Navigating Buy-Sell Agreements: Part 1

As directors of private family businesses, you’re no strangers to the delicate balance of maintaining harmony among shareholders while safeguarding the company’s long-term stability. In this space, we often discuss topics like shareholder engagement, dividend policy, and succession planning — core elements that keep the family enterprise thriving across generations. Today, let’s dive into a related but often overlooked tool: buy-sell agreements. These agreements act as a safety net, ensuring smooth transitions when life throws curveballs, such as a shareholder’s departure, death, or divorce.

But here’s the thing — many family businesses draft these agreements and then let them gather dust. What if the terms no longer reflect your current reality? Drawing on our comprehensive review checklist, we walk through some main areas and questions to consider. Think of this as a discussion starter for your next family board meeting. How robust is your agreement? Does it protect everyone’s interests without sparking disputes?

Why Review Your Buy-Sell Agreement Now?

In family businesses, emotions often run high, and unclear agreements can lead to costly litigation or fractured relationships.

We recommend reviewing your buy-sell agreement if you are unsure whether the agreement addresses the following questions. Is it binding on all parties? Does it include future shareholders automatically? And does it address life insurance or rights of first refusal (ROFR) to keep ownership within the family?

A strong agreement isn’t just legal jargon — it’s a roadmap for business continuity. For instance, if a family member wants to exit, a provision for rights of first refusal gives existing shareholders the first shot at buying those shares, preventing outsiders from diluting control.

Understanding the Types of Buy-Sell Agreements

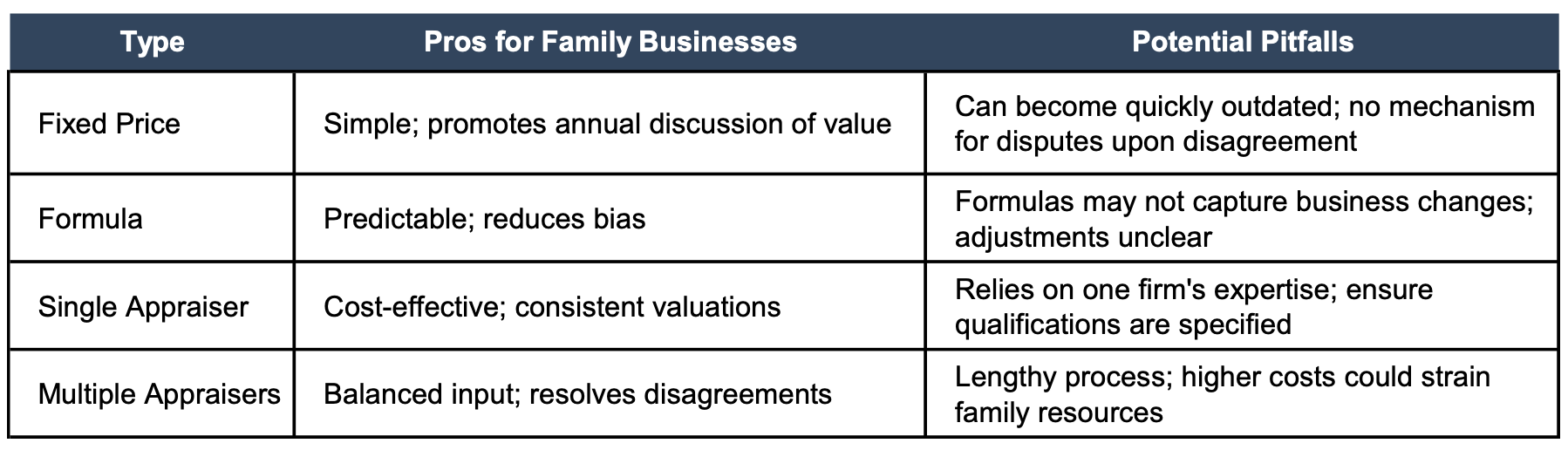

Buy-sell agreements typically fall into one of three categories based on how they determine the price of shares. Each has its place in family dynamics, but pitfalls abound if not tailored properly.

- Fixed Price Agreements: These set a pre-determined price, often agreed upon unanimously by owners and updated annually. It sounds simple, but what if the price hasn’t been refreshed in years? Check for “stale” price alternatives, like fallback valuation processes. In family settings, an outdated fixed price could undervalue or overvalue shares and lead to potential resentment. Ask yourself: Is our fixed price aligned with the current market value? If life insurance is involved, is it clear who buys the deceased owner’s shares — the company or individuals?

- Formula Price Agreements: Here, a mathematical formula (based on book value or earnings multiples) calculates the price. The appeal? Objectivity. However, definitions must be crystal clear — does the formula account for adjustments like non-recurring expenses? The checklist recommends replicating the formula with current data to spot discrepancies.

