4 Considerations for Your RIA’s Buy-Sell Agreement

This time of year, we’re typically wrapping up much of our annual valuation work for RIA clients with buy-sell agreements. Thankfully, these clients have worked with us or legal counsel to iron out many potential issues in crafting the valuation portion of the buy-sell or operating agreement, so we don’t have to address them every year. We still get a lot of questions from clients and prospects about drafting or revising their buy-sell agreement to govern the terms of shareholder transactions when they inevitably occur. A well-crafted buy-sell should clearly acknowledge all the considerations laid out below to avoid shareholder disputes and costly litigation down the road. We highly recommend looking at your buy-sell agreement to see if these issues are addressed before something comes up.

1. Formula Pricing, Rules of Thumb, and Internally Generated Valuation Metrics Don’t Withstand Time

Since valuation is usually the most time-consuming and expensive part of administering a buy-sell agreement, there is substantial incentive to short-cut that part of the process. However, valuation methods such as formula pricing, rules of thumb, and internally generated valuation metrics are often key reasons for costly disputes or disruptions down the road.

We have written extensively about the fallacy of formula pricing. No multiple of AUM, revenue, or cash flow can consistently estimate the value of an interest in an investment management firm. A multiple of AUM (typically expressed in percentage terms) does not consider relative differences in stated or realized fee schedules, client demographics, trends in operating performance, current market conditions, compensation arrangements, profit margins, growth expectations, regulatory compliance issues, and a host of other issues which have helped keep our valuation practice gainfully employed for decades.

