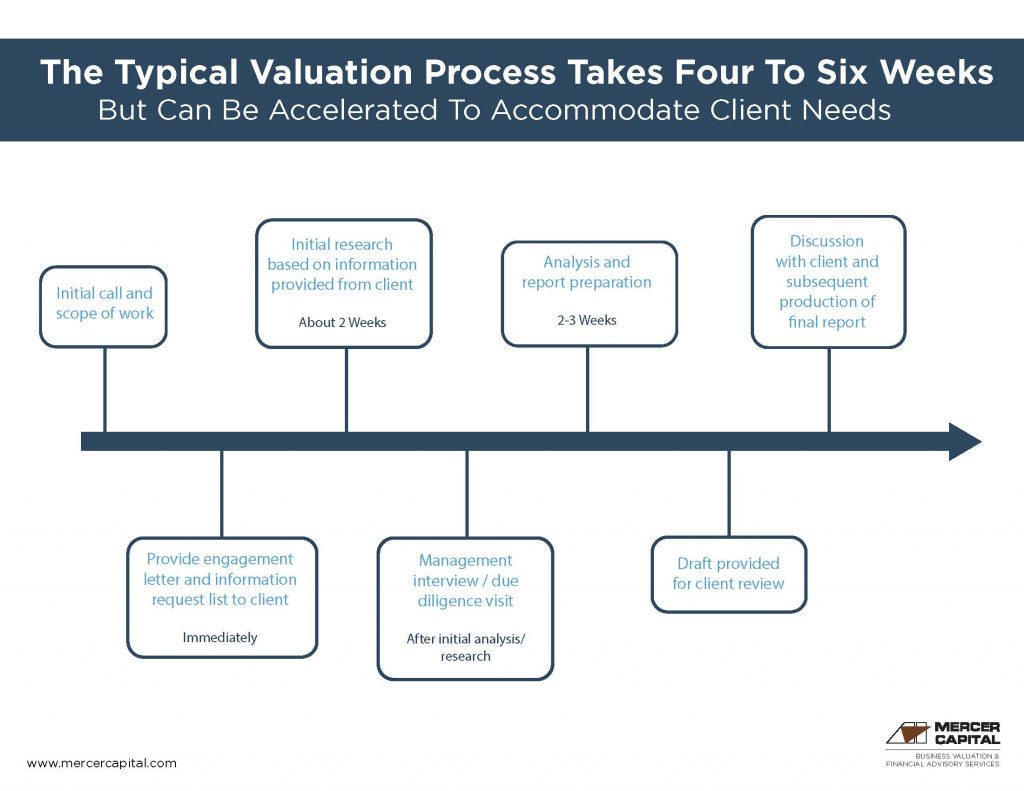

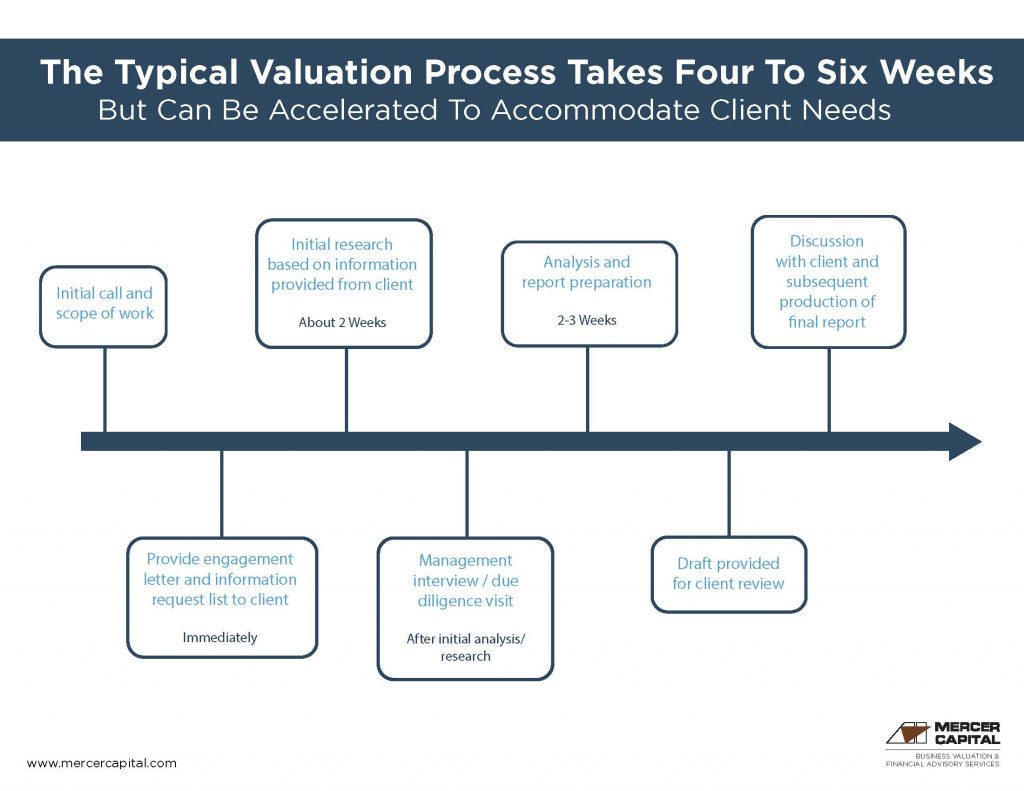

Mercer Capital’s valuation process consists of three stages: the engagement phase, the valuation phase, and the report phase. The timeline is typically 4-6 weeks.

Engagement Phase

- Initial call

When you call us, we discuss (1) your firm, (2) your situation, and (3) your needs. During our discussions, we determine the type and scope of services that your project will entail. - Provide engagement letter (immediately)

The engagement letter provides a descriptive project overview and sets forth the timetable and fee agreement. At this point, we also send you a preliminary information request.

Valuation Phase

- Initial research

We conduct a preliminary analysis of your company, including research and review of industry data and any information you provide. - Leadership interview (after initial research)

We visit with appropriate members of management to review your company’s background, financial position, and outlook, and respond to questions from management. - Analysis and report preparation

Following the leadership interview, the analysis is completed and the valuation report is prepared to explain and support our analysis.

Report Phase

- Draft provided for client review

Your review of the draft report is an important element in the process. We discuss the draft report with you to assure factual correctness and to clarify questions you have about the report. - Final report & discuss next steps

Upon final review, the valuation is issued. Any follow-up consulting, if needed, is begun.

Contact one of our professionals if you have questions or to discuss your needs in confidence at 1.800.769.0967.