Navigating Private Company Valuations

When and Why to Use an Independent Appraiser

An independent appraisal, also known as a business valuation, provides an unbiased assessment of a private company’s fair market value, conducted by a skilled and impartial expert or firm. This process generates an objective valuation by drawing on financial information, market trends, and other relevant factors in order to effectively eliminate the distortions that can arise from in-house valuations. For private business owners and directors, this independence can provide peace of mind when making key financial and strategic decisions.

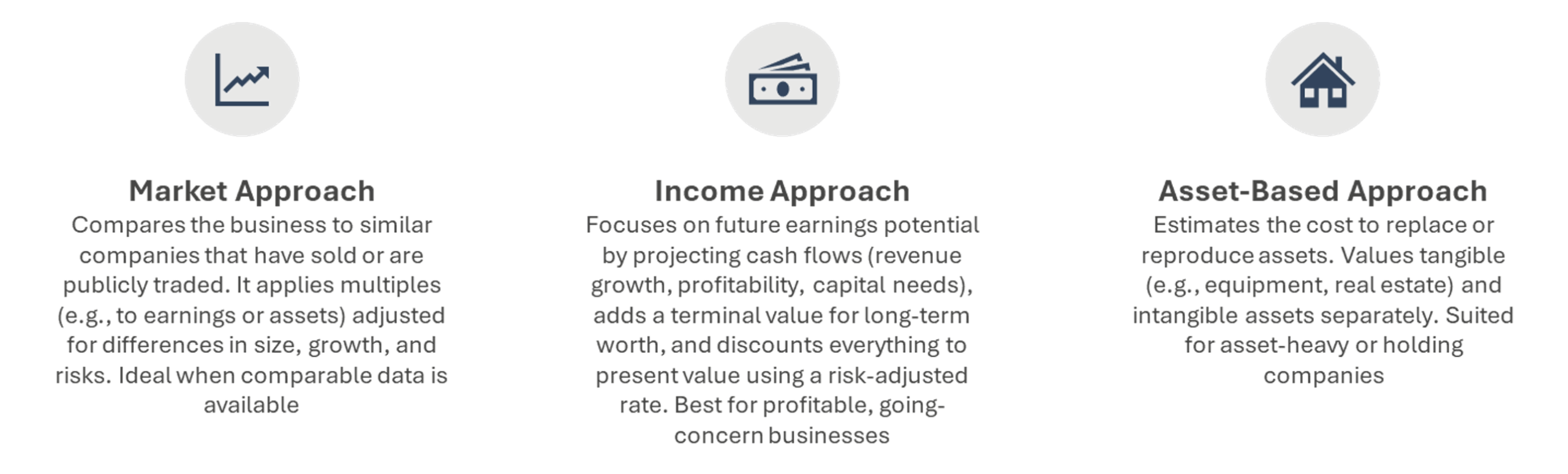

Business valuation is a dynamic balance of art and science, combining the analytical precision of seasoned professionals with structured and methodical approaches. The scientific aspect is grounded in approaches like the income, market, and asset-based methods, which draw on financial records, statistical models, and economic principles to determine a company’s worth. The artistic element shines through as appraisers interpret subjective factors such as market sentiment, management effectiveness, and growth potential, which often require adjustments to capture the unique story of each company.

In this post, we explore the reasons private business directors might engage an independent appraiser and provide an overview of what to expect throughout the appraisal process.

Why Would Someone Need an Independent Appraisal?

Private business owners or stakeholders often obtain independent appraisals for various strategic, legal, financial, and transactional purposes. These valuations ensure fairness, meet regulatory standards, and support informed choices. Here are some typical situations:

- Purchasing or Selling a Business: To establish a reasonable price for acquisitions, mergers, or sales to external parties. This aids in setting achievable expectations, drawing in buyers, and arranging payment terms for successful transactions. It also supports due diligence and addresses regulatory pricing concerns.

- Tax and Estate Planning: For estate, gift, or income taxes, to provide a well-documented value that reduces the likelihood of IRS challenges during ownership transfers or interest distributions. This is key for funding future tax obligations or gifting shares.

- Litigation and Disputes: In scenarios like divorces, partnership breakups, or damage claims (e.g., breach of contract or lost profits), an objective appraisal facilitates settlements or serves as expert testimony in legal proceedings.

- Financing and Investment: To obtain loans, attract capital from investors or venture capitalists, or evaluate investment returns for private equity groups. It offers an unbiased perspective to negotiate terms and demonstrate worth.

- Buy-Sell Agreements and Ownership Transitions: For agreements among partners or shareholders in private firms, to determine fair prices for buyouts or transfers. This may involve multiple appraisers to settle valuation disagreements.

- Employee Stock Ownership Plans (ESOPs): To set up or maintain ESOPs, ensuring fair valuation for employee stock purchases or options to enhance talent retention and attraction.

- Strategic Insights and Fiduciary Responsibilities: To gain an external view of the business’s assets, profitability, and market standing, supporting decisions like recapitalization, going public, or going private. This fulfills fiduciary duties and highlights areas for growth.

- Regulatory Compliance: For requirements like IRS rules during ownership changes, or in leveraged buyouts and public offerings, where independent valuations are needed for transparency.

Overall, independent appraisals offer credibility, reduce risks of further conflict, and ensure decisions are grounded in data rather than guesswork.

How Does the Process Work?

The independent appraisal process for a private business follows a consistent structure, with the ultimate goal of deciphering the fair market value or the price a willing buyer would pay a willing seller under normal conditions. Here’s a high-level overview of how it generally unfolds:

- Engagement and Planning: The business owner or stakeholder contacts an independent valuation firm or specialist to discuss the purpose of the appraisal, scope, and timeline. The appraiser gathers initial documents like financial statements, tax returns, organizational charts, and operational details.

- Data Collection and Analysis: The appraiser performs a detailed review, including financial analysis, industry research, market reviews, management interviews, and even onsite visits. This phase identifies key value drivers and potential adjustments (e.g., for non-operating assets).

- Valuation Approaches: Appraisers use one or more standardized methods to calculate value, often reconciling results from multiple approaches for a balanced conclusion. The three primary approaches are:

Click here to expand the image above - Adjustments and Discounts: Depending on the characteristics of the subject interest, an appraiser may derive and apply factors like minority interest discounts (for lack of control), a discount for lack of marketability (difficulty selling shares).

- Reporting and Review: The appraiser compiles a detailed report with methodologies, assumptions, and the final value conclusion. This can be a full narrative report or a summary, depending on the scope of the engagement.

Conclusion

Engaging an independent appraiser can address a wide range of needs while minimizing the risks of bias and conflict. As you consider the future of your enterprise, leveraging the expertise of a trusted independent appraiser can provide the clarity and credibility needed to navigate today’s dynamic business landscape, ensuring decisions are both informed and defensible. Next week, we will delve into some examples of how independent appraisers are used in buy-sell disputes

Family Business Director

Family Business Director