Market Volatility & Shareholder Liquidity

Recent volatility in economic policy has contributed to stock market volatility. Of the 16 market trading days since “Liberation Day,” the S&P 500 has registered 11 daily index changes greater than 1% (six positive and five negative).

A recent article on Bloomberg.com, “Billionaires Seek to Take Companies Private as Market Melts,” describes how some of the world’s wealthiest families are responding to the volatility. The theme of the article is that disrupted equity markets present long-term investors with opportunities to take underperforming or underappreciated public companies private.

The article rehearses the by-now-familiar litany of benefits associated with private ownership:

- Reducing costs associated with public company compliance procedures

- Moving quickly without regard to public investor responses

- Adhering to a long-term strategy without the pressure of the quarterly earnings cycle

- Implementing operational changes

Those benefits are real, and we see many of our family business clients take advantage of them every day. But what the article really made us think about was the Owner Strategy triangle.

We’ve professed our admiration for the Owner Strategy triangle in previous posts (A Framework for Ownership Strategy – Part I and A Framework for Ownership Strategy – Part II). For those needing a refresher, the Ownership Strategy triangle highlights the tradeoffs family business owners face regarding the “goals” of growth, control, and liquidity. As the authors of the Harvard Business Review Family Business Handbook note, most family businesses can only prioritize two goals, thereby de-emphasizing the third.

The wealthy families featured in the Bloomberg.com article noted above are sacrificing liquidity for the sake of control and growth. Why are they willing to do so?

- The most obvious answer is that they don’t need it. For families with multiple billions of dollars, access to liquidity is generally less of a concern than for those who measure their fortunes in the millions.

- Markets, however, clearly prize liquidity. For example, when public companies issue so-called “restricted stock” that can’t be traded for a time, the restricted shares are often issued at discounts of 20% or more to the trading price of unrestricted shares.

When markets value something you don’t need or want, that is an invitation for you to build wealth.

Since — all else equal — markets prefer liquidity, investors can earn a premium return for accepting illiquidity. There is ample market evidence to suggest that this return premium can be substantial. Compounded over a generation or two, the ability to bear the incremental risks associated with illiquidity can, well, make the rich richer.

