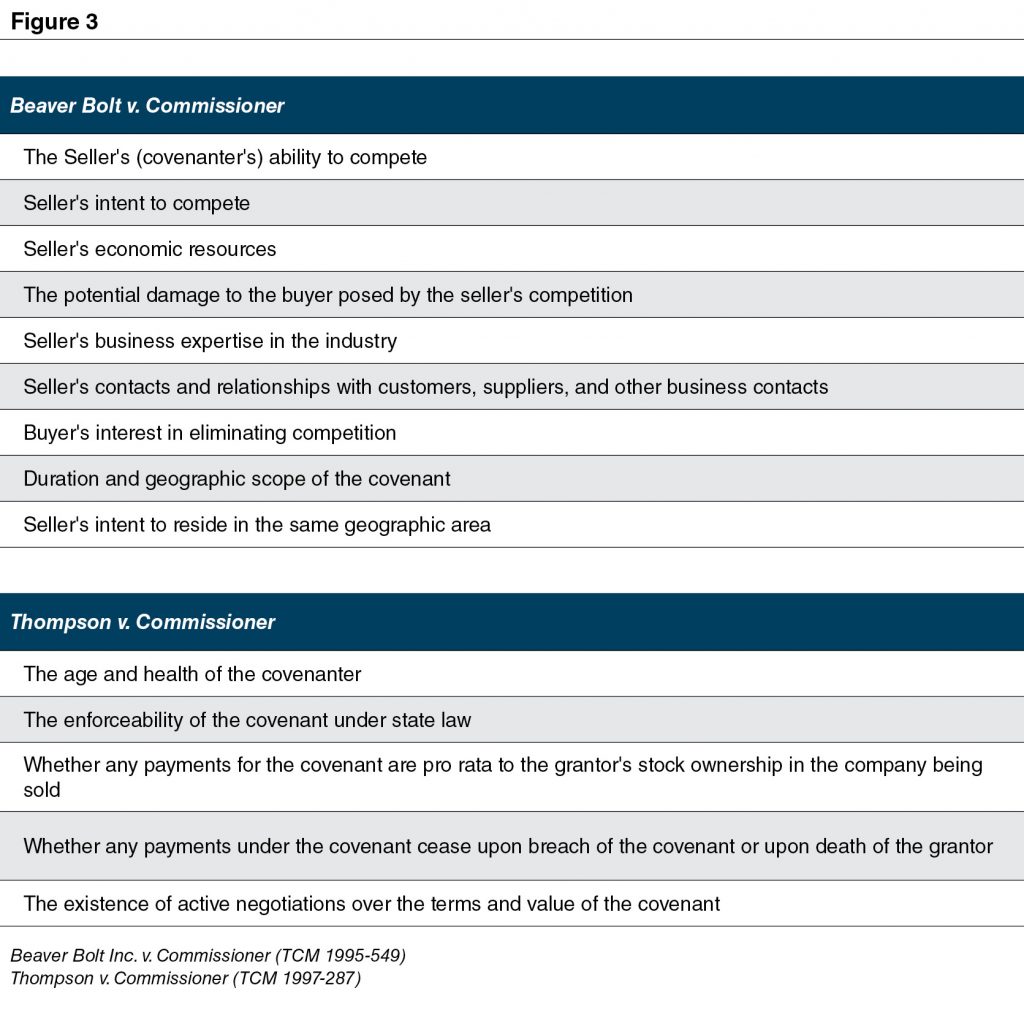

“In determining whether the covenant [not to compete] has any demonstrable value, the facts and circumstances in the particular case must be considered. The relevant factors include: (1) whether in the absence of the covenant the covenantor would desire to compete with the covenantee; (2) the ability of the covenantor to compete effectively with the covenantee in the activity in question; and (3) the feasibility, in view of the activity and market in question, of effective competition by the covenantor within the time and area specified in the covenant.”

Some of the factors to be considered when evaluating the “economic reality” of a noncompete agreement have been enumerated in various Tax Court cases, as detailed in Figure 3.

