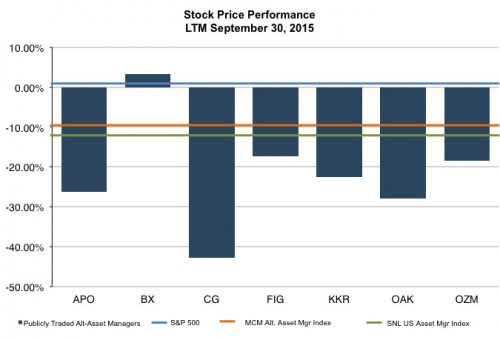

Many Alternative Asset Managers in Bear Market Territory

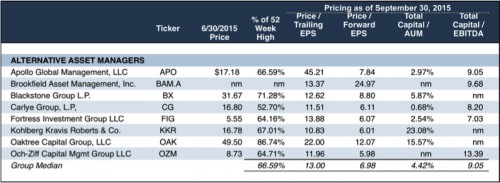

A particularly rocky quarter for the equity markets precipitated huge market cap losses for most of the publicly traded hedge funds and PE firms. The lone bright spot and only sector component to generate a positive return over the last year is Blackstone, which benefited from strong performance fees on its portfolio company investments earlier this year. Still, the stock is down over 20% since its peak in May, which shows just how volatile the industry can be, particularly during times of market distress (our recent post discusses the impact of the recent downturn on asset manager shares).

With over $300 billion in AUM, Blackstone’s size is both a blessing and a curse. On the one hand, a large AUM base affords it the opportunity to invest in a multitude of asset classes and industries to enhance its risk/return profile with a diverse product offering. But, size can be a drag on performance and cut into carried interest fees if the underlying fund’s stature trumps viable investment opportunities. Still, some of this risk is mitigated by the added stability of higher management fees from a larger asset base. And the market doesn’t seem to mind this trade-off as AUM fees represent a relatively stable source of income to complement unpredictable and often inconsistent returns from carried interest.

Stocks of publicly traded PE firms have typically displayed more volatility than traditional money managers, and building larger funds with longer investment horizons may be one way to temper this disparity. Diversifying fund offerings beyond LBOs and into other asset classes such as hedge funds and real estate also helps. Sector analyst Marc Irizarry at Goldman Sachs notes, “All of these firms…have done a lot to diversify their businesses or to position themselves to grow assets on a more sustainable basis.” Indeed alt manager shares have outperformed the RIA index as a whole over the last year, albeit by a fairly small margin.

Much of the divergence in financial and investment performance within the alternative asset manager sector can be explained by timing. A Bloomberg News piece in Financial Advisor expounds, “buyout firms’ earnings rarely follow a linear path because they are driven by the lumpy timing of exits as well as the “mark-to-market” valuations of fund holdings, which are vulnerable to market swings and required each quarter under accounting rules.” The economic cycles and gyrations in the stock market since the financial crisis have compounded this volatility as many of the deals that were struck at the last buyout peak of 2005 to 2007 have taken longer to exit at profitable levels, so their shareholders have yet to witness a full fund cycle while these businesses have been publicly traded.

Irizarry elaborates, “[alternative asset managers] are still ‘show-me’ stories in the eyes of the market. There’s some reluctance on the part of investors to ascribe higher valuations on these managers until they see how sustainable these businesses really are.”

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry.

RIA Valuation Insights

RIA Valuation Insights