Over the past year we have seen an uptick in transactions (and contemplated transactions) in which boards seek to reduce the number of shareholders via reverse stock splits and cash out mergers. The central question for a board aside from fairness and process is: what price?

While the terms “fair market value” and “fair value” appear to be similar, they are very different concepts. When seeking a business valuation, it is critical to ensure that the appraisal is performed according to the relevant and proper standards.

Transactional Value

Fair market value (“FMV”) and fair value as defined in Accounting Standards Codification (“ASC”) 820 define value in the context of a market clearing price. Statutory fair value (“FV”) is defined in state statutes and is interpreted through precedents established in case law over the year, most notably in Delaware.

The accounting profession defines fair value in ASC 820 as:

The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the

measurement date.

The accounting profession defines fair value from the seller’s perspective with the indicated value used for a variety of purposes including disclosure in financial statements for Level 1, 2, and 3 assets and liabilities.

In the business valuation community, FMV is the most widely recognized valuation standard. FMV is the primary standard used in valuations for estate tax, gifting, and tax compliance.

The IRS defines fair market value in Revenue Ruling 59-60 as:

The price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts.

What brings hypothetical, willing buyers and sellers to the intersection point of fair market value is their respective assessments and negotiations regarding the expected cash flows, risk, and growth associated with the subject interest. Depending on the corporate governance of the specific interest, fair market value also may incorporate discounts to reflect a business interest’s lack of control or lack of marketability. 1, 2

Expropriated Value

Statutory fair value is governed by state law and interpreted by state courts in which dissenting shareholders to certain corporate transactions (e.g., a merger approved by a shareholder vote) petition the court for the fair value of their shares.

Most state statutes provide appraisal rights that allow shareholders to obtain payment of the FV of their shares in the event of various corporate actions, including amendments to the articles of incorporation that reduce the number shares owned to a fraction of a share if the corporation has the right or obligation to repurchase the fractional share.

In 1950, the Delaware Supreme Court offered this interpretation of fair value:

“The basic concept of (fair) value under the appraisal statutes is that the (dissenting) stockholder is entitled to be paid for that which had been taken from him viz. his proportionate interest in a going concern. By value of the stockholder’s proportionate interest in the corporate enterprise is meant the true intrinsic value of his stock which has been taken by merger.”

In effect, the noncontrolling shareholder who is dissenting to a transaction is entitled to his or her pro rata share of value of the company as interpreted in most jurisdictions. As a result, the controlling shareholder cannot expropriate value from the minority shareholder who is being forced out. Therefore, some state statutes explicitly declare and most case law affirms the view that neither a discount for lack of control and/or an illiquidity discount should be considered in determining fair value. 3

While there is no official valuation hierarchy in the Delaware Court of Chancery, based upon a review of recent cases a few observations can be made:

- Unaffected stock price immediately before the transaction announcement in an efficient market (with regards to both volume and information) is the best indication of value

- Deal price is a reliable indicator if the analysis excludes the benefit of synergies

- No recognized valuation methods have been ruled out

- The discounted cash flow method is generally one of the preferred valuation methods if unable to observe efficient transaction prices that occurred before the transaction

The observations from Delaware case law about the meaning of statutory FV are reflected in some states’ business corporation act. For instance, FV according to the Guam Business Corporation Act §281301(d) shall be determined:

- Immediately before the effectuation of the corporate action to which the shareholder objects excluding any appreciation or depreciation in anticipation of the corporate action objected to;

- Using customary and current valuation concepts and techniques generally employed for similar businesses in the context of the transaction requiring appraisal; and

- Without discounting for lack of marketability or minority status except, if appropriate, for amendments to the articles pursuant to §281302 (a)(5).