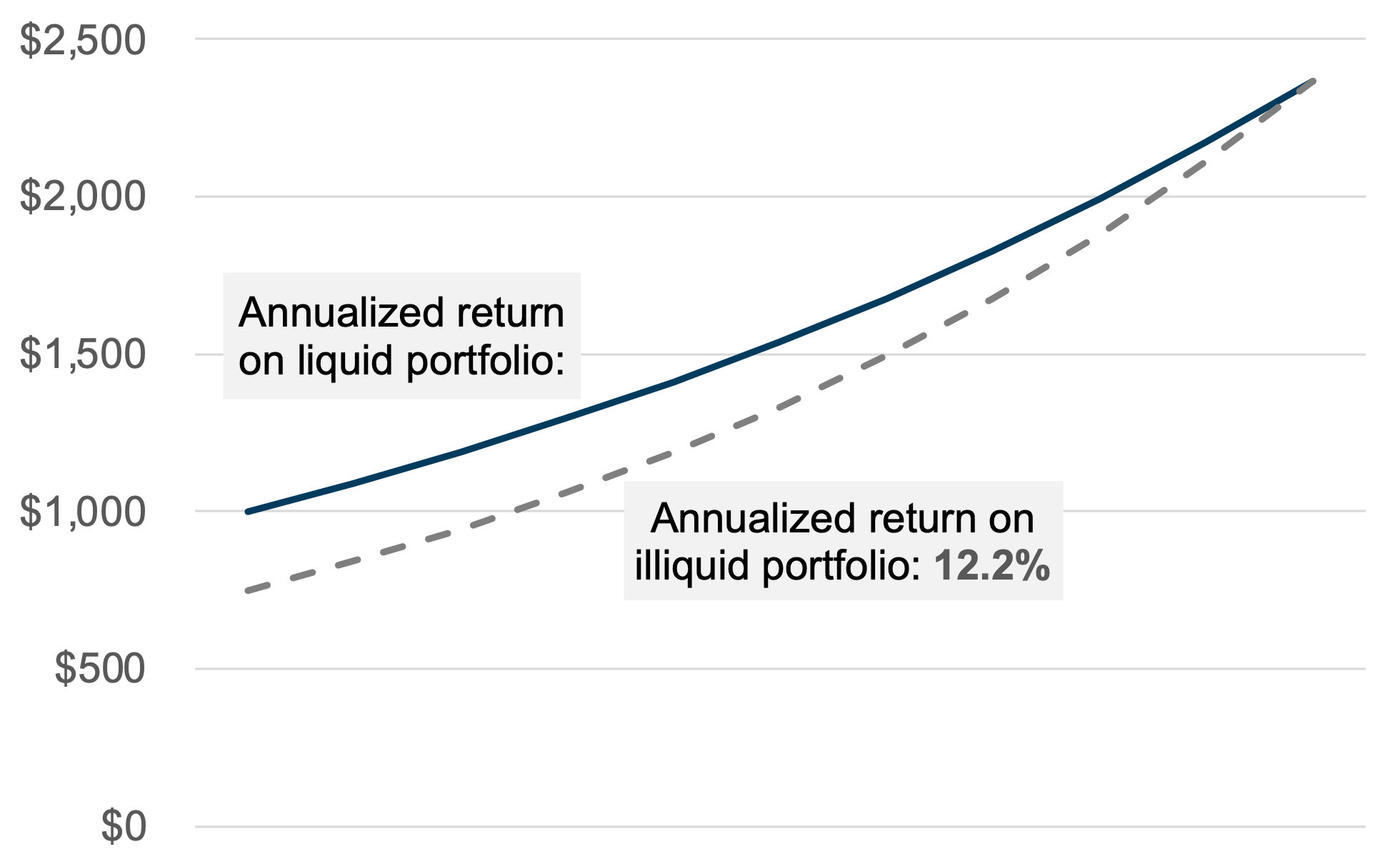

The power of compound interest is well-attested. Consider the outcomes for two investors over a 10-year period:

- The first investor — like most investors — prefers liquidity and invests in a basket of public company shares, earning a compound annual return of 9.0%. Assuming reinvestment of dividends, his initial $1 million investment grows to approximately $2.4 million.

- The second investor does not need or value liquidity and is therefore willing to invest in a portfolio of assets of comparable risk but for the absence of a ready trading market. By accepting the attendant illiquidity, she can acquire her portfolio for $750,000 (a 25% discount to the freely traded portfolio). If the performance of the underlying assets is the same (i.e., grows to $2.4 million over ten years) and she can sell the portfolio on an undiscounted basis at that point, her annualized return is 12.2%.

Is all this just math, or does it mean something for family business directors? We think there are two lessons for directors.

- Take advantage of the benefits of being private. If investors have learned anything in the post-Enron, Sarbanes-Oxley world of the past two decades, it is that aspiring to be publicly traded is a misguided goal for most businesses. Privately held family businesses are not second-class citizens compared to public companies (which have somehow “made it”). Focus on the long-term and (continue to) build a great business for future generations of your family.

- Acknowledge differing liquidity preferences within your family shareholder base. Investor liquidity preferences are not just about investor wealth – psychology, life stage, and other factors are legitimate factors that influence how much your individual family shareholders value liquidity. Seeking ways to responsibly accommodate shareholders who place a higher value on liquidity can promote positive shareholder engagement, family harmony, and enhanced returns for those family shareholders willing and able to bear the burdens of illiquidity.

We make no predictions as to how long the elevated market volatility will persist. Some of the world’s wealthiest families are seeing opportunity in the chaos. What about yours?

Family Business Director

Family Business Director