RIA M&A Update: Q4 2025

Key Takeaways

- RIA M&A activity stayed elevated in 2025 despite a slower Q4.

Deal volume remained well above prior years, with 276 transactions in 2025, reflecting a resilient consolidation environment. - Private equity–backed acquirers dominated the market.

PE-backed aggregators drove the majority of deals and assets, fueling a 16% increase in total transacted AUM led by several large transactions. - Structural buyer and seller motivations continue to support M&A.

Succession planning, scale benefits, and improved financing conditions are driving deal activity beyond short-term market cycles.

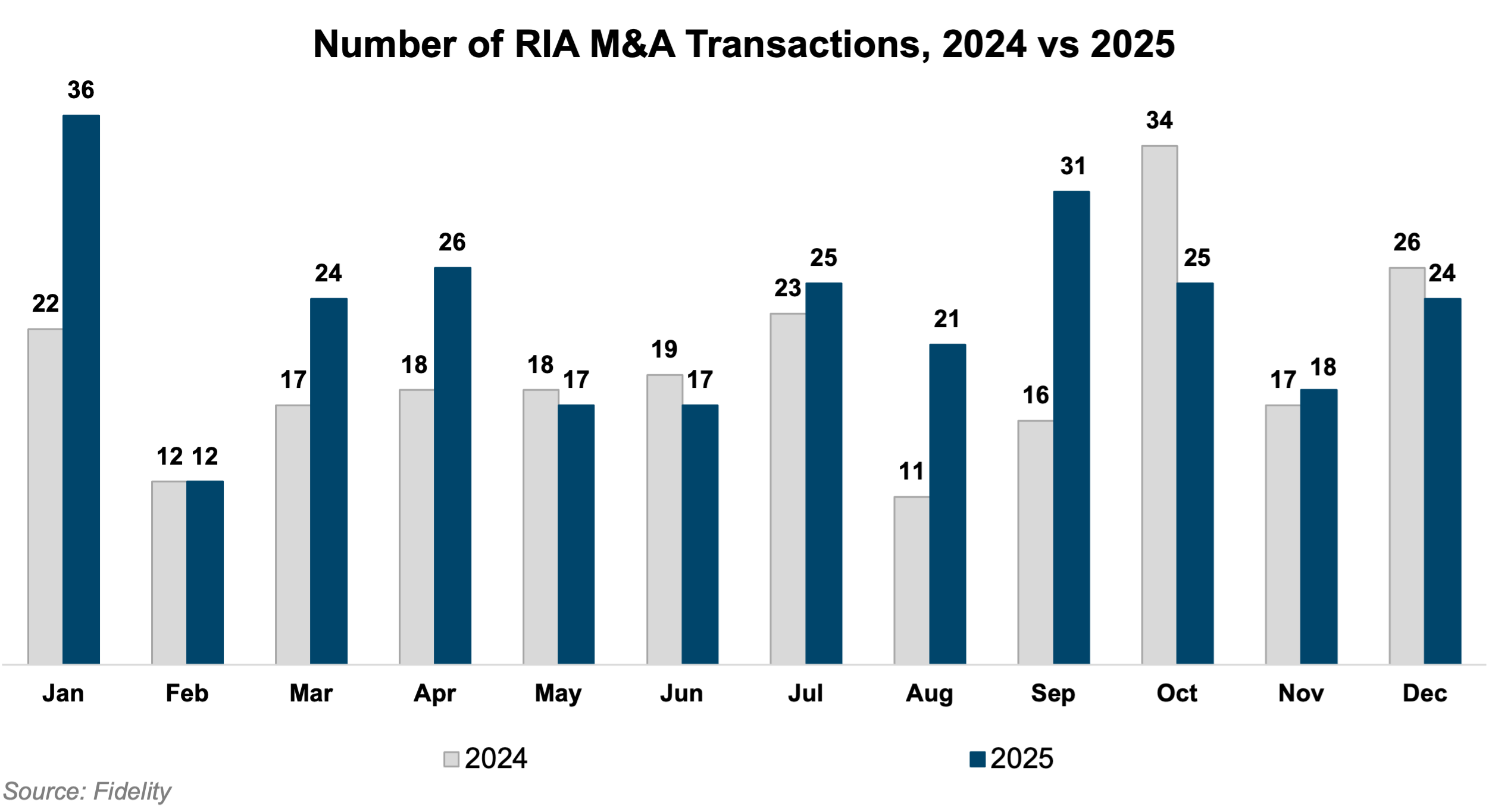

M&A activity in the RIA industry remained elevated through the end of 2025, capping a year defined by historically strong deal volume. While monthly deal counts in the fourth quarter moderated from the record-setting pace observed earlier in the year, overall activity remained well ahead of prior-year levels. According to Fidelity’s December 2025 Wealth Management M&A Transaction Report, a total of 276 RIA transactions were completed in 2025, compared to 233 in 2024, underscoring the sustained strength of the M&A environment despite a more measured pace in the latter part of the year.

