Alt Managers Race Ahead

A Resurgent Year for Investment Management Firms

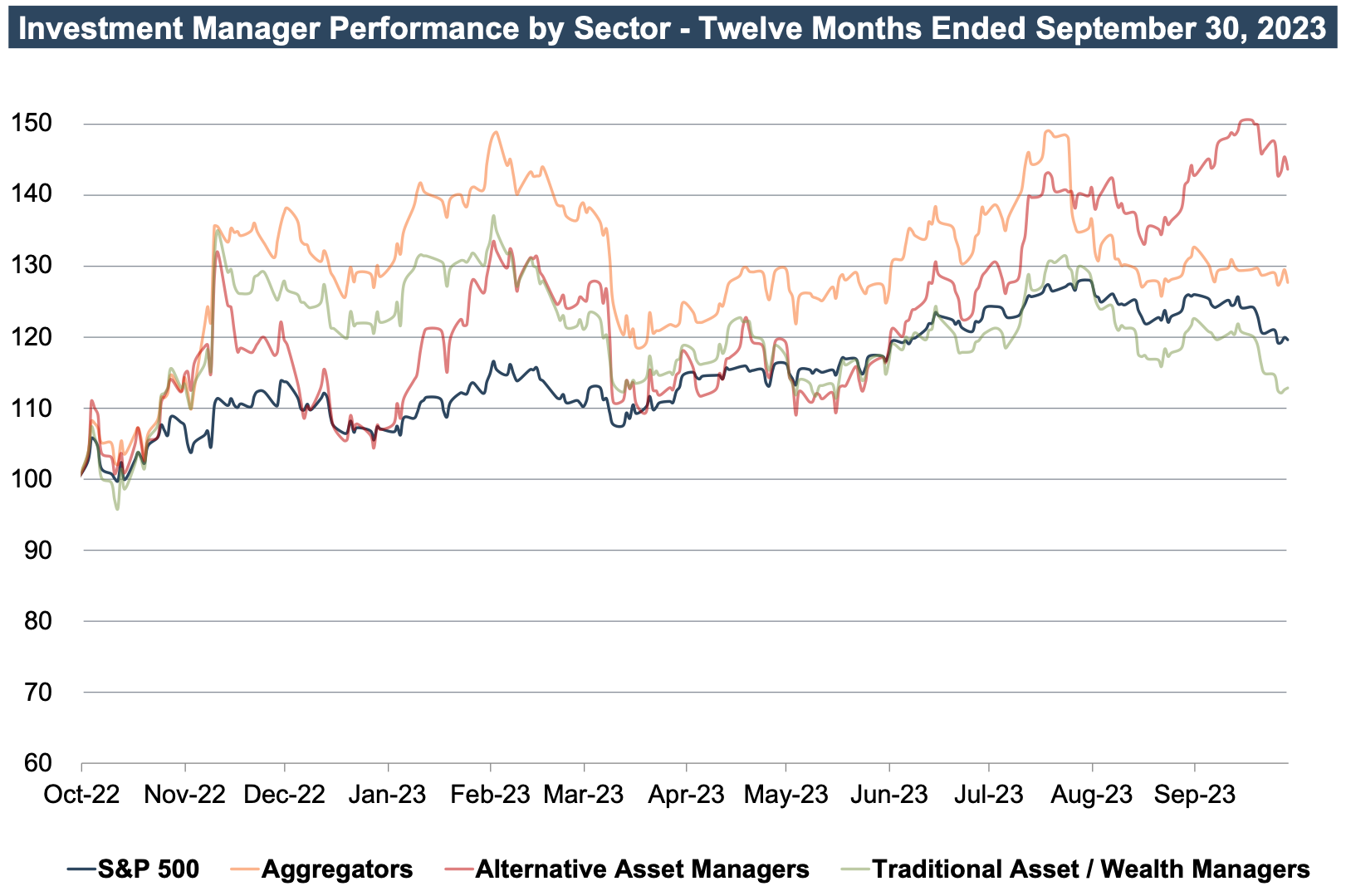

Alternative asset managers fared particularly well during favorable market conditions for the RIA sector. Over the past year, all categories of RIAs have experienced growth as the market has rebounded from its Q3 2022 trough. Alternative asset managers and RIA aggregators both outperformed the S&P 500 with gains of 44% and 28% over the past year. However, traditional asset managers trailed the S&P 500 with gains of 13%. RIAs have directly benefited from improved market conditions, which have boosted assets under management (“AUM”).

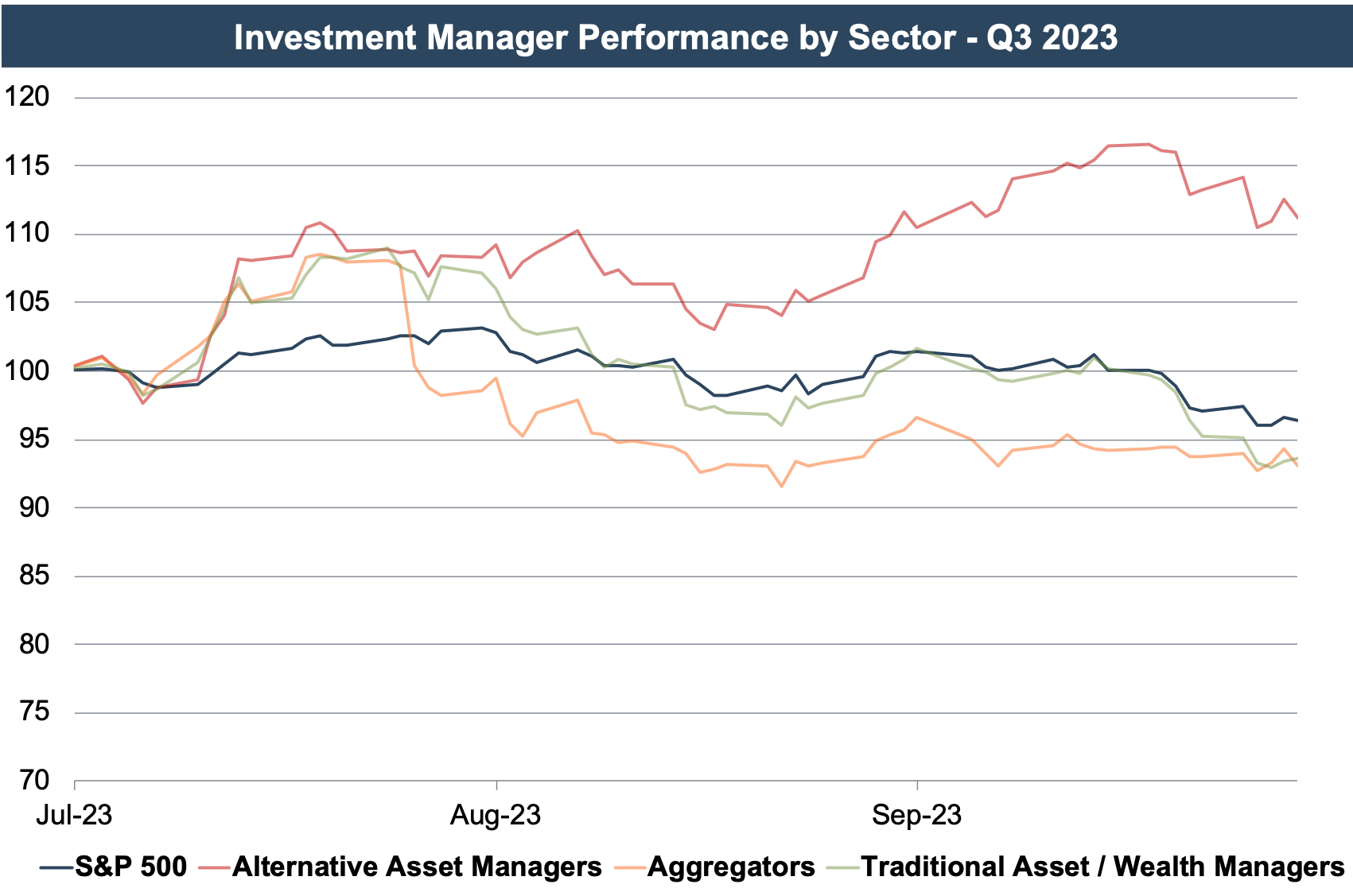

Drilling down into the most recent quarter, we see more mixed results. While the broader market’s decline in Q3 adversely impacted the share prices of most public RIAs, aggregators and traditional asset managers endured a somewhat harsher decline than the S&P 500, declining 7% and 6%, respectively. In contrast, alternative asset managers thrived, with their share prices surging by over 10%. Heightened volatility in the market since 2020 has led to fluctuations in AUM and, in turn, to the heightened interest in the stocks of alternative asset managers. Private equity funds and other alternative investment instruments typically secure assets for an extended period (typically ten to twelve years). This practice results in a revenue stream that is more reliable and stable, displaying lower correlations with the overall market conditions.

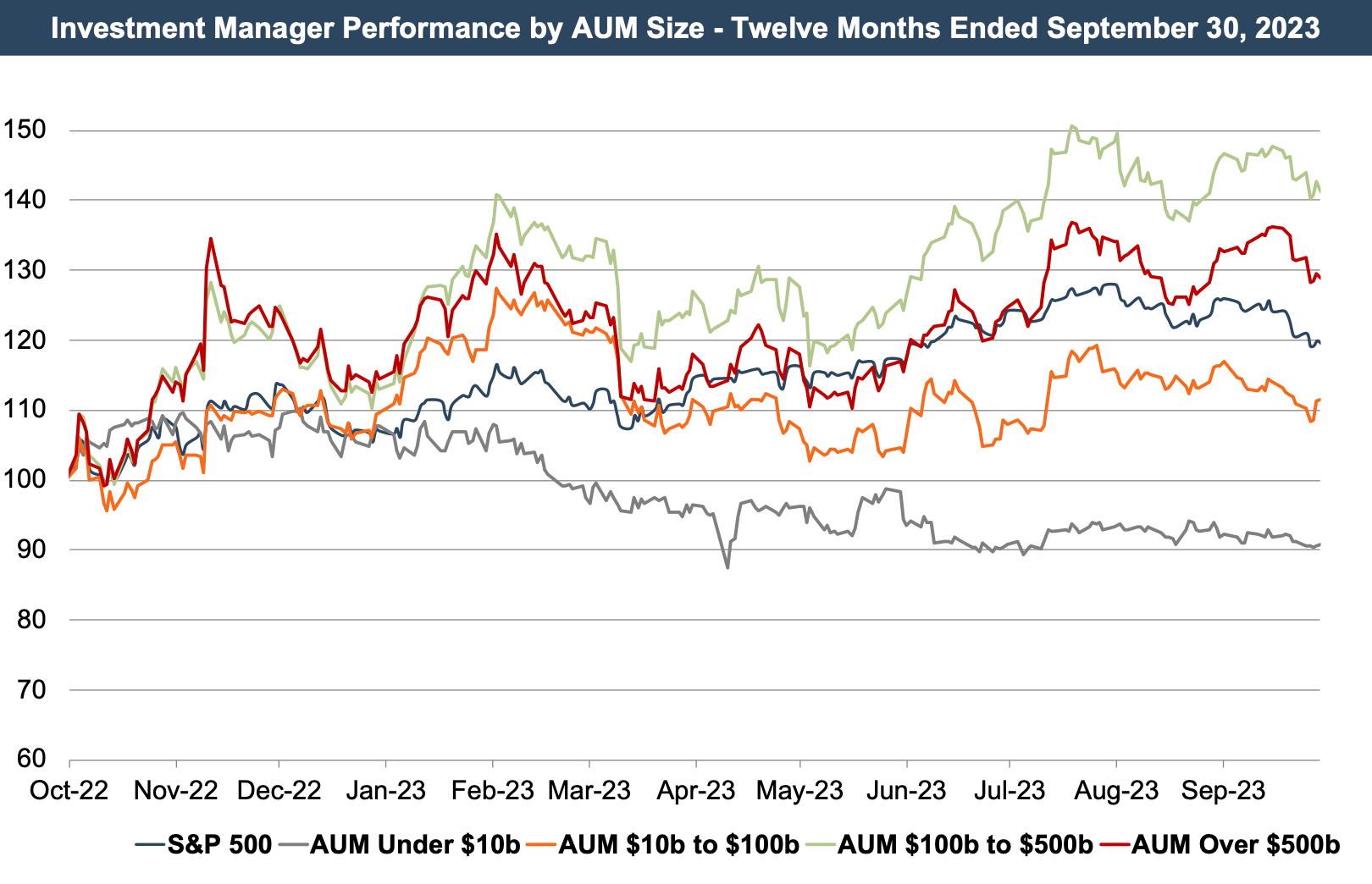

Performance for many of these public companies continues to be impacted by headwinds, including fee pressure, asset outflows, and the rising popularity of passive investment products. These trends have especially impacted smaller publicly traded RIAs, while larger asset managers have generally fared better. For the largest players in the industry, increasing scale and cost efficiencies have allowed these companies to offset the negative impact of declining fees. Large asset managers, particularly those overseeing assets over the $100 billion range, have displayed notable outperformance compared to the S&P 500, while smaller RIAs have lagged behind.

