A Shortcut for Tax Savings

Charitable Giving Prior to a Business Sale Yields Big Results

On purpose? European rally car races defy logic and gravity (press.pirelli.com).

As the pace of RIA transactions continues, one topic we haven’t seen much coverage of is taking advantage of a clever tax strategy that will both maximize a seller’s charitable giving and minimize their taxes on the transaction. Taxes aren’t usually the primary driver in making large gifts to a charity, but a little foresight and planning offers flexibility for the donor, yields more gift per dollar, and ultimately results in less transaction proceeds going to Uncle Sam. In this week’s post, we offer a quick overview of the tax strategy that charitable RIA owners ought to keep in mind when selling their firm (and don’t forget RIA clients’ selling businesses as well!).

Charitable Gifts and Business Transactions

For many RIA owners, the original cost basis of their business ownership interest is extremely low, if not zero. If you have received stock via gifting or as certain kinds of equity compensation, your stock’s basis is “carried over” from the original donor (or was the stock’s fair market value at the time of receipt). In short, for many family businesses, any sale likely has quite a large built-in capital gains tax, especially if your firm has prospered and grown for a decade or longer. At some level, it’s a success tax, but paying all of that tax is optional.

Is there a better way? A donation of some portion of your ownership in your RIA prior to a sale provides two benefits:

- A charitable tax deduction for the fair market value of the interest at the time the gift is made.

- Minimized capital gains exposure for the portion donated and sold by the charity rather than the family.

Below, we provide an example and some thoughts on this strategy.

Utilizing a Donor Advised Fund

A donor-advised fund, or “DAF,” is a flexible and tax-efficient way to give to charities. A DAF operates like a charitable investment account for the sole purpose of supporting charitable organizations. When taxpayers contribute assets, such as cash, stock, or other (read: private business stock) assets to a DAF, they can take an immediate tax deduction, avoid capital gains recognition, and grow the donation tax-free. A primary benefit of using a DAF to implement this gifting strategy is a practical one. Many charities are not structured to take stock of closely held companies, whereas organizations that support DAFs can handle the complexities around private (i.e., illiquid) stock gifts.

Gift Timing

Before you head down this path, you’ll need to see if your situation would benefit from the strategy. As the saying goes, “Pigs get fat, hogs get slaughtered.” If you already have a legally binding transaction agreement in place, this strategy is less useful, and the IRS is not likely to allow recognition of the gift. However, a non-binding letter of intent (“LOI”), where each side can walk away from the transaction, usually suits this type of tax planning.

For the gift, a qualified appraisal would likely give significant weight to the pro rata offer on the table in measuring fair market value. The likelihood of a near-term transaction would also limit the typical discounts for lack of marketability or control. This would maximize the value of the ownership interest for gifting purposes.

This works for donating stock to charity broadly, not just in a business transaction context. However, if a path to liquidity is not on the horizon, discounts for lack of control and marketability will likely be more significant. This lowers your gift’s total fair market value, reducing tax savings at the time of the gift.

On the flip side, if the gift is made to a donor-advised fund, as discussed, the ownership interest may be held and grow as the business value grows. At a business exit, your DAF reaps the benefits of the sale and avoids the capital gains tax on that portion of ownership, maximizing future charitable gifts from the DAF.

Qualified Appraisal

If you’re reading this blog, you may have guessed this already: gifts of private family ownership interests require qualified appraisals per the IRS.

A current valuation opinion is essential to quantifying existing exposures as well as facilitating the desired ownership transfers. If you don’t have a satisfactory, ongoing relationship with a business appraiser, the first step is to retain a qualified independent business valuation professional.

You should select an appraiser who has experience valuing closely-held businesses for this purpose, has a good reputation, understands the dynamics of your industry, and has appropriate credentials from a reputable professional organization, such as the American Society of Appraisers (ASA) or the American Institute of Certified Public Accountants (AICPA).