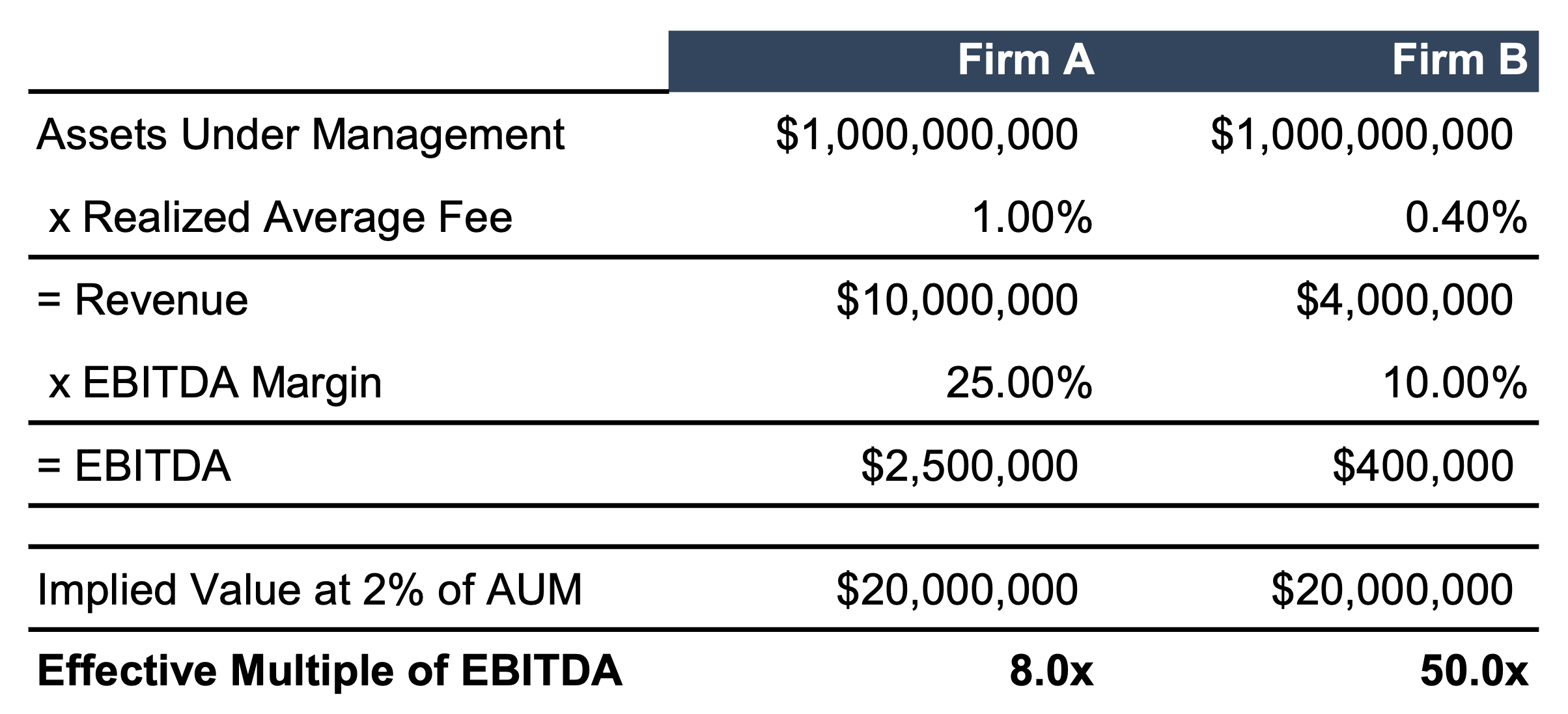

The example below demonstrates the problematic nature of using a rule-of-thumb valuation (in this case, 2% of AUM) for two investment management firms of similar size but widely divergent fee structures and profit margins.

Both Firm A and Firm B have the same AUM. However, Firm A has a higher realized fee than Firm B (100 bps vs. 40 bps) and operates more efficiently (25% EBITDA margin vs 10% EBITDA margin). The result is that Firm A generates $2.5 million in EBITDA versus Firm B’s $400,000, even though both firms have the same AUM. The “2% of AUM” rule of thumb implies an EBITDA multiple of 8.0x for Firm A—a multiple that may or may not be reasonable for Firm A, given current market conditions and Firm A’s risk and growth profile. Nevertheless, this multiple is within the historical range of what might be considered reasonable. The same “2% of AUM” rule of thumb applied to Firm B implies an EBITDA multiple of 50.0x—a multiple unlikely to be considered reasonable in any market conditions.

We’ve seen rules of thumb like the one above appear in buy-sell and operating agreements as methods for determining the price for future transactions among shareholders or between shareholders and the company. The issue is that rules of thumb do not have a long shelf life, even if they made perfect sense at the time the document was drafted. If value is a function of company performance and market pricing, then both factors must remain static for any rule of thumb to remain appropriate. Obviously, this circumstance is highly unlikely.

But the real problem with short-cutting the valuation process is credibility. If the parties to a shareholder’s agreement think the pricing mechanism in the agreement isn’t robust, then the ownership model at the firm is flawed. Flawed ownership models eventually disrupt operations, which works to the disservice of owners, employees, and clients.

2. Don’t Forget to Specify the “As Of” Date for Valuation

While seemingly obvious, the effective date of the valuation matters. If the buy-sell agreement specifies that value be established annually (something we highly recommend to manage expectations and avoid confusion), then the date might be the calendar year-end. If you opt for an event-based trigger mechanism in your buy-sell instead of having annual valuations performed, there is a little more to consider.

Consider whether you want the event precipitating the transaction to factor into the value. If so, prescribe that the valuation date is some period of time after the event giving rise to the subject transaction. This can be helpful if a key shareholder passes away or leaves the firm, and there is concern about losing clients due to the departure. After an adequate amount of time, the impact on firm cash flows of the triggering event becomes apparent. If, instead, there is a desire not to consider the impact of a particular event on valuation, make the as-of date the day before the event, as is common in statutory fair value matters.

