Alternative Asset Managers Outperform as RIA Sector Gains Momentum

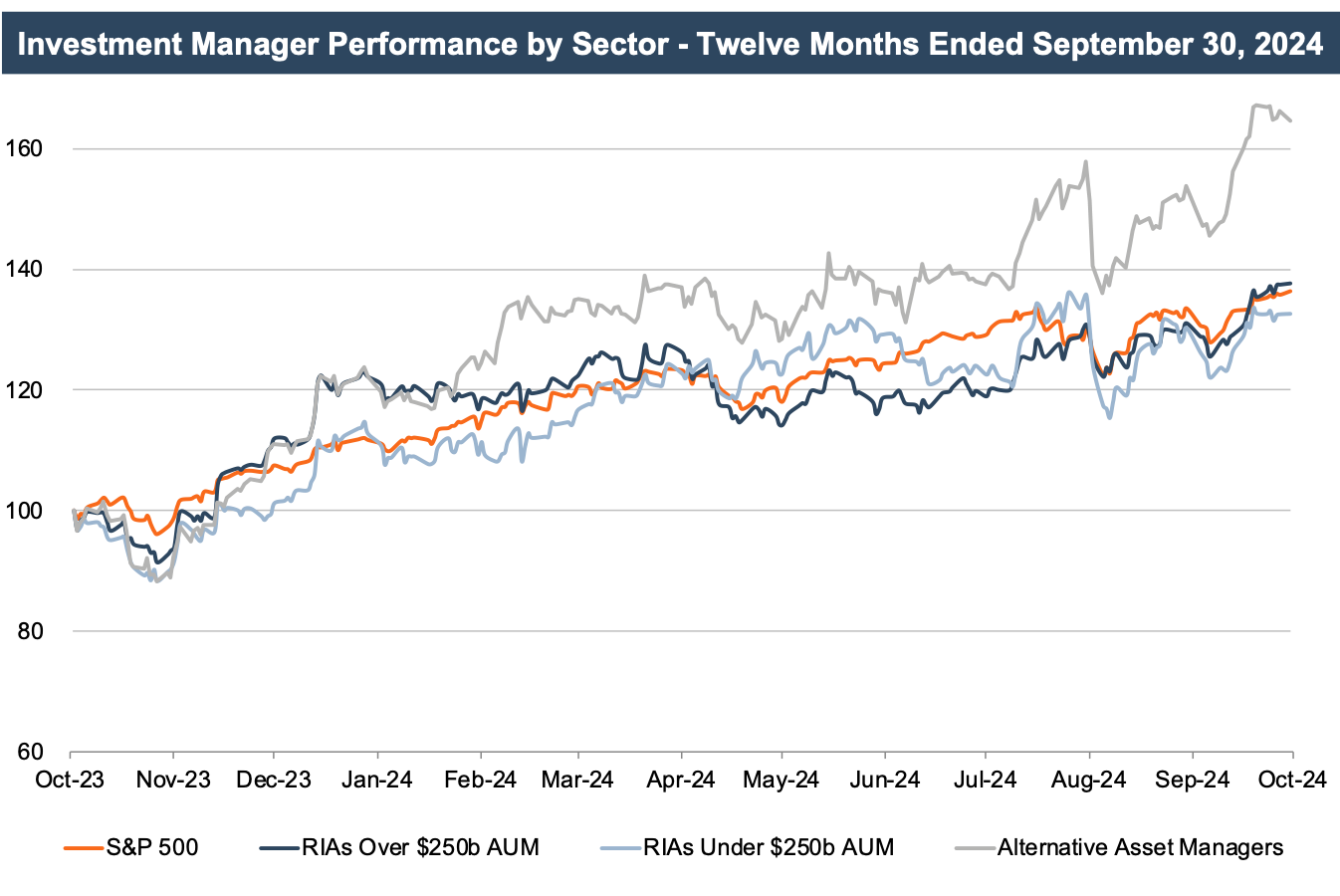

Alternative asset managers fared particularly well during favorable market conditions for the RIA sector. Over the past year, both alternative asset managers and large RIAs (with assets under management, or AUM, exceeding $250 billion) outperformed the S&P 500, achieving gains of 64.6% and 37.7%, respectively. In contrast, smaller RIAs (AUM under $250 billion) underperformed relative to the broader market, posting gains of 32.7%. RIAs have directly benefited from improved market conditions, which have boosted AUM.

