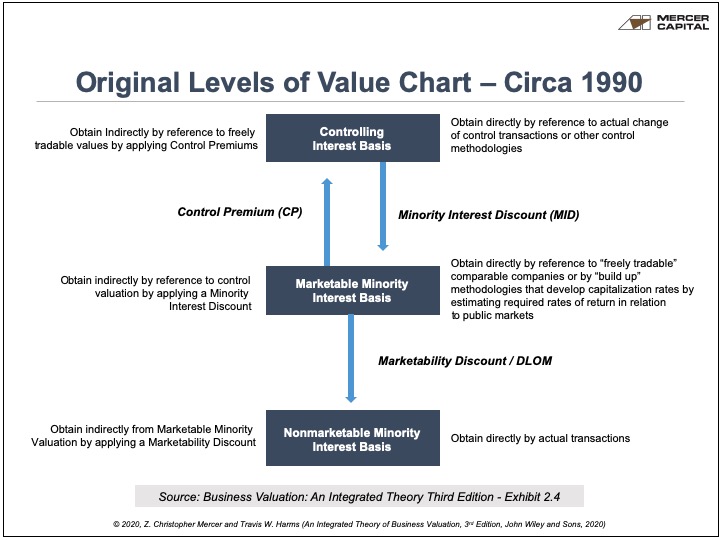

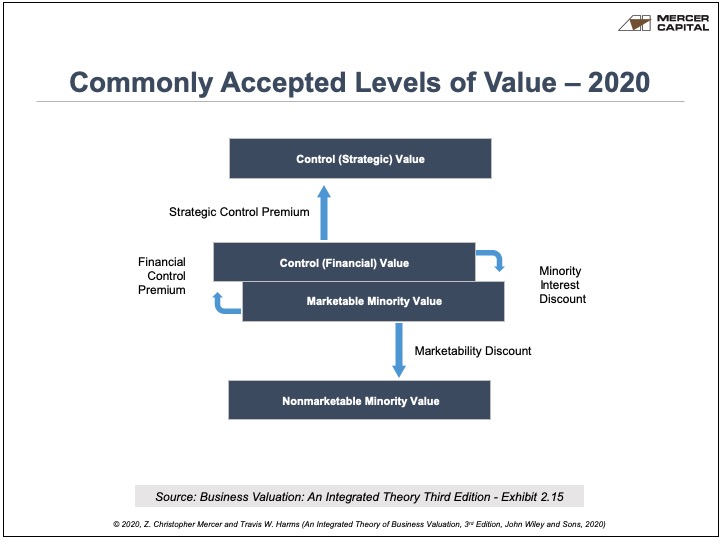

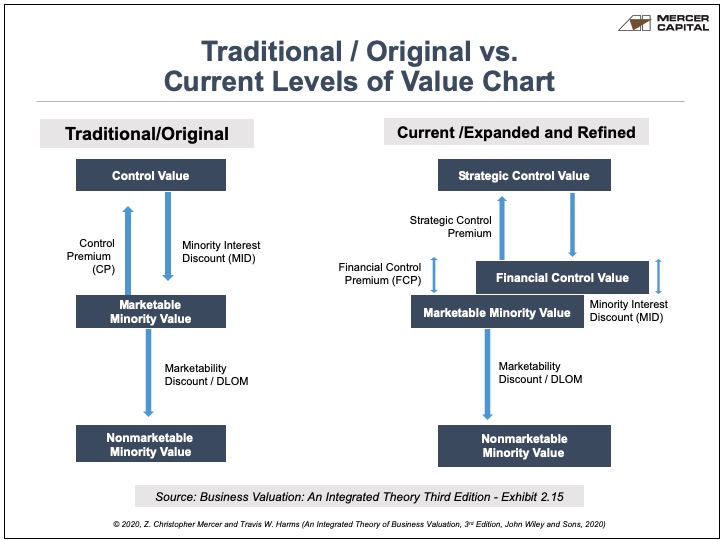

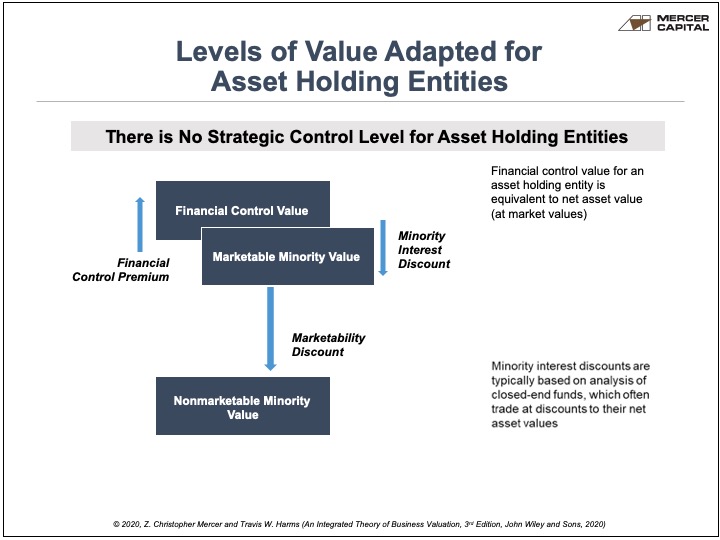

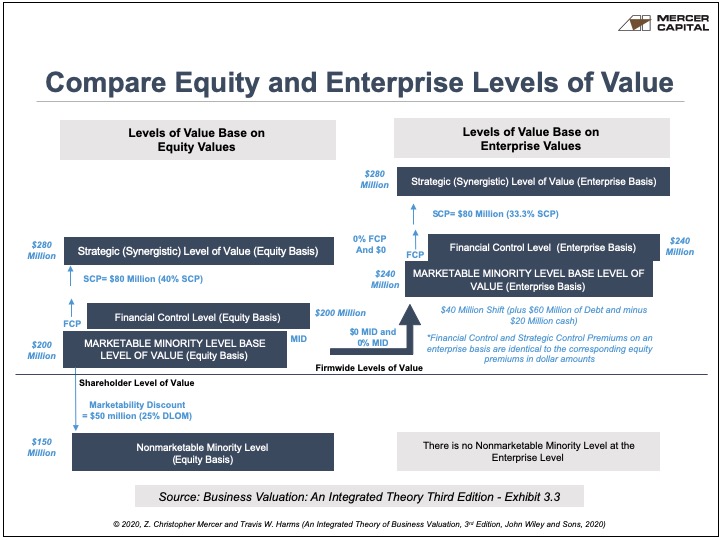

Business appraisers refer to different kinds of values for businesses and business interests in terms of “levels of value.” Since value is a function of expected cash flows, risk and growth, the different levels of value are defined by these factors as they relate to each level. Beginning in 1990, a three-level chart reflected the manner in which most appraisers looked at the value of businesses and interests in them. Currently, most appraisers think in terms of four levels of value, and these charts provide a conceptual overview of these levels. Business appraisers use certain valuation “premiums” and “discounts” to describe movement between the levels on the chart. The first four charts refer to the value of equity of businesses. The last chart translates the levels of value in terms of enterprise (total capital) value. The charts are taken or derived from Business Valuation: An Integrated Theory Third Edition by Z. Christopher Mercer, FASA, CFA, ABAR, and Travis W. Harms, CFA, CPA/ABV.

If you have questions pertaining to the valuation of businesses or business interests, feel free to contact us to discuss in confidence.

Click here to download the charts.