3. Appraiser Qualifications: Who Will Perform the Valuation?

Once you decide to engage a professional to value your firm, you’ll need reasonable criteria to decide with whom to work. Often, partners in investment management firms feel they are equipped to value their own businesses, as such firms (unlike many other closely held companies) have ownership groups with ample training in relevant areas of finance that enable them to understand financial statement analysis, cash flow forecasting, and market pricing data.

What insiders lack, however, is the arm’s length perspective to use their technical skills to determine an unbiased result. Many business owners suffer from familiarity bias and the so-called “endowment effect” of ascribing more value to their business than what it is actually worth simply because it is well known to them or because it is already in their possession. On the opposite end of the spectrum, some owners are prone to forecast extreme mean reversion such that they discount the outperformance of their business and anticipate only the worst.

Partners with a strong grounding in securities analysis and portfolio management are biased to see their business from the perspective of intrinsic value, which can limit their acceptance of certain market realities necessary to price the business at a given time. Just as physicians are cautioned not to self-medicate and attorneys not to represent themselves, so too should professional investment advisors avoid trying to be their own appraisers.

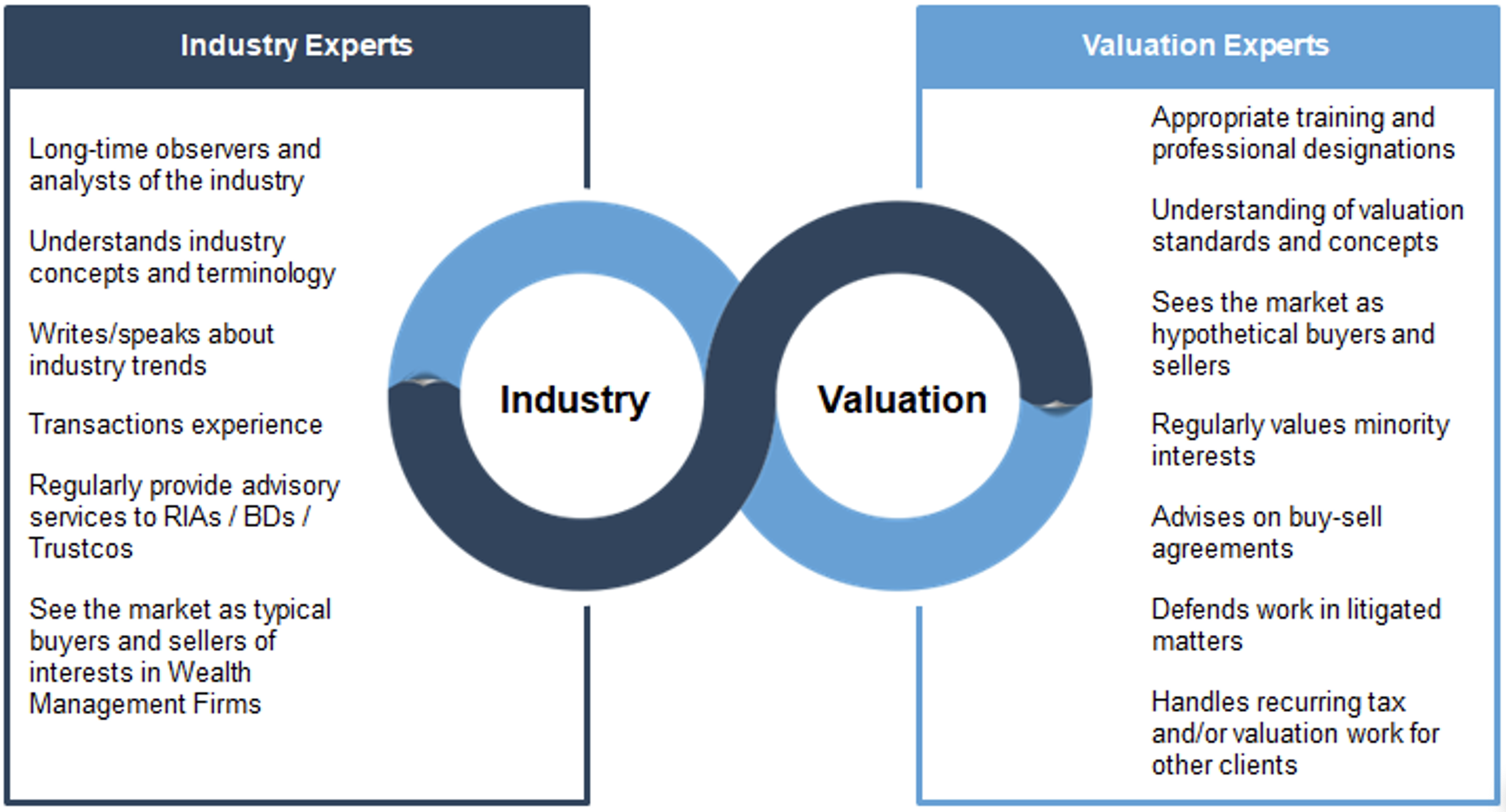

Over time, we have reviewed a wide variety of work products from different types of service providers but have generally observed that two types of experts are available to investment management firm owners: valuation experts and industry experts. These two types of experts are often seen as mutually exclusive, but you’re better off not hiring one to exclude the other.

Plenty of valuation experts have the appropriate training and professional designations, understand the valuation standards and concepts, and see the market in a hypothetical buyer-seller framework. The two primary credentialing bodies for business valuation are the American Society of Appraisers (ASA) and the American Institute of Certified Public Accountants (AICPA). The former awards the Accredited Senior Appraiser designation, or ASA, and the latter the Accredited in Business Valuation, or ABV designation. Both require extensive education and testing to become credentialed, along with continuing education. Also well-known in the securities industry is the Chartered Financial Analyst (CFA) designation issued by the CFA Institute. While it is not directly focused on valuation, it is a rigorous program in securities analysis.

