Outlook for Alternative Asset Managers During COVID-19

Despite the global pandemic, the long-term outlook for most alternative asset managers appears healthy due to strong investor interest and emerging opportunities caused by market dislocation. Demand for alt assets has benefited from increases in alt asset allocations among institutional investors, and this long-term trend appears poised to continue, pandemic or not. If anything