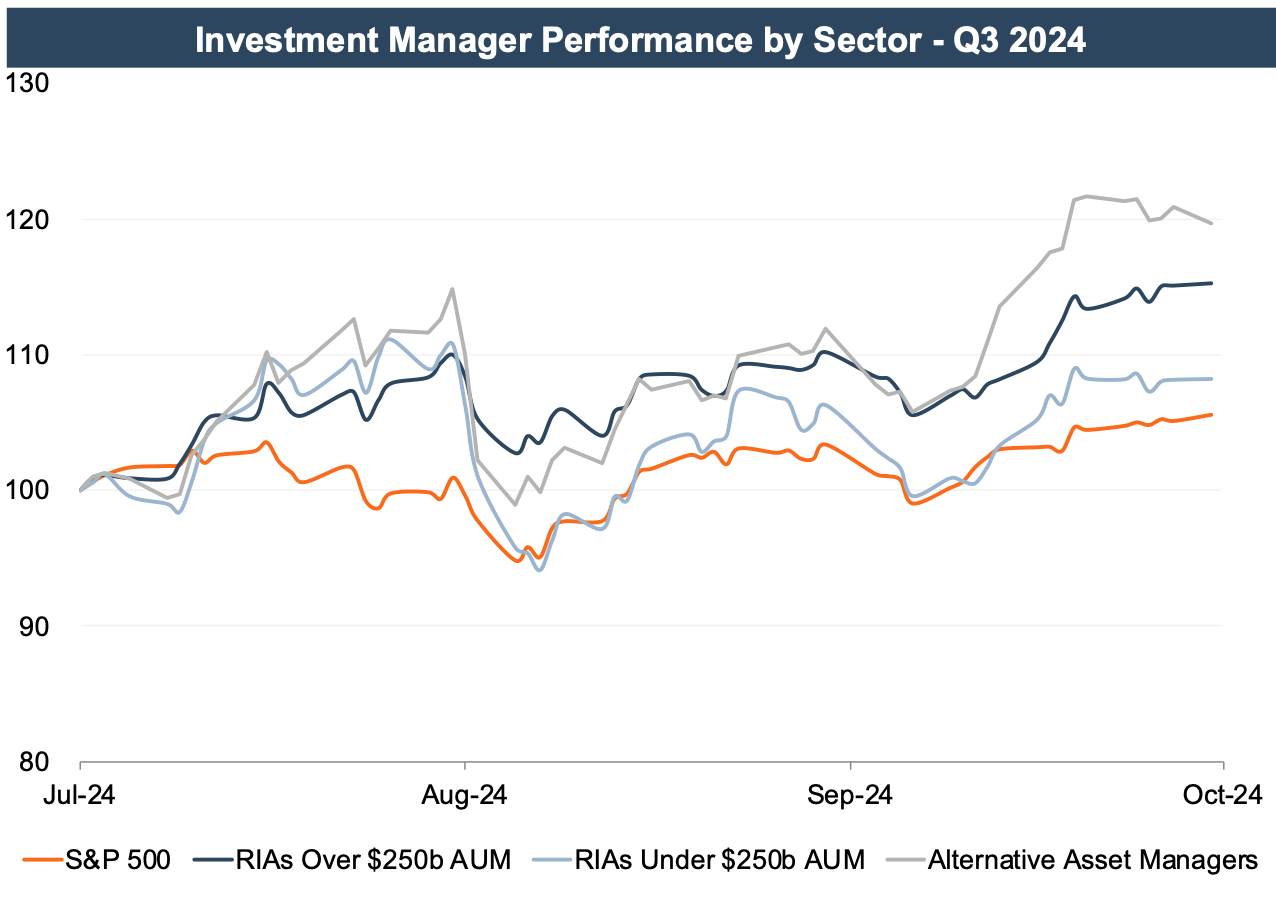

Recent quarterly data shows a similar trend. In the third quarter, alternative asset managers surged 19.7%, significantly outpacing the S&P 500’s 5.6% gain over the same period. Larger RIAs also performed well, increasing 15.3%, while their smaller counterparts posted an 8.2% increase. The divergence in performance illustrates the continued strength of alternative asset managers, whose investment strategies—frequently insulated from short-term market gyrations—provide stability during periods of heightened volatility.

Since 2020, increased volatility has driven fluctuations in AUM, drawing heightened interest in the stocks of alternative asset managers. This interest can be attributed to the long-term nature of their investment vehicles, such as private equity funds, which typically lock in capital for extended periods (often 10-12 years). This structure provides a more stable and predictable revenue stream, largely insulated from short-term market fluctuations. As a result, alternative asset managers tend to exhibit lower correlations with broader market conditions, enhancing their appeal during periods of uncertainty.

The attractiveness of these firms lies not only in their ability to weather volatility but also in their capacity to capitalize on it. Many alternative investments, like private equity and hedge funds, are positioned to thrive in environments of market dislocation, offering both downside protection and opportunistic growth when traditional asset classes falter.

Valuation Trends and Earnings Multiples

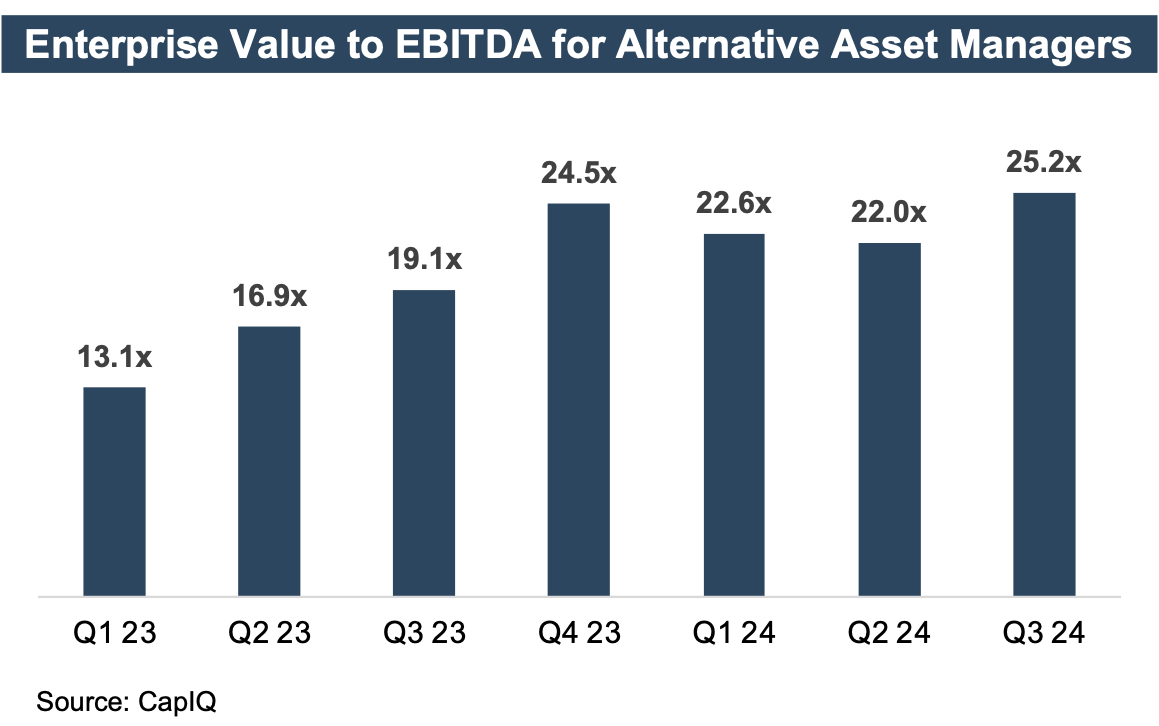

From a valuation perspective, the market’s sentiment towards alternative asset managers is clearly reflected in the evolution of their earnings multiples. After a downward trend throughout much of 2022, EBITDA multiples for alternative asset managers rebounded sharply through 2023 and 2024.

However, it’s important to note that many publicly traded alternative asset managers carry significant investment assets on their balance sheets—investments in their own funds—which are factored into their stock prices. When comparing firms within this space, it’s often necessary to adjust earnings and implied enterprise values to account for these balance sheet investments.

SEC’s Private Fund Adviser Rules Vacated

In August of 2023, the SEC adopted new Private Fund Adviser Rules, attempting to tighten the regulatory oversight of private fund advisers. These new rules mandated quarterly performance disclosures, annual audits, and enhanced reporting for certain transactions. These rules were expected to significantly increase compliance costs, especially for smaller alternative asset managers.

However, in June 2024, the U.S. Fifth Circuit Court unanimously vacated the rules, stating that the SEC had overstepped its regulatory authority. This ruling was a significant win for alternative asset managers, removing the prospect of steep compliance costs that could have strained smaller firms. Going forward, this ruling may have set a precedent for future SEC efforts to regulate private funds and may give rise to challenges to other SEC rules that rely on similar authority.

Implications for Your RIA

While the valuation of publicly traded asset and wealth managers offers insights into broader investor sentiment, direct comparisons with privately held RIAs require careful consideration. Publicly traded firms, particularly smaller ones, often focus on active asset management, which remains vulnerable to fee compression and capital outflows toward passive investment products. This trend has put pressure on public asset managers, especially those who rely heavily on active strategies.

In contrast to public asset/wealth managers, many smaller, privately held RIAs, particularly those focused on wealth management for HNW and UHNW individuals, have been more insulated from industry headwinds. Their fee structures, asset flows, and deal activity reflect this.

Notably, the market for privately held RIAs remained relatively strong in 2024 despite macroeconomic uncertainty and elevated interest rates. As noted in our Q3 M&A Update, deal activity has slightly lagged the levels seen in 2023 (down 11%), however, there has been a 168% increase in total transacted AUM (a proxy for transaction value) over the same period. A main contributor to this increase in transacted AUM can be attributed to RIAs partnering with private equity firms. According to Fidelity’s September 2024 Wealth Management M&A Transaction Report, private equity backing was involved in 63% of September transactions. Per Echelon’s Q2 2024 RIA M&A Deal Report (latest available), private equity acquirers directly invested in twelve wealth managers with an average AUM per deal of $54.6 billion in the second quarter of 2024.

As these dynamics continue into Q4 2024, the outlook for continued multiple expansion and robust deal activity for alternative asset managers remains favorable.

RIA Valuation Insights

RIA Valuation Insights