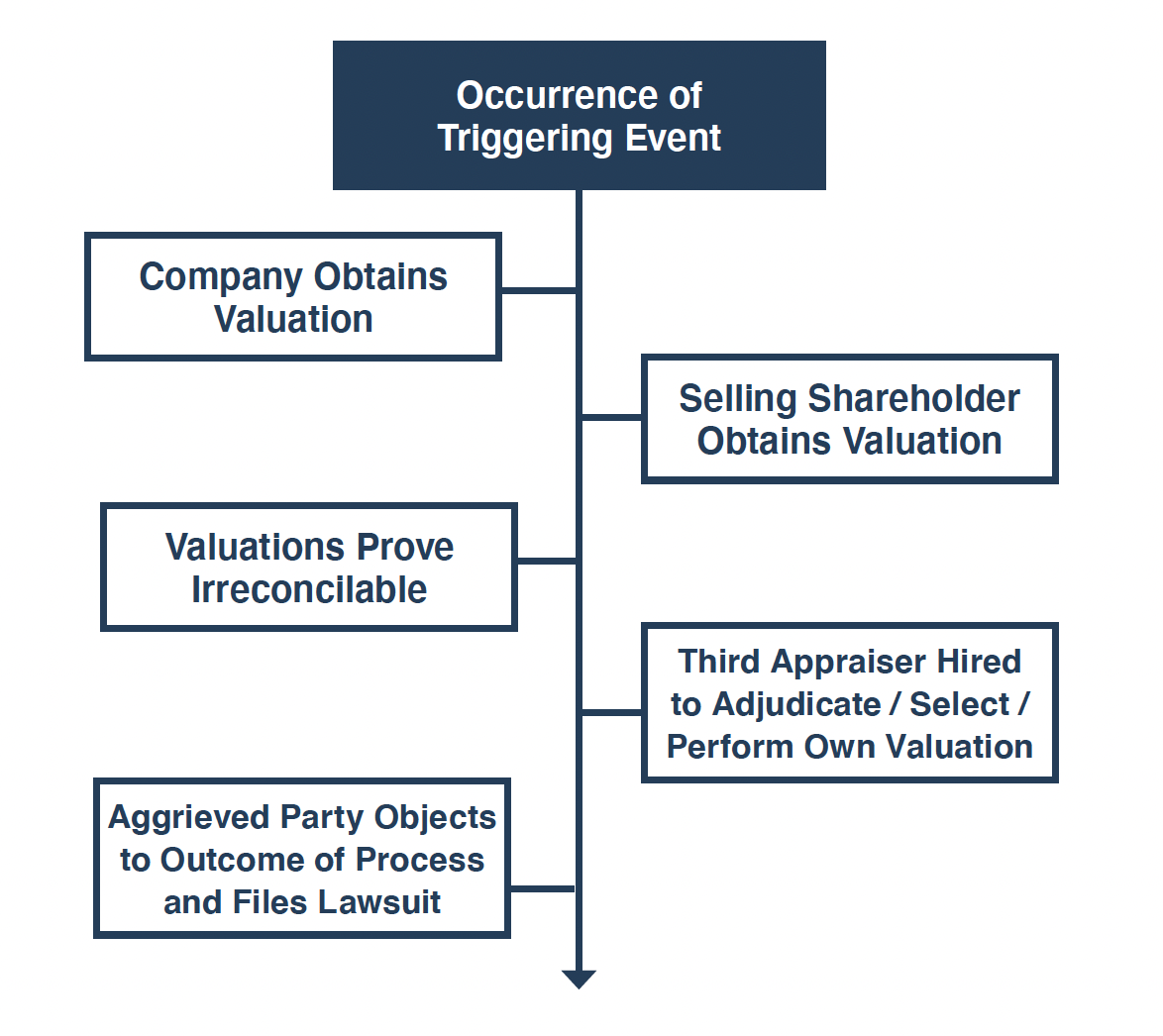

- Valuation Process Agreements: These rely on appraisers for a fair market valuation at the time of a trigger event. There are two subtypes:

- Single Appraiser: One firm is selected before or at the trigger event, and valuations are performed regularly or on demand. A preferred method for efficiency, as it avoids disputes over multiple opinions.

- Multiple Appraisers: This involves two initial appraisers (one from each side), with a third serving as the reconciler, determiner, or judge if the values differ significantly. This can be thorough but time-consuming and expensive — ideal for situations where impartiality is key.

Given the challenges described above, is there any hope that a valuation process for a buy-sell agreement can reliably lead to reasonable resolutions? We think so. We have identified three steps that we recommend to help make buy-sell agreements work better.

1. Ensure precise buy-sell agreement language.

Make sure that the buy-sell agreement provides unambiguous guidance to all parties as to the level of value and qualifications of the appraiser.

2. Retain an appraiser now.

It’s important to retain an appraiser to value the company now, before a trigger event occurs. This is essential for two reasons. First, it transforms the “words on the page” into an actual document that shareholders can review and question. No matter how carefully one defines what an appraisal is supposed to do, the shareholders are likely to have different ideas about what the output will actually look like. This appraisal report should be widely circulated among the shareholders, so they have an opportunity to familiarize themselves with how the company is appraised.

Second, performing the valuation before a trigger event occurs increases the likelihood that the family shareholders can build consensus around what a reasonable valuation looks like. People tend to take a more rational view of things when they don’t know if they will be the buyer or the seller.

3. Update the valuation periodically.

Simply put, static valuation formulas don’t work in a changing world. Periodic updates to the valuation help the valuation process become more efficient and help all shareholders keep reasonable expectations about the outcome in the event of an actual trigger Discontent and strife are more likely to be the product of unmet expectations rather than the absolute valuation outcome. Periodic valuations help to set expectations and reduce the likelihood of friction.

Following these three steps is essential to increasing the likelihood that the valuation process in a buy-sell agreement will actually work. Having a solid buy-sell agreement will help keep the family out of the courtroom, where both sides of the dispute often walk away losers.

Wrapping Up

Buy-sell agreements aren’t set-it-and-forget-it documents; they evolve with your business and family. If this sparks questions, consider giving one of our family business professionals a call today. What’s one area in your agreement you’d review first? Stay tuned for Part II, in which we will discuss trigger events and life insurance.

Family Business Director

Family Business Director