Tax Benefits of Planning

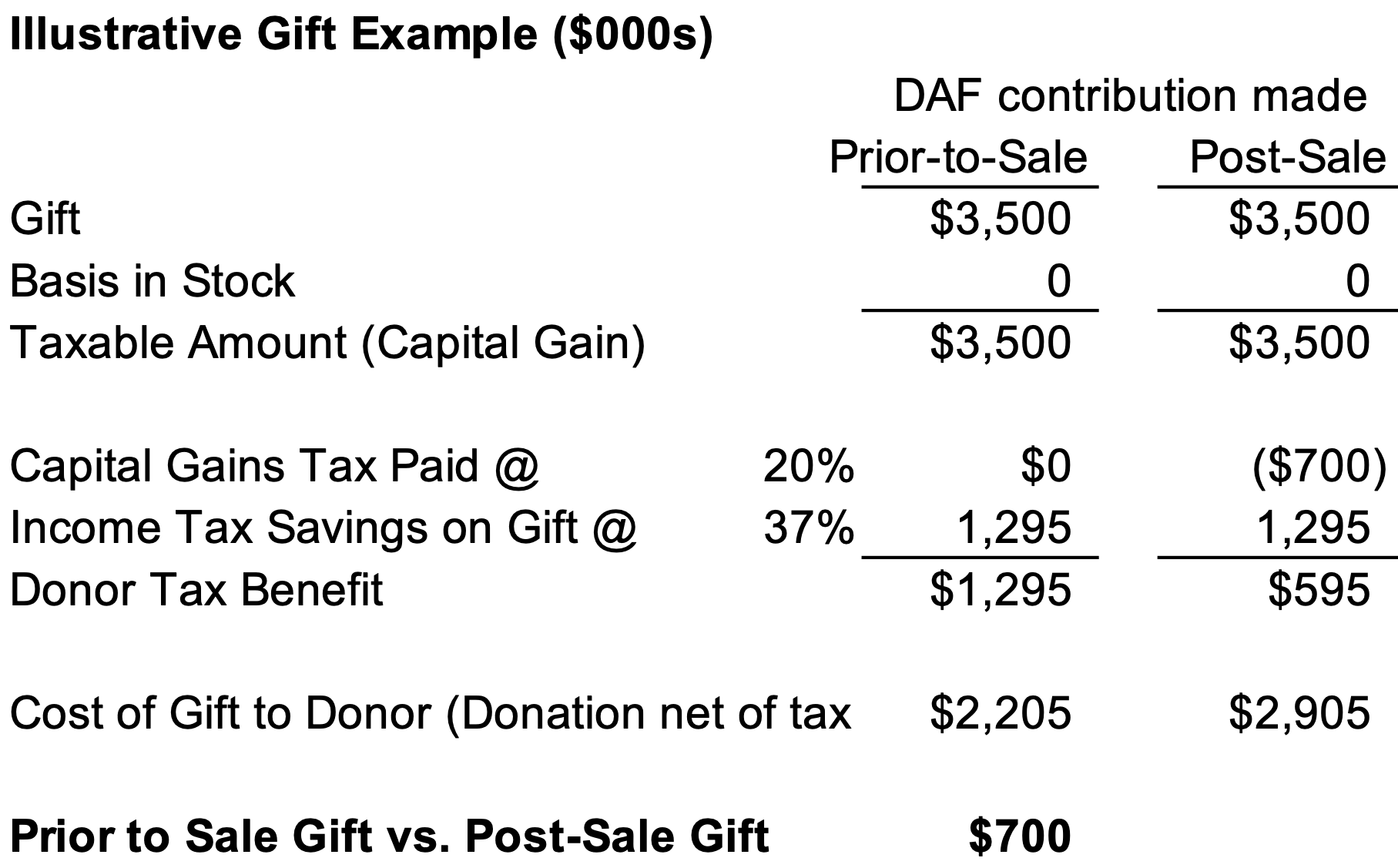

To illustrate the benefits of this strategy, consider two alternative scenarios: (1) the selling RIA owner contributes to charity using funds after a sale of the business (“post-sale”), or (2) the selling RIA owner contributes stock to charity prior to the deal closing (“prior-to-sale”). We’ll briefly summarize Figure 1 below.

- In both scenarios, the value of the gift is assumed to be $3.5 million. This represents the pro rata cash proceeds in the post-sale scenario and the value of the privately held stock based on a qualified appraisal (which referenced the non-binding LOI purchase price in developing the conclusion of fair market value) in the prior-to-sale scenario.

- In the prior-to-sale scenario, the business owner avoids the capital gains tax because the stock was gifted to a DAF. In the post-sale scenario, the business owner pays $700,000 in capital gains tax on the appreciation in the stock (20% of $3.5 million, assuming a $0 basis).

- Under both scenarios, the business owner is entitled to a charitable deduction of $1.295 million for income tax purposes.

- The total tax benefit in the post-sale scenario is $595,000 ($1.295 million less the capital gains tax paid of $700,000). The prior-to-sale scenario’s total tax benefit is $1.295 million, or $700,000 higher.

Tax considerations rarely are the primary driver of major gifts, but the sale of an RIA (or any closely held business) offers a unique opportunity to use the prospective proceeds from the transaction to maximize giving. While gifts of closely held stock can be complex, the benefits of the strategy and the impact it can have are too significant to ignore. We’ve worked with business owners to provide qualified appraisals for gifting purposes in both charitable and estate-planning contexts. Let us know if you’d like to discuss further how this strategy can work for you.

[Thanks to Atticus Frank, whose original work contributed to this post.]

Note: The example and discussion of this topic are for illustrative purposes only. Mercer Capital does not offer tax or legal advice. This article does not consider state, AMT, or other complex tax issues. The value of your stock in your situation may not equal post-sale pro rata proceeds. Talk to your tax advisor regarding your particular situation.

RIA Valuation Insights

RIA Valuation Insights