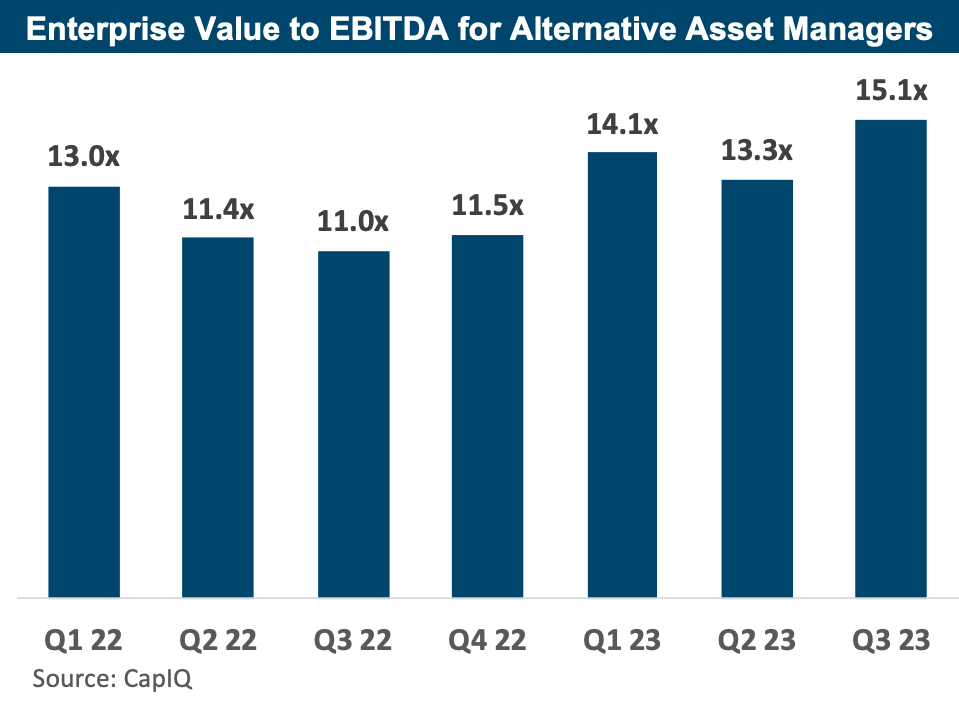

As valuation analysts, we’re often interested in how earnings multiples have evolved since these multiples can reflect market sentiment for the asset class. After a downward trend for most of 2022, EBITDA multiples for alternative asset managers trended upwards during 2023 as LTM earnings metrics began to fully reflect the impact of the tumultuous 2022 market conditions. There is, however, a notable caveat to this data: many publicly traded alternative asset managers have substantial investment assets (i.e., investments in their own funds) on their balance sheets, which are inherently reflected in the publicly traded price. When making comparisons between firms, significant adjustments to earnings and implied enterprise values may be required.

Implications for Your RIA

The value of public asset and wealth managers provides some perspective on investor sentiment towards the asset class, but strict comparisons with privately held RIAs should be made with caution. Many smaller publics focus on active asset management, which has been particularly vulnerable to headwinds such as fee pressure and asset outflows to passive products.

In contrast to public asset/wealth managers, many smaller, privately held RIAs, particularly those focused on wealth management for HNW and UHNW individuals, have been more insulated from industry headwinds. Their fee structures, asset flows, and deal activity reflect this.

Notably, the market for privately held RIAs remained strong in 2023 despite macroeconomic uncertainty and elevated interest rates. As noted in our Q3 M&A update, deal activity has remained on par with 2022, however, there has been an increase in total transacted AUM (a proxy for transaction value) over the same period. A main contributor to this increase in transacted AUM can be attributed to RIAs partnering with private equity firms. According to Fidelity’s August 2023 Wealth Management M&A Transaction Report, private equity backing was involved in 75% of August transactions. Private equity acquirers directly invested in wealth managers with assets totaling $877 billion in the third quarter of 2023, more than tripling the amount in the second quarter of 2023 (per Echelon’s Q3 2023 RIA M&A Deal Report).

As these dynamics continue into Q4 2023, the outlook for continued multiple expansion and robust deal activity for alternative asset managers remains favorable.

RIA Valuation Insights

RIA Valuation Insights