Deal activity in the investment management industry continued to compare favorably with broader U.S. M&A markets throughout 2025. According to EY’s U.S. M&A Activity Insights, aggregate U.S. M&A deal value for transactions over $100 million increased meaningfully year-over-year, supported by rate cuts and strategic drivers such as technology adoption and operational efficiency. Growth was particularly pronounced in the $1 billion-plus segment, where deal value more than doubled, underscoring sustained confidence among strategic and financial acquirers despite pockets of volatility elsewhere in the market.

Total transacted AUM increased in 2025 despite a relatively stable average transaction size. Aggregate AUM transacted during the year reached approximately $782.7 billion, representing a 16% increase compared to the same period in 2024. Average AUM per transaction declined modestly to $2.9 billion, a decrease of roughly 2% year-over-year. As in prior periods, these figures exclude LPL’s acquisition of Commonwealth, as we omit independent broker-dealer transactions from our analysis of RIA M&A activity. Notably, year-over-year growth in total transacted AUM was influenced by several large transactions completed late in the year, including Creative Planning’s acquisition of SageView Advisory Group in the fourth quarter, which represented one of the largest RIA transactions of 2025 ($235 billion in AUM).

Private equity remained a significant driver of RIA M&A activity in 2025, particularly toward year-end. According to Fidelity’s December 2025 Wealth Management M&A Transaction Report, private equity capital backed 100% of RIA transactions announced during the month, underscoring the continued role of financial sponsors in industry consolidation. Private equity-backed acquirers continued to provide capital and scale to RIAs pursuing growth, acquisitions, and succession solutions, reflecting sustained investor confidence in the RIA business model.

Serial acquirers and aggregators (often backed by PE firms) continued to dominate RIA M&A activity in the fourth quarter of 2025. According to Fidelity’s December 2025 Wealth Management M&A Transaction Report, these firms accounted for approximately 72% of RIA transactions completed during the quarter and an estimated 92% of transacted AUM. The concentration of transacted assets was heavily influenced by Creative Planning’s acquisition of SageView Advisory Group.

Both buy-side and sell-side factors have fueled the surge in M&A among RIAs. Factors affecting deal activity include:

Willingness to Buy |

Willingness to Sell |

|---|---|

|

|

Deal activity has continued to be supported by the supply side of the RIA M&A market, as the decision to sell is often driven by considerations beyond market timing. Sellers frequently seek to address succession planning needs, improve quality of life, and access enhanced organic growth capabilities through partnerships with larger firms. These motivations are generally less sensitive to short-term market conditions and are likely to continue supporting M&A activity across market cycles.

M&A activity in the RIA market has also been influenced by the evolving interest rate environment following the Federal Reserve’s initial policy pivot in late 2024. After an extended period of monetary tightening that weighed on deal activity, rate cuts implemented in late 2024 and continued through 2025 improved financing conditions and reduced borrowing costs for acquirers. Looking ahead, a more stable and accommodative interest rate environment could continue to support M&A activity as capital availability improves and consolidation trends persist across the RIA marketplace.

What Does This Mean for Your RIA?

For RIAs planning to grow through strategic acquisitions: Pricing for RIAs has trended upwards in recent years, leaving you more exposed to underperformance. Structural developments in the industry and the proliferation of capital availability and acquirer models will likely continue to support higher multiples than the industry has seen in the past. That said, a long-term investment horizon is the greatest hedge against valuation risks. Short-term volatility aside, RIAs continue to be the ultimate growth and yield strategy for strategic buyers looking to grow their practice or investors capable of long-term holding periods. RIAs will likely continue to benefit from higher profitability and growth than their broker-dealer counterparts and other diversified financial institutions.

For RIAs considering internal transactions: We’re often engaged to address valuation issues in internal transaction scenarios, where valuation considerations are top of mind. Internal transactions don’t occur in a vacuum, and the same factors driving consolidation and M&A activity have also influenced valuations in internal transactions. As valuations have increased, financing in internal transactions has become a crucial secondary consideration where buyers (usually next-gen management) lack the ability or willingness to purchase a substantial portion of the business outright. As the RIA industry has grown, so too has the number of external capital providers who will finance internal transactions. A seller-financed note has traditionally been one of the primary ways to transition ownership to the next generation of owners (and, in some instances, may still be the best option). Still, increasing bank financing and other external capital options can provide selling partners with more immediate liquidity and potentially offer the next-gen cheaper financing costs.

For RIAs Considering Selling: Whatever the market conditions are when you go to sell, it is essential to have a clear vision of your firm, its value, and what kind of partner you want before you go to market. As the RIA industry has grown, a broad spectrum of buyer profiles has emerged to accommodate different seller motivations and allow for varying levels of autonomy post-transaction. A strategic buyer will likely be interested in acquiring a controlling position in your firm and integrating a significant portion of the business to create scale. At the other end of the spectrum, a sale to a patient capital provider can allow your firm to retain its independence and continue operating with minimal outside interference. Given the wide range of buyer models, picking the right buyer type to align with your goals and motivations is a critical decision that can significantly impact personal and career satisfaction after the transaction closes.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights