Acquisitions of Consolidators Continue to Drive RIA Deal Activity

Asset and Wealth Manager M&A Keeping Pace with 2018’s Record Levels

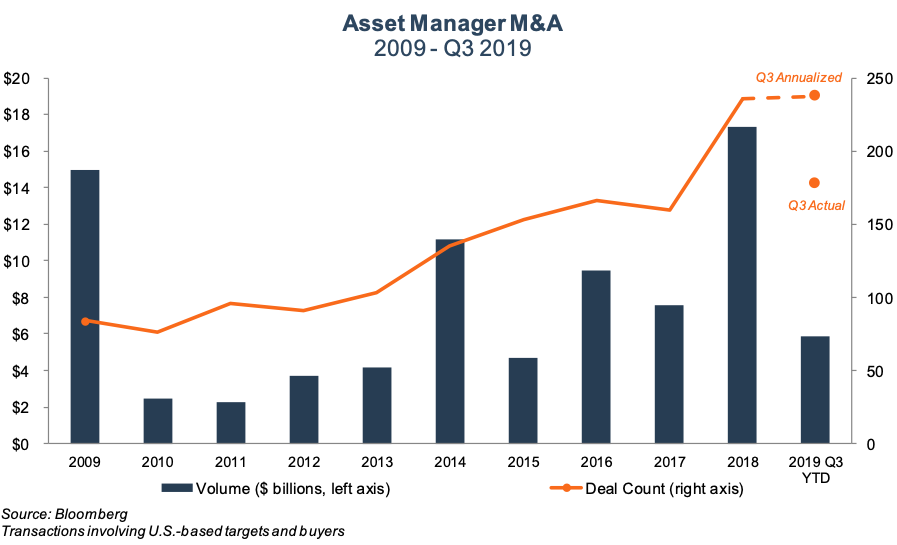

Through the first three quarters of 2019, asset and wealth manager M&A has kept up with 2018, the busiest year for sector M&A during the last decade. Transaction activity is poised to continue at a rapid pace as business fundamentals and consolidation pressures continue to drive deal activity. Several trends which have driven the uptick in sector M&A in recent years have continued into 2019, including increasing activity by RIA aggregators and mounting cost pressures.

Total deal count during the first three quarters is set to exceed 2018’s record levels. Reported deal value during the first three quarters was down, although the quarterly data tends to be lumpy and many deals have undisclosed pricing. Dollar value in 2018 was also boosted by Invesco’s $5 billion purchase of OppenheimerFunds.

Acquisitions by (and of) RIA consolidators continue to be a theme for the sector. The largest deal of the second quarter was Goldman Sachs’s $750 million acquisition of RIA consolidator United Capital Partners. The deal is a notable bid to enter the mass-affluent wealth management market for Goldman Sachs. For the rest of the industry, Goldman’s entrance into the RIA consolidator space is yet another headline that illustrates the broad investor interest in the consolidator model and yet one more approach to building a national RIA brand.

Acquisitions by (and of) RIA consolidators continue to be a theme for the sector.

Mercer Advisors’ recent sale to Oak Hill Capital Partners is further evidence of growing interest in the RIA consolidator space. While deal terms weren’t disclosed, some industry analysts estimate a high teens EBITDA valuation that exceeded $500 million.

These RIA aggregators have been active acquirers in the space with Mercer Advisors and United Capital Advisors each acquiring multiple RIAs during 2018 and the first three quarters of 2019.

Sub-acquisitions by Focus Financial’s partner firms and other firms owned by RIA consolidators are further drivers of M&A activity for the sector. These acquisitions are typically much smaller and are facilitated by the balance sheet and M&A experience of the consolidators. For some RIAs acquired by consolidators, the prospect of using buyer resources to facilitate their own M&A may be a key motivation for joining the consolidator in the first place. For the consolidators themselves, these deals offer a way to drive growth and extend their reach into the smaller RIA market in a way that is scalable and doesn’t involve going there directly.

Consolidation Rationales

Sector M&A has historically been less than what we might expect given the consolidation pressures the industry faces.

Building scale to enhance margins and improve competitive positioning are typical catalysts for consolidation, especially on the asset management side. One way to stem the tide of fee pressure and asset outflows is to cut costs through synergies to preserve profitability as revenue skids. The lack of internal succession planning is another driver as founding partners look to outside buyers to liquidate their holdings. While these factors are nothing new, sector M&A has historically been less than what we might expect given the consolidation pressures the industry faces.

Consolidating RIAs, which are typically something close to “owner-operated” businesses, is no easy task. The risks include cultural incompatibility, lack of management incentive, and size-impeding alpha generation. Many RIA consolidators structure deals to mitigate these problems by providing management with a continued interest in the economics of the acquired firm while allowing it to retain its own branding and culture. Other acquirers take a more involved approach, unifying branding and presenting a homogeneous front to clients in an approach that may offer more synergies, but may carry more risks as well.

Market Impact

Deal activity in 2018 was strong despite the volatile market conditions that emerged in the back half of the year. So far in 2019, equity markets have largely recovered and trended upwards. Publicly-traded asset managers have lagged the broader market so far in 2019, suggesting that investor sentiment for the sector has waned following the correction at the end of last year.

M&A Outlook

Consolidation pressures in the industry are largely the result of secular trends. On the revenue side, realized fees continue to decrease as funds flow from active to passive. On the cost side, an evolving regulatory environment threatens increasing technology and compliance costs. The continuation of these trends will pressure RIAs to seek scale, which will, in turn, drive further M&A activity.

With over 11,000 RIAs currently operating in the U.S., the industry is still very fragmented and ripe for consolidation. Given the uncertainty of asset flows in the sector, we expect firms to continue to seek bolt-on acquisitions that offer scale and known cost savings from back office efficiencies. Expanding distribution footprints and product offerings will also continue to be a key acquisition rationale as firms struggle with organic growth and margin compression. An aging ownership base is another impetus. The recent market volatility will also be a key consideration for both buyers and sellers for the remainder of this year and the next.

RIA Valuation Insights

RIA Valuation Insights