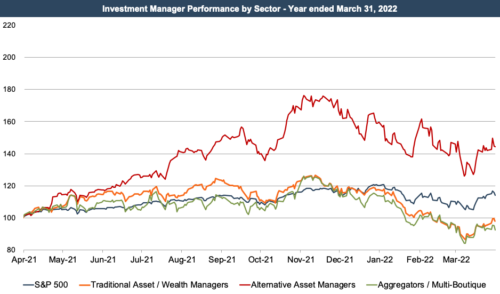

Alt Managers Best the Market and Other Types of RIAs During a Rocky Twelve Month Stretch for the Industry

Access to cheap financing and favorable market conditions spurred significant gains for private equity firms and hedge fund managers during 2021. These tailwinds reversed course in the first three months of this year, and now many of these businesses are in bear market territory. Such volatility is typical for the alt space, which often relies on leverage to enhance returns on its underlying fund investments.

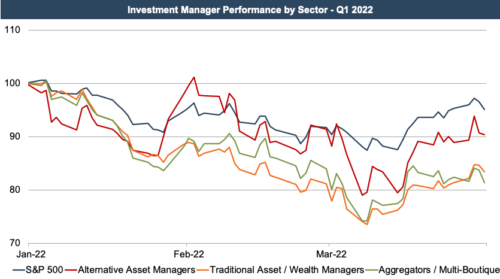

Other classes of RIAs didn’t fare so well as the market downturn in January and February erased all their gains over the prior nine months. A closer inspection of the first quarter shows all classes of RIAs down 20% or more at the end of February when the S&P was only off 8%. Investors are likely anticipating lower margins for the RIA industry as AUM and revenue falls with the market while labor costs continue to rise.

RIA aggregators also had a rough start to the year. Because the aggregator model is levered to the performance of the wealth management industry generally, the recent downturn for RIA stocks has impaired consolidator valuations too. While the opportunity for continued consolidation in the RIA space is significant, investors in aggregator models have expressed mounting concern about rising interest rates and leverage ratios which may limit the ability of these firms to continue to source attractive deals.

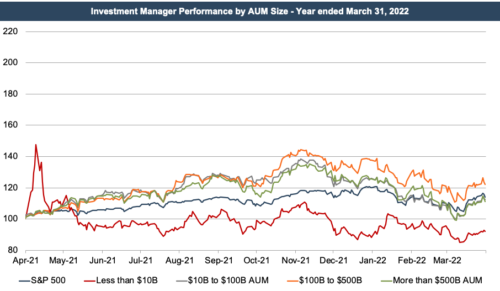

Performance for many of these public companies continues to be impacted by headwinds including fee pressure, asset outflows, and the rising popularity of passive investment products. These trends have especially impacted smaller publicly traded RIAs, while larger asset managers have generally fared better. For the largest players in the industry, increasing scale and cost efficiencies have allowed these companies to offset the negative impact of declining fees. Market performance over the last year has generally been better for larger firms, with firms managing more than $100B in assets outperforming their smaller counterparts.

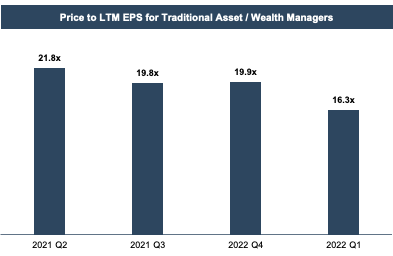

As valuation analysts, we’re often interested in how earnings multiples have evolved over time since these multiples can reflect market sentiment for the asset class. After steadily increasing over the second half of 2020 and first quarter of 2021, LTM earnings multiples for publicly traded asset and wealth managers declined modestly in the back of last year before dropping nearly 20% last quarter, reflecting investor anticipation of lower revenue and earnings as the market pulled back in the first two months of the year.

Implications for Your RIA

The value of public asset and wealth managers provides some perspective on investor sentiment towards the asset class, but strict comparisons with closely held RIAs should be made with caution. Many of the smaller publics are focused on active asset management, which has been particularly vulnerable to the headwinds such as fee pressure and asset outflows to passive products.

In contrast to public asset/wealth managers, many smaller, private RIAs, particularly those focused on wealth management for HNW and UHNW individuals, have been more insulated from industry headwinds, and the fee structures, asset flows, and deal activity for these companies have reflected this.

Notably, the market for privately held RIAs remained strong in 2021 as investors flocked to the recurring revenue, sticky client base, low capex needs, and high margins that these businesses offer. Deal activity for these businesses continued to be significant in 2021, and multiples for privately held RIAs tested new highs due to buyer competition and shortage of firms on the market. As these dynamics continue into 2022, the outlook for continued multiple expansion and robust deal activity remains favorable assuming interest rates and market conditions stabilize in the near future.

RIA Valuation Insights

RIA Valuation Insights