Review of Key Economic Indicators for Family Businesses

As we approach the middle of the year, uncertainty in the U.S. economy remains elevated, making this a good time for family businesses to return to the fundamentals and review key macroeconomic indicators from the first quarter of 2025 and into the second quarter. In this week’s post, we provide a brief look at these trends and their implications, as well as some key risks in the U.S. economy to stay aware of through the balance of 2025.

GDP

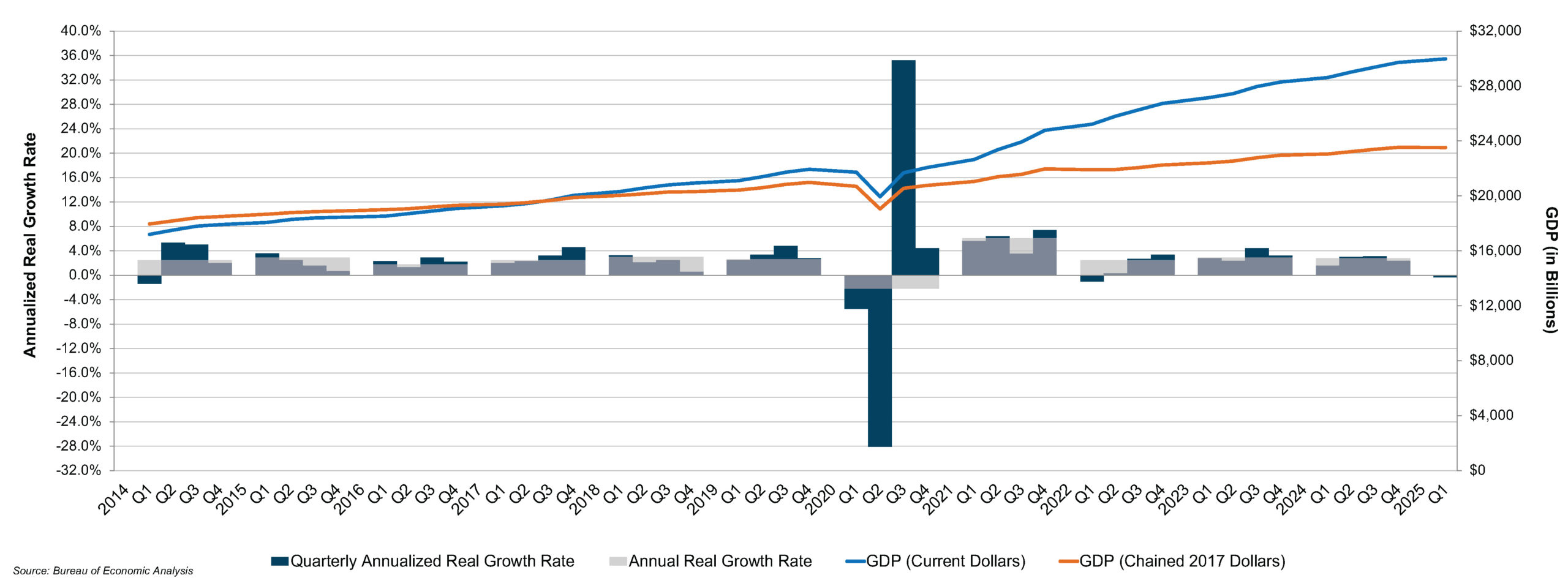

According to advance estimates released by the Bureau of Economic Analysis, GDP decreased at an annualized rate of 0.2% during the first quarter of 2025, which follows an increase of 2.4% in the fourth quarter of 2024. Consumer spending, representing roughly 70% of total economic activity, increased only marginally (0.8%), contributing to the overall contraction in GDP. Consumer spending on durable goods fell 0.3% in the first quarter while spending on services increased 0.8%.

Despite the contraction in the first quarter, economists expect GDP growth to resume in the next two quarters. A survey of economists conducted by The Wall Street Journal reflects an average GDP forecast of 0.8% annualized growth in the second quarter of 2025, followed by 0.6% annualized growth in the third quarter of 2025.

Gross Domestic Product

Click here to expand the image above

Inflation and Monetary Policy

Recent inflation readings for April and May have come in generally below economist expectations. The expectation for elevated inflation measures has been predicated on the Trump administration’s volatile tariff announcements and implementations, which have been ongoing and evolving on a nearly daily basis since President Trump took office in January.

