Alt Managers Bounce Back After Years of Underperformance

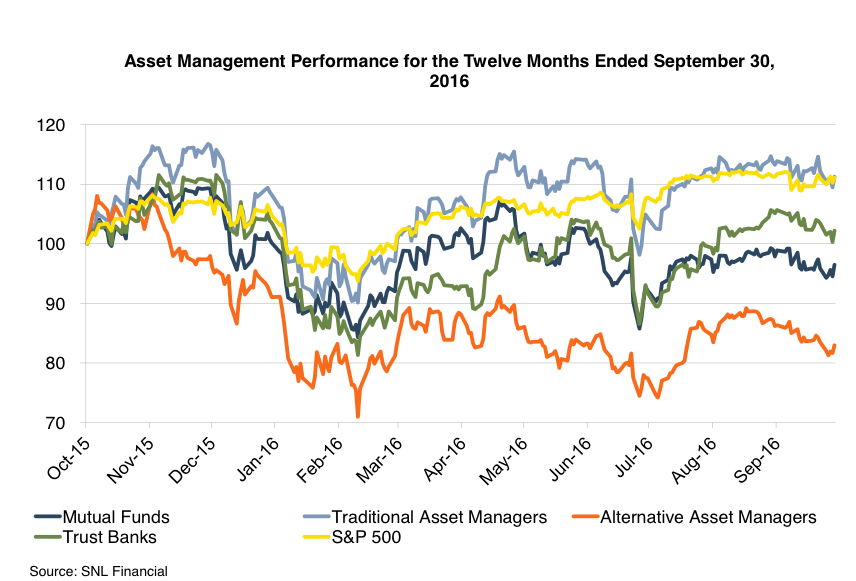

The recent woes surrounding the alt asset space have been well documented. Fee pressure, expanding index opportunities, and relative underperformance has plagued the industry in recent years despite favorable market returns. These headwinds led to significant declines in share prices for publicly traded hedge funds and private equity firms when we wrote about this topic last year:

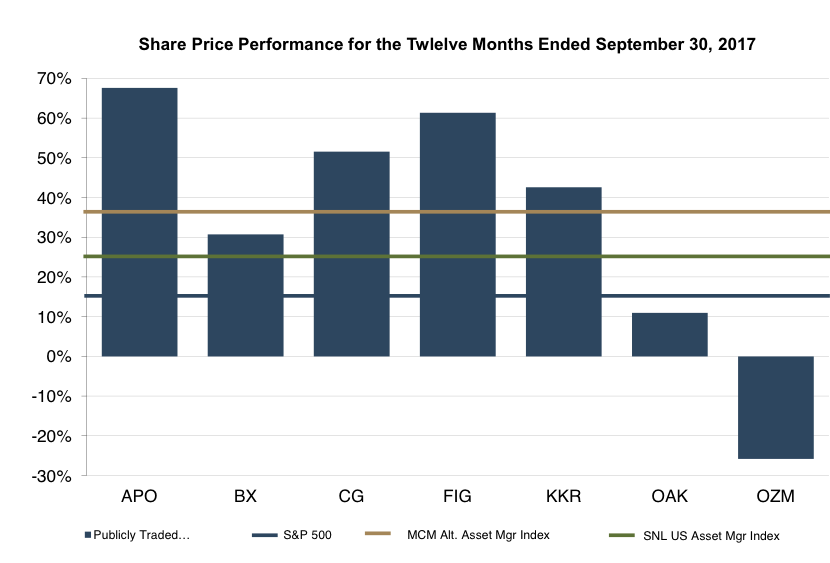

But one year later, things seem to be looking up for the industry. Improving performance, favorable capital markets, the potential for enduring low tax rates on carried interest, and generally robust economic conditions have precipitated a nice turnaround for these businesses that have generally lagged other classes of asset managers in prior years.

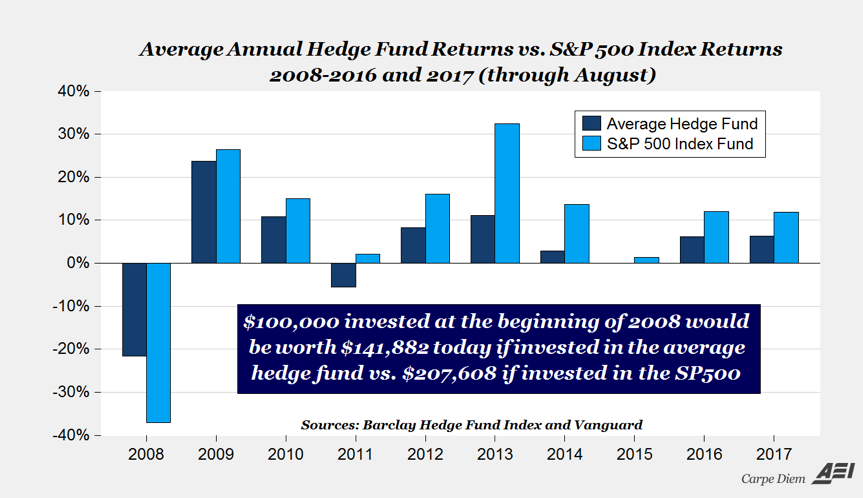

Despite the recent uptick, we don’t think these businesses are quite out of the woods just yet. Performance fees are likely to continue their decline to keep pace with the rising popularity of passive investing. Recent scandals have adversely affected their reputation within the investing community. Relative underperformance over the long-run has also diminished the value-added proposition of active management and hedge fund investing:

And yet, the industry has endured and performed reasonably well over the last year, at least in the eyes of market participants. Most investors value the diversification offered by alternative investors, especially when other asset classes appear relatively rich. Active management may not be as lucrative as it once was it, but is still sought by many institutional investors to complement their passive holdings.

Even though the market seemed to be questioning the long-term viability of these businesses this time last year, it appears to have reversed course in recent months. You may attribute this to market schizophrenia, but industry revenue and profitability have improved on stronger asset flows into active products earlier this year.

The recent mean reversion, therefore, appears justified. The outlook remains less certain though it does appear that the sector’s prospects have improved over the last year. Asset flows out of active products seem to have stabilized, and AUM growth has outpaced fee compression in recent quarters. The record low volatility, at least as measured by the VIX gauge, doesn’t appear to have slowed slow down asset gathering or investment returns for most alternative managers.

Conclusion

We think performance fees will likely continue to fall (in one form or another), but, like active management, never be totally eliminated. So on balance, a modestly improving outlook for the sector is probably justified after a rough 2015 and 2016 for most industry participants.

If you’d like to continue the conversation further or have any questions on how we may assist you, give us a call.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights