Active Management Down But Not Out

Fresh off a 111-82 KO from the San Antonio Spurs on Saturday, our hometown Memphis Grizzlies are certainly battered but not totally eliminated from this year’s NBA title race. As this post goes to press, we still don’t know the outcome of Game 2, but it will undoubtedly be an uphill climb for the Grizz as it usually is against their divisional foes in Central Texas. Still, the Spurs/Grizz rivalry over the last ten years has not been nearly as one-sided as the battle for fund flows between active and passive investors in the ETF era.

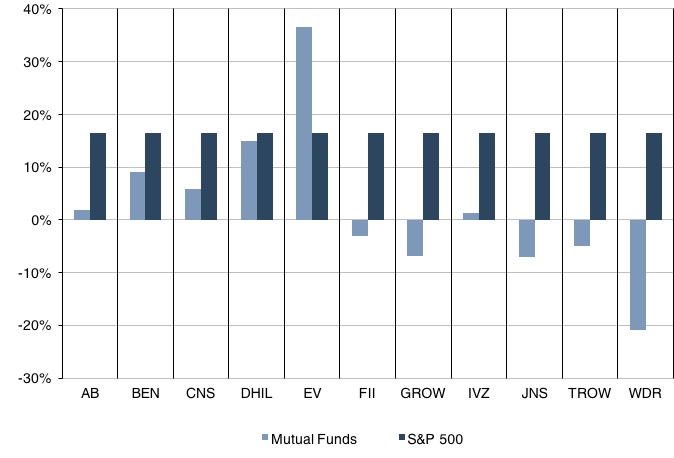

These dynamics are problematic for many mutual fund companies that rely on active equity products with higher fee schedules and profit margins. As a result, most publicly exchanged mutual fund companies are down while the market is up about 15% over the last year.

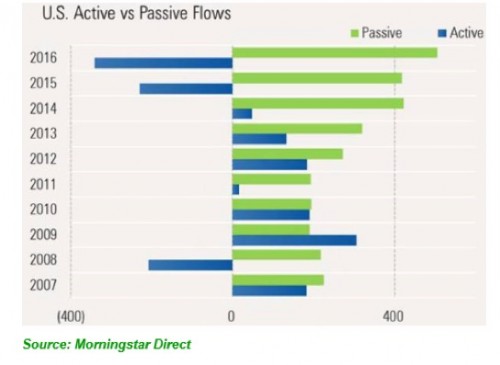

Active fund outflows are not only attributable to the rise in popularity of low-cost ETF strategies, but also sector-wide underperformance against their applicable benchmarks. Both individual and institutional investors are now more inclined to shun active managers for cheaper, more readily available products, particularly when performance suffers. Many active managers and mutual funds have responded by cutting fees or offering their own passive products to stem the outflows, but this has adversely affected their revenue yields and profitability.

Another potential headwind is the GOP’s current proposal to treat all 401(k) deferrals as after-tax contributions, which could disincentive employers from offering defined contribution plans that often invest in mutual funds and other active managers. Republican lawmakers still have a lot of work to do in getting this passed, but it is being seriously considered as one way to help finance the new administration’s proposed tax cuts.

Despite these headwinds, 45% of domestic active managers were beating their benchmarks for the first two months of this year, after just 31% in 2016, according to Morningstar and The Wall Street Journal. To put this in perspective, the last year that even half of all active funds outperformed their index was 2009. Higher volatility, asset decoupling, and rising market conditions has been beneficial to most stock and bond pickers over the last few months. As a result, actively managed mutual funds posted their first month of positive new inflows in February since April 2015, according to Morningstar.

The recent outperformance of some active managers means they may be gaining the upper hand on ETF’s value added proposition, which is all about alpha net of fees. ETFs and other passive strategies gained substantial inflows from active managers since their performance net of (lower) fees has been stronger than most active managers over the last decade, resulting in higher and higher allocations to index products. Active managers are now poised to reverse this trend, but it is going to take more than just two months of alpha to put much of a dent in this trend. We’ve all read that consistently beating the market is nearly impossible, even for the savviest of stock pickers, but none of that research was compiled when passive strategies dominated the investment landscape.

We don’t foresee a huge shift back to active management any time soon, but we realize that we were probably overdue for some mean reversion. It is conceivable that the current market environment could be more conducive to stock picking, but we’ll need more time to judge whether this is truly the case. Regardless, it is hard to imagine that passive investing will completely replace active management. Such a scenario could lead to significant mispricing in the securities markets, which would be fertile ground for enterprising investors and mutual funds. This is why we say that active management, much like the Grizz, is down but not out as the series currently stands.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights