Alt Managers Best the Market Along with Other Types of RIAs During a Strong Year for Investment Management Firms

Alternative asset managers fared particularly well during favorable market conditions for the RIA sector. Access to cheap financing and heightened market volatility spurred significant gains for private equity firms and hedge fund managers during 2021. Other types of investment management firms also benefited from another solid year in the equity markets as traditional asset managers and RIA aggregators outperformed the S&P 500 with 30% to 40% gains on average.

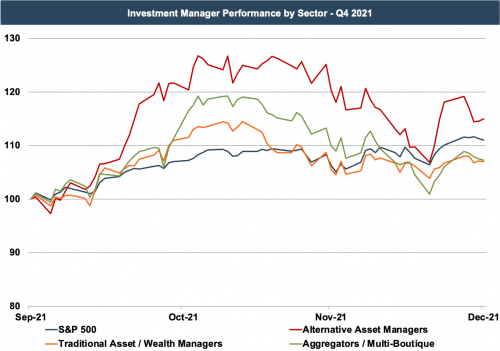

Drilling down into the most recent quarter, we see more mixed results with positive gains for all sectors, but traditional asset managers and aggregators lagged the market as investors weighed the impact of the omicron variant and rising inflation on the sector’s prospects. Alt managers continued to benefit from higher allocations to risky assets despite some weakness across all sectors during the back half of the quarter.

RIA aggregators exhibited outsized volatility during the quarter but ended on a positive note with the stock market in the last week of the year. Because the aggregator model is levered to the performance of the RIA industry generally, recent volatility for RIA stocks has triggered mixed investor sentiment towards the RIA aggregator model. While the opportunity for consolidation in the RIA space is significant, investors in aggregator models have expressed mounting concern about rising competition for deals and high leverage at many aggregators which may limit the ability of these firms to continue to source attractive deals.

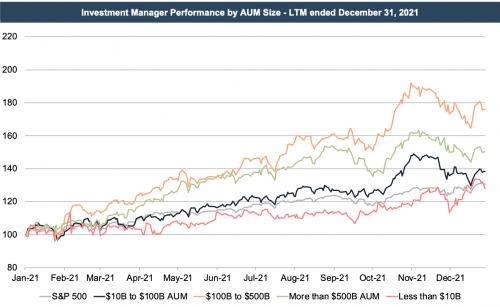

Performance for many of these public companies continues to be impacted by headwinds including fee pressure, asset outflows, and the rising popularity of passive investment products. These trends have especially impacted smaller publicly traded RIAs, while larger asset managers have generally fared better. For the largest players in the industry, increasing scale and cost efficiencies have allowed these companies to offset the negative impact of declining fees. Market performance over the last year has generally been better for larger firms, with firms managing more than $100B in assets outperforming their smaller counterparts.

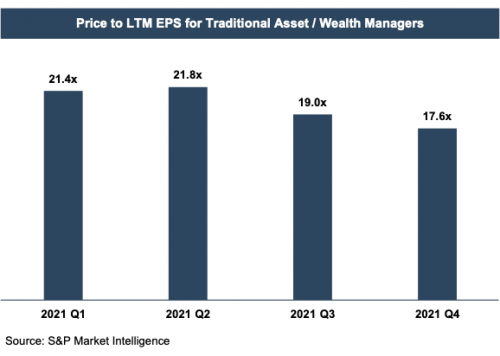

As valuation analysts, we’re often interested in how earnings multiples have evolved over time since these multiples can reflect market sentiment for the asset class. After steadily increasing over the second half of 2020 and first half of 2021, LTM earnings multiples for publicly traded asset and wealth managers declined moderately during the most recent quarter, reflecting the market’s anticipation of lower or flat revenue and earnings as the market pulled back modestly in September and November.

Implications for Your RIA

The value of public asset and wealth managers provides some perspective on investor sentiment towards the asset class, but strict comparisons with privately-held RIAs should be made with caution. Many of the smaller publics are focused on active asset management, which has been particularly vulnerable to the headwinds such as fee pressure and asset outflows to passive products.

In contrast to public asset/wealth managers, many smaller, privately-held RIAs, particularly those focused on wealth management for HNW and UHNW individuals, have been more insulated from industry headwinds, and the fee structures, asset flows, and deal activity for these companies have reflected this.

Notably, the market for privately held RIAs remained strong in 2021 as investors flocked to the recurring revenue, sticky client base, low capex needs, and high margins that these businesses offer. Deal activity for these businesses continued to be significant in 2021, and multiples for privately held RIAs tested new highs due to buyer competition and the shortage of firms on the market. As these dynamics continue into 2022, the outlook for continued multiple expansion and robust deal activity remains favorable.

RIA Valuation Insights

RIA Valuation Insights