Managing Your RIA’s Priorities

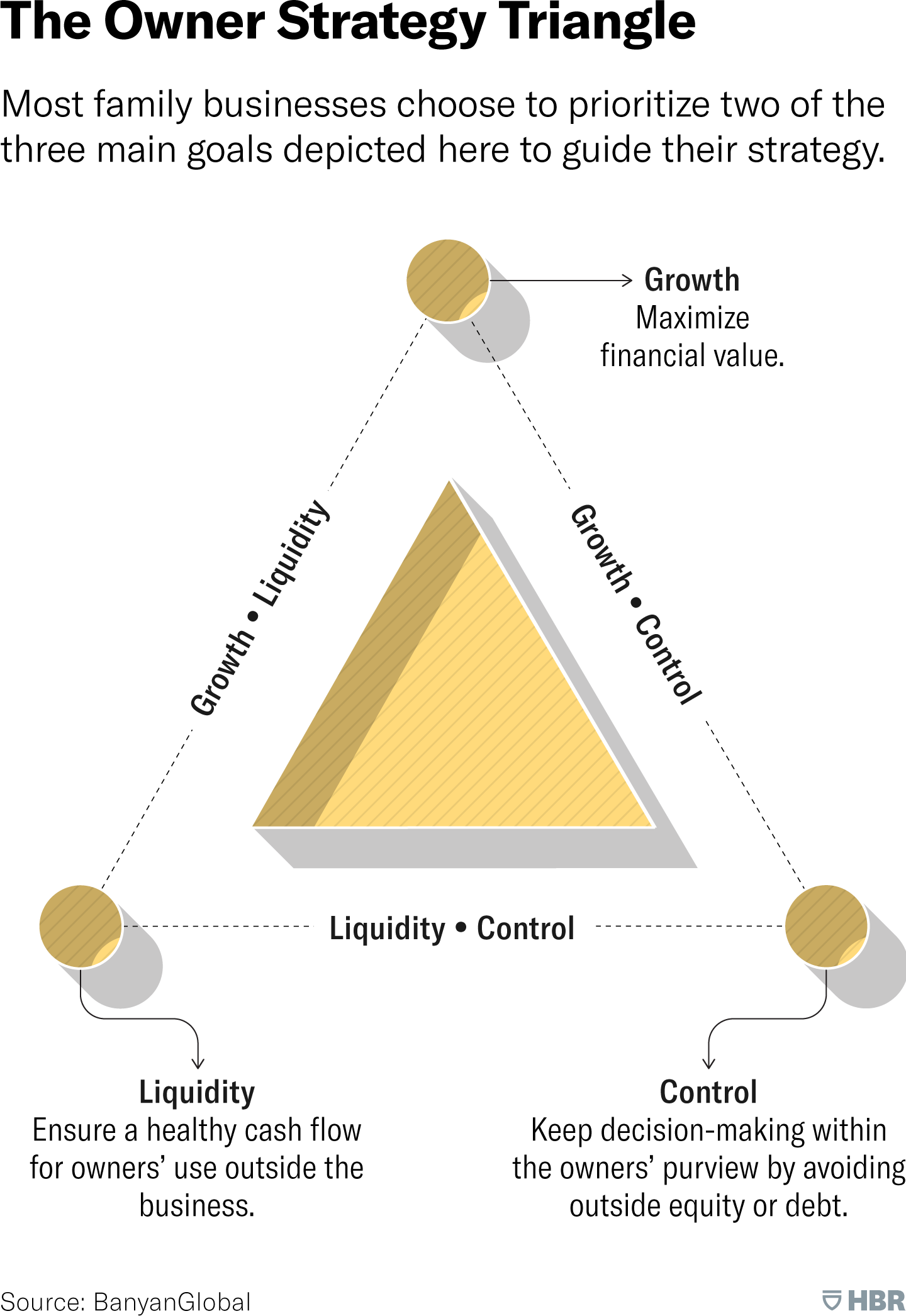

The Owner Strategy Triangle

It had a nice personality…the “boxy, but good” Volvo 240d (imagined image via Grok).

Sometimes we come across an idea that is so good we’re jealous of the person or persons who developed it. The Owner Strategy Triangle is one such idea. Josh Baron and Rob Lachenauer are family business consultants who founded Banyan Global and saw a strategic need for family business owners to decide what they valued most between three options: liquidity, growth, and control.