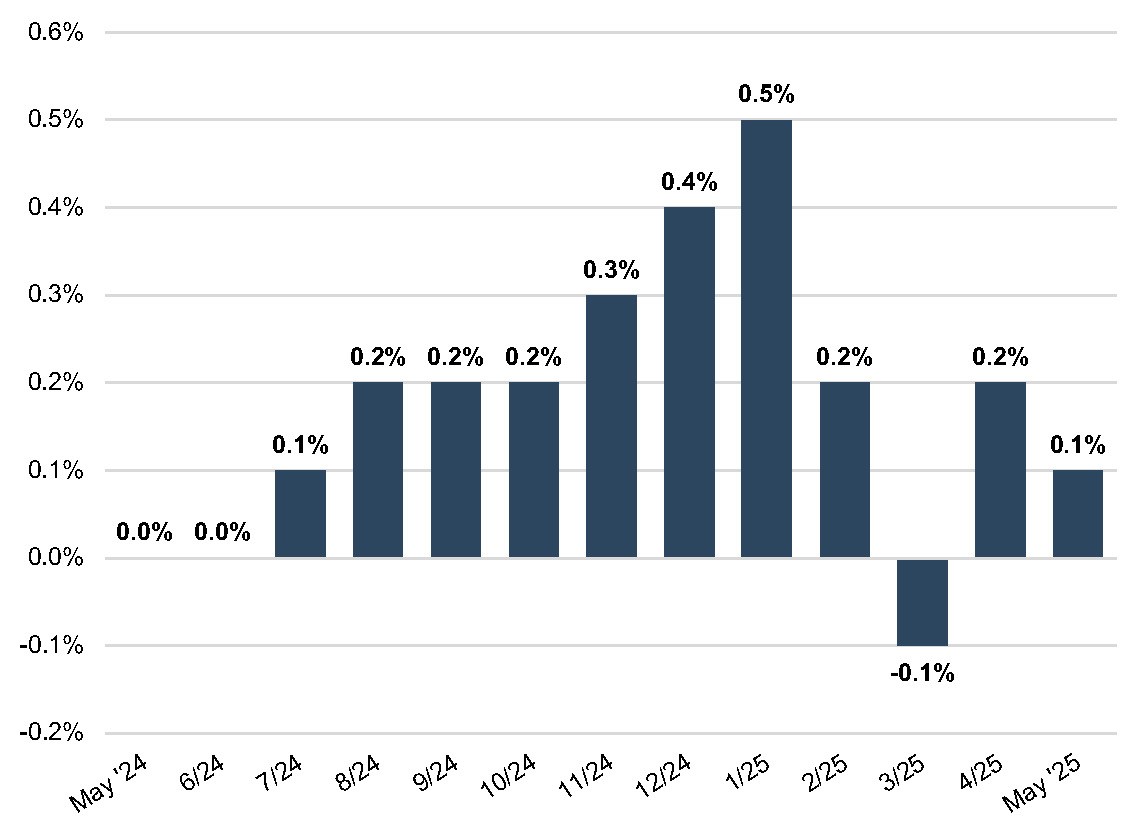

In April, the Consumer Price Index (“CPI”) increased 0.2% month over month. While the monthly reading was generally in line with forecasts under the assumption that inflationary effects from tariffs had not yet permeated the U.S. economy, the annual CPI of 2.3% in April was marginally below expectations and represented a four-year low in this measure of annual inflation. Core CPI (which excludes volatile food and energy prices) increased 2.8% annually in April, aligning with forecasts. Markets were muted in response to these readings, and they gave the Fed no case to deviate from its current “wait and see” approach as it pertains to future rate cuts.

Inflation in housing costs and services showed continued signs of improvement in the April readings, and the April readings generally fell in line with Federal Reserve projections. Both of these points could be viewed as positive signs regarding future inflationary activity — even to the point that the Fed may have been able to resume its rate cuts on these readings if not for the looming prospect of tariffs. However, forecasters and commentators warned that the April readings were likely the “calm before the storm,” as tariffs were expected to influence CPI readings beginning in May.

Monthly % Change in CPI

May inflation readings came in well below forecasts, with monthly CPI increasing 0.1% from April (a decrease from the April monthly reading) and annual CPI increasing 2.4% through the twelve months ended May 2025. Prices for new cars and clothing, which are highly tariff-sensitive consumer goods, actually fell marginally in May. Prices for other consumer goods, such as appliances, car parts, and audio equipment, did see increases in May, which could be early indicators of tariff-induced inflation.

If inflation readings continue on their current trajectory, the Fed could potentially have a case to resume cutting rates later this year, particularly when coupled with recent signs of cooling in labor markets. Job growth slowed in May, and the unemployment rate remained at 4.2% despite widespread cuts to federal government jobs and spending. With the Fed set to meet on June 17th and 18th, favorable inflation readings and stagnating employment data will certainly be top of mind for FOMC officials. The Fed is widely expected to hold rates steady, as it has through all of 2025 to this point. Rather than wondering if there will be a rate cut at the June meeting, Fed observers will be keenly awaiting the Fed’s newest set of economic and rate cut projections following the June meeting, which should provide clues as to how FOMC members view the latest inflation and employment releases.

Ongoing Risks and Outlook

As of mid-June, the risk of a recession appears to be higher than it was at the beginning of the year, but not as high as it was in April and early May when U.S. tariffs on China reached 145%. Anecdotally, we are hearing of businesses implementing hiring and capital spending freezes until budgeting becomes more manageable — pointing to the vast amount of uncertainty still pervading the economy and business environment. Adding to this uncertainty is the Fed’s pause on rate cuts or hikes until the picture around tariff policy and its effect on inflation becomes clearer.

There are several key risks that, if they materialize, could induce a recession in 2025. First, as mentioned previously, consumer spending has generally remained steady in 2025. A significant decline in consumer demand and spending would be detrimental to businesses and the economy as a whole. Increased inflation resulting from tariffs could act as a catalyst for reduced consumer spending by eroding purchasing power and slashing discretionary spending, the effects of which would be widespread. One of the key effects, if this were to materialize, would be reductions in corporate earnings and outlooks, as well as subsequent declines in equity markets since elevated asset values have supported both business investment and high-income consumer spending in recent years.

Another key risk to monitor through the remainder of 2025 is labor market stability. While many companies have enacted hiring freezes in recent months, they also aren’t currently firing employees at elevated rates either. This has led to a steady employment rate of 4.0% to 4.2%. Any shock to this balance could destabilize job markets, leading to recessionary economic conditions. Despite these risks, recent declines in energy prices could help offset potentially elevated inflation on goods and services and keep the economy out of a recession.

Final Thoughts

With so much uncertainty in the current U.S. economic environment, typical corporate finance functions, such as budgeting and capital planning, become more challenging. However, maintaining constant vigilance and actively monitoring key economic risk factors can help shield businesses from unfavorable outcomes. Being able to maneuver through times of heightened volatility is often a function of preparedness, and we believe that being continually apprised of ever-evolving economic conditions is one of the best ways for family business owners and directors to navigate potential economic adversity.

Family Business Director

Family Business Director