Alternative Asset Managers

Segment Focus

Alternative investment managers took off in the wake of the financial crisis when investors flocked to risk mitigating strategies and uncorrelated asset classes; however, during 2015 and 2016 these businesses floundered against a backdrop of strong equity market performance. Alt managers bounced back in 2017, and over the last twelve months, have continued to perform well. Despite improving performance over the last two years, the industry continues to face a number of headwinds, including fee pressure, expanding index opportunities, and relative underperformance.

Segment Struggles

Hedge fund managers, in particular, have struggled since the financial crisis. Although industry assets reached a record $3.2 trillion in 2018, net inflows have stagnated and the record AUM level is primarily due to market increases rather than investor interest in the asset class. At the same time, the industry is struggling with fee schedules that continue to decline and a plummeting number of new funds being established.1

Despite improving performance over the last two years, the industry continues to face a number of headwinds

Many of the hedge fund industry’s woes can be traced back to significant underperformance over the last decade. Since 2009, the S&P 500 index has dwarfed the performance of hedge funds (as measured by the HFRI Fund Weighted Composite Index), and this underperformance has driven outflows and fee declines. Part of industry’s underperformance may be attributable to the protracted bull market. While it may seem counterintuitive that strong market performance would be a bad thing for an asset manager, a long/short fund that seeks to generate positive returns regardless of which way the market moves is naturally going to underperform during prolonged periods of steady market increases. Recent volatility in the equity markets may alleviate this underperformance, but the numbers haven’t been reported yet.

Other categories of alt managers have suffered many of the same difficulties as hedge funds in justifying their value propositions over the last decade. Alternative asset classes saw major inflows after the financial crisis due to their lack of correlation with traditional asset classes. Fast forward to today, the S&P 500 index has grown at a nearly 16% CAGR since bottoming out in 2009. Investors holding asset classes uncorrelated to U.S. equities over the last decade probably wish they hadn’t been with hindsight.

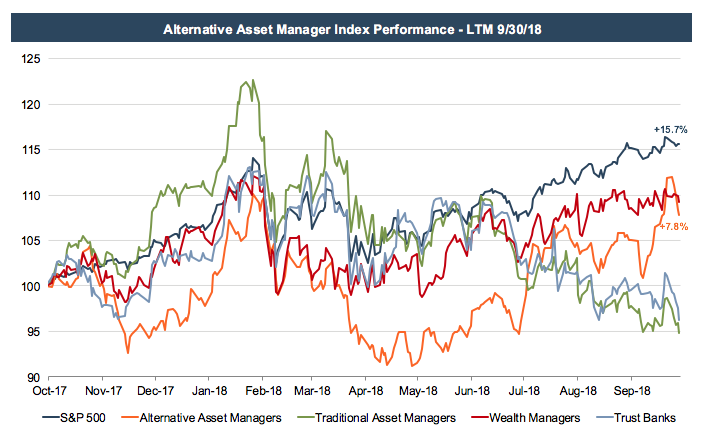

While performance has been volatile, alt managers closed out the year ended September 30 up 7.8%

Industry Performance

The industry has endured and performed reasonably well over the last year, at least in the eyes of market participants. While performance has been volatile, alt managers closed out the year ended September 30 up 7.8% — making them one of the better performing sectors of publicly traded asset managers over the past year. For all the problems the industry faces, most investors still value the diversification offered by alternative assets, particularly late in the economic cycle. While active management may not be as lucrative as it once was, it is still sought by many institutional investors to complement their passive holdings.

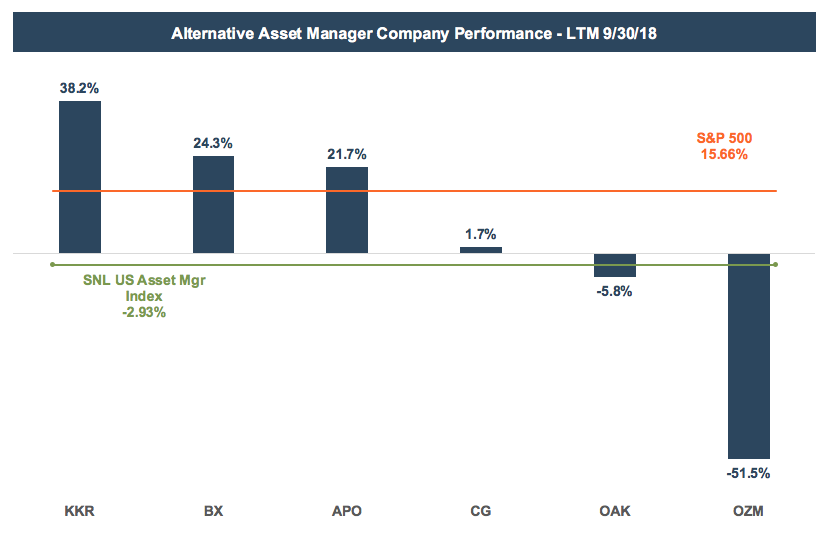

Taking a closer look at the performance of the alt manager index’s constituent companies over the last year reveals that most of the positive performance was attributable to publicly traded private equity managers, with KKR, Blackstone (BX), and Apollo (APO) all beating the S&P 500 while Carlyle Group (CG) was up modestly. Oaktree Capital Management (OAK), which specializes in distressed debt, was down 5.8% while hedge fund manager Och-Ziff Capital Management (OZM) declined more than 50% over the last year on issues with succession and investment performance.

Given the performance over the last year, the market appears to be reasonably optimistic about the prospects for most publicly traded alt managers, at least relative to other categories of asset managers. Some of the fundamentals are improving as well. Asset flows out of active products seem to have stabilized, and AUM growth has generally been outpacing fee compression in recent quarters. We think performance fees will likely continue to fall (in one form or another), but like active management, never be totally eliminated. So on balance, a modestly improving outlook for the industry appears justified.

RIA Valuation Insights

RIA Valuation Insights