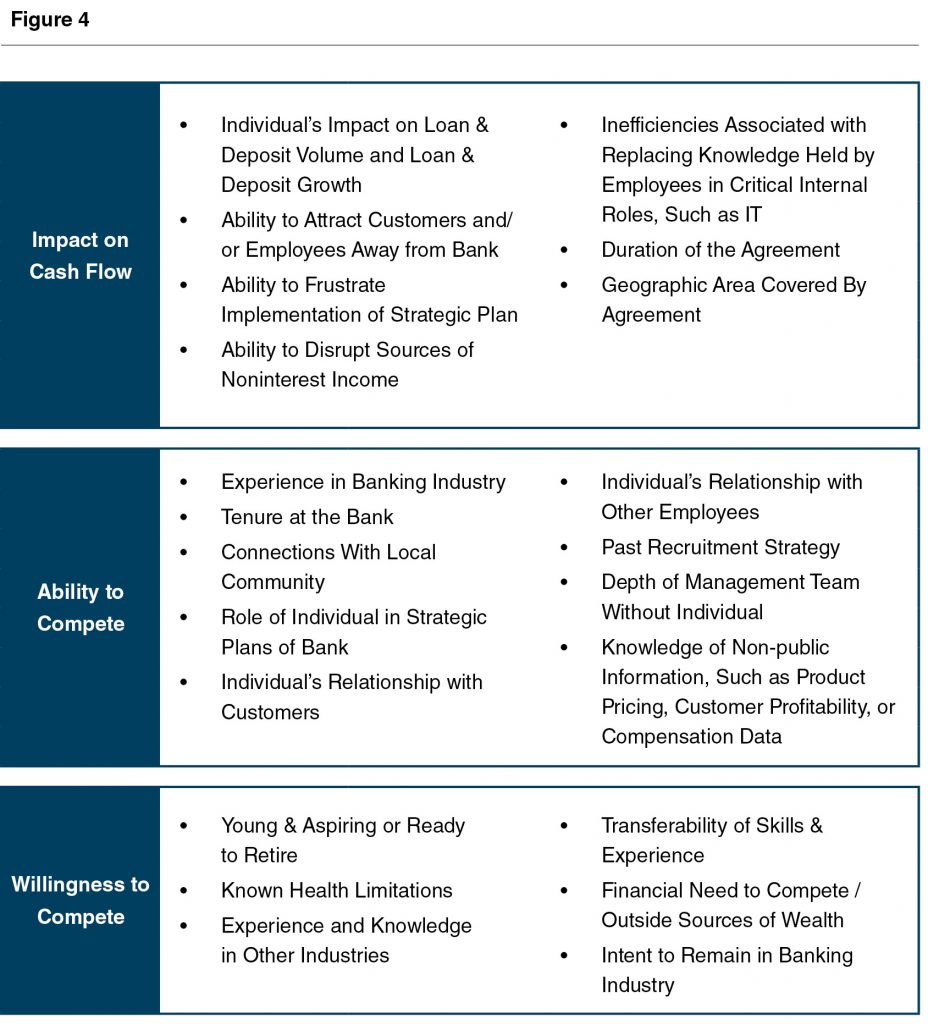

A common method to value noncompete agreements is the “with or without” method. Fundamentally, a noncompete agreement is only as valuable as the stream of cash flows the firm projects “with” an agreement compared to “without” one. The difference between the two projections effectively represents the “cost” of competition, or stated differently, the value of the cash flows protected by the noncompete agreement. Cash flow models can be used to assess the impact of competition on the firm based on the desire, ability, and feasibility of the executive to compete. Valuation professionals consider factors such as revenue reductions, increases in expenses, and the impact of employee solicitation and recruitment.

To illustrate how the three factors of Revenue Ruling 77-403 can be evaluated in light of the specific terms of a noncompete agreement for a bank employee, we put together Figure 4.

Mercer Capital provides independent valuation opinions to assist companies with IRC Section 280G compliance. Our opinions are well-reasoned and well-documented regarding the factors influencing the value of non-compete agreements.