Once the priorities of the family business were identified, Baron and Lachenauer reckoned the owners could evaluate strategic alternatives and decide what tradeoffs they were willing to accept to achieve their priorities.

You can read more about the Owner Strategy Triangle in numerous articles, but I recommend the explanation of the work in context in Baron and Lachenauer’s insightful and practical text, The Harvard Business Review Family Business Handbook.

In general, the Owner Strategy Triangle examines how most family business strategies prioritize two points on the triangle at the expense of the third. Family business owners might, for example, de-prioritize receiving significant returns through distributions to instead reinvest profits to grow their business while maintaining family control. Others might want to use the control of their business to provide current income for the family, sacrificing growth to support a stream of distributions. Family business owners who prioritize growth and liquidity might choose to take on a financial sponsor as a minority or majority shareholder, thus giving up control of their business.

While the authors developed the Owner Strategy Triangle as a way to examine strategy for family businesses, we see useful applications of their framework for RIA leadership as well.

Applicability to RIAs

Upon learning about the Owner Strategy Triangle, my initial observation was that RIAs were the exception to the rule of the triangle: choose two priorities while sacrificing the third. The Owner Strategy Triangle is a framework suited to more typical capital-intensive businesses. If anything, it functions to bring clarity to communication with family members who may not be involved with the daily decisions required to run a legacy family business.

On the other hand, RIA owners can, and indeed frequently do, maintain control of a growing business while taking out most, if not all, profits in the form of distributions. RIAs are usually owner-operator models with low levels of capital intensity that grow from market dynamics as much as reinvestment, such that the leadership can maintain a significant foothold on all three priorities without sacrificing one to the benefit of the other two.

On further reflection, I think the logic of the Owner Strategy Triangle applies to RIAs as it does to family businesses. And the process of thinking about strategy using Baron and Lachenauer’s framework reveals the priorities of different leaders or leadership groups and how they run their investment management businesses.

If You Prioritize Growth and Liquidity

Because investment management firms enjoy an AUM-driven revenue model, growth can come from market behavior as well as organic growth, either from new relationships or the expansion of existing relationships. This growth can be accommodated, to a point, while still distributing substantially all the firm’s profitability.

Founder-led firms can enjoy growth and liquidity without giving up control — to a point. Successful businesses last longer than careers, and the inevitable succession issues will lead to some redistribution of cash flow (liquidity) and/or control.

In addition, firms seeking greater levels of growth and liquidity, such as through inorganic growth, will willingly sacrifice control by taking sponsor capital to add other professionals or firms to grow the business. Sacrificing control, in this way, enables firms to pay for acquired growth with other people’s money. There is a tradeoff, but for a decade now many have decided this tradeoff was worth it.

If You Prioritize Liquidity and Control

If maximizing your current distributions while maintaining control of your RIA is important to you, odds are that you won’t achieve as much growth in your business. Aside from market effects, growth in an RIA requires reinvestment in the form of attracting, training, and nurturing new staff, recruiting revenue producers from other firms, or acquiring teams or firms. All of that growth activity comes at the cost of discretionary cash flow. It may not be the sort of reinvestment activity that hits the P&L like a new factory does for a manufacturing business, but it’s a drain on distributable cash flow, nonetheless.

In our experience, this set of priorities — to maintain control and focus on maximizing distributions — describes the priorities of many investment management firms. Leadership at these firms may not realize it, but they’ve delegated growth to market effects. Fortunately, and for some time now, the market has obliged.

If You Prioritize Control and Growth

Absent the need for distributable cash flow or the monetization of ownership interests, an RIA owner group that wants to self-finance a higher rate of growth can do so without taking on outside capital. I will say that this approach to practice management is unusual but not unheard of in the investment management community.

What Are Your Priorities?

The Owner Strategy Triangle is a powerful way to boil down the strategic priorities of an RIA’s leadership, expose inconsistencies, and create alignment. The developers of the framework look at it primarily as a way to foster productive communication with family business owners. In our way of thinking, it’s a useful tool for considering opportunities and tradeoffs in investment management firms.

I will note that there is no perfect choice of priorities when managing an investment management firm. There aren’t even some that are better than others. Each approach to the Owner Strategy Triangle works if it suits the needs and aspirations of the firm’s leadership. What matters is choosing, and choosing deliberately.

About Us

We are a valuation and advisory firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, RIAs, trust companies, broker-dealers, PE firms, and alternative managers.

RIA Valuation Insights

RIA Valuation Insights