Many industry experts are long-time industry observers and analysts who understand industry trends and have experience providing advisory services to investment management firms.

However, business valuation practitioners are often guilty of shoehorning RIAs into generic templates, resulting in flawed valuation conclusions that don’t square with market realities. By contrast, industry experts are frequently guilty of a lack of awareness concerning using and verifying unreported market data, misapplying valuation models, and understanding valuation practice reporting requirements.

We think it is most beneficial to be both industry and valuation specialists.

The valuation profession is still, for the most part, populated with generalists. But as the profession matures, an increasing number of analysts are realizing that it isn’t possible to be good at everything. Valuation experts can do better work for clients if they specialize in a type of valuation or a particular industry.

Ultimately, you want an expert with both professional standards and practical experience.

4. Manage Expectations by Testing Your Agreement

No matter how well-written your agreement is or how many factors you consider, no one really knows what will happen until your firm is valued. If you have a regular valuation prepared by a qualified expert, then you can manage everyone’s expectations such that, when a transaction situation presents itself, parties to the transaction have a reasonably good idea of what to expect. Managing expectations is the first step to avoiding arguments, strategic disputes, failed partnerships, and litigation.

Annual valuations do require some commitment of time and expense. However, these yearly commitments to test the buy-sell agreement usually pale in comparison to the time and expense required to resolve a major buy-sell disagreement. If you don’t plan to have annual valuations prepared, have your company valued anyway. Doing so when nothing is at stake will make a huge difference if you get to a situation where everything is at stake.

Most shareholder agreement disputes we are involved in start with dramatically different expectations regarding how the valuation will be handled. Going ahead and having a valuation prepared will help to center, or reconcile, those expectations and might even lead to some productive revisions to your buy-sell agreement.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides asset managers, wealth managers, and independent trust companies with business valuation and financial advisory services related to internal and external transactions, buy-sell agreements, and dispute resolution. For more information about our team and buy-sell agreement considerations for RIAs, please see the resources below:

RIA Valuation Insights

RIA Valuation Insights