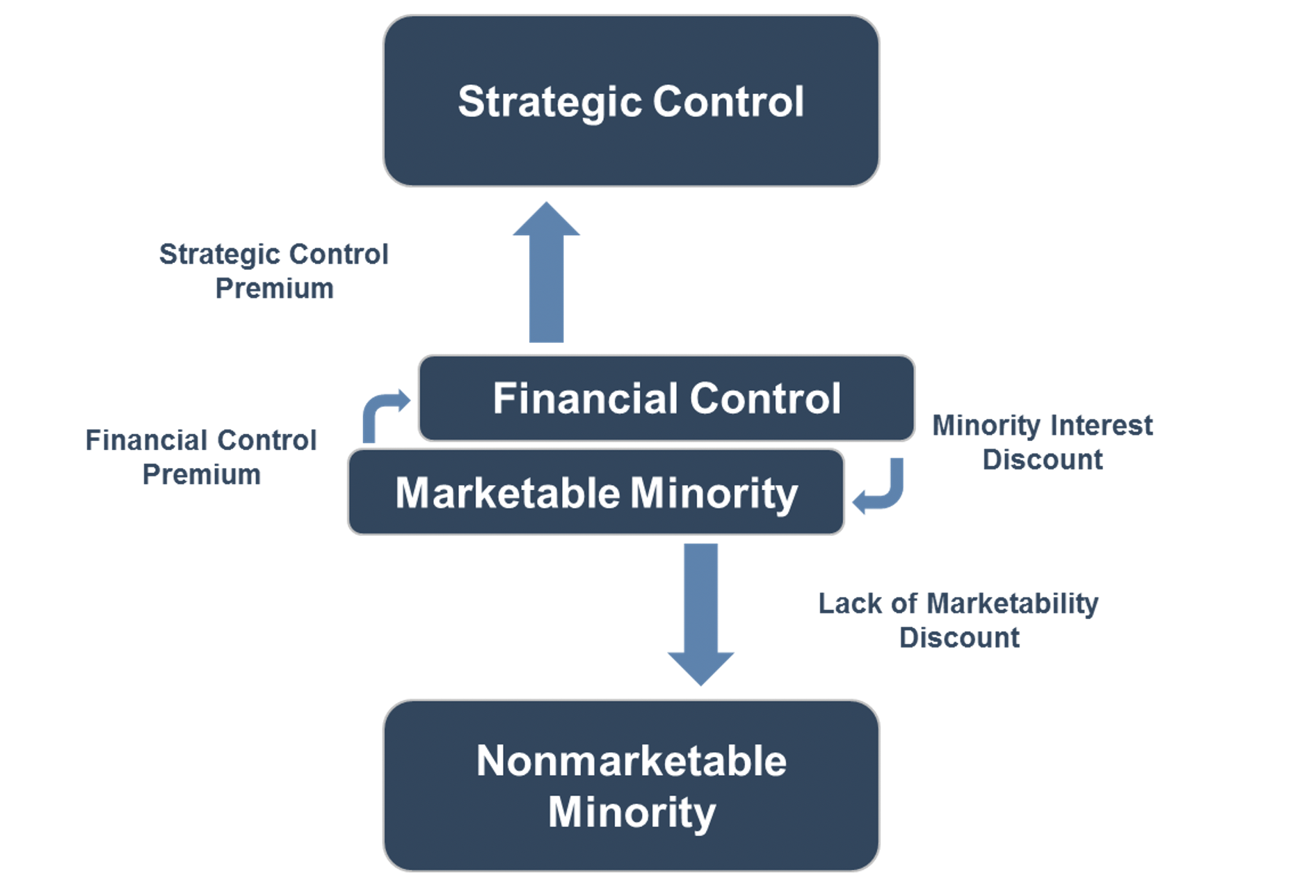

Shown below is a graphic detailing the different levels of value and how we at Mercer Capital think about them in relation to fair value and fair market value.

Controlling interest basis refers to the value of the enterprise as a whole and may be analyzed from two perspectives:

- Strategic Control Value is best described as Investment Value, based on individual investment requirements and expectations. The strategic control level of value is not generally consistent with FMV, in that it considers the motivations of a specific buyer as opposed to a hypothetical buyer. In other words, the “strategic control premium” is often deemed to be outside both the fair market value and statutory fair value standards. Most bank M&A deals take place at this level of value given cost save assumptions that are common in the industry. In a statutory fair value appraisal, deal value generally may not include the benefit of synergies.

- Financial Control Value is most often consistent with the fair market value and statutory fair value standards because (i) the underlying premise is a going concern; (ii) it typically does not include any premiums that might be paid by a buyer with specific motivations and the ability to implement synergistic structural and financial changes; and (iii) no minority interest or marketability discounts are applied.

Marketable minority interest basis refers to the value of a minority interest, lacking control, but enjoying the benefit of liquidity as if it were freely tradable in an active market. The marketable minority level of value also is an enterprise level of value that may align with the financial control value.

Nonmarketable minority interest basis refers to the value of a minority interest, lacking both control and market liquidity. The standard of value for a nonmarketable minority interest valuation is usually fair market value and is seldom statutory fair value.

Conclusion

Mercer Capital has decades of experience working with boards of directors regarding statutory fair value in the context of transactions that create appraisal rights and dissenters’ rights. While we sometimes are called to assist in such matters once a transaction has occurred, it is better to address the issue of fair value (and fairness) beforehand. Please call if we can assist your institution.

1 Valuation of Noncontrolling Interests in Business Entities Electing to be Treated as S Corporations for Federal Tax Purposes, page 8, Accessed Online March 31, 2022 | https://www.irs.gov/pub/irs-utl/S%20Corporation%20Valuation%20Job%20Aid%20for%20IRS%20Valuation%20Professionals.pdf

2 Statutory Fair Value, Accessed Online March 25, 2022, https://mercercapital.com/content/uploads/MerceCapital-Statutory-Fair-Value.pdf.

3 Tri-Continental v. Battye, 74 A 2d 71, 72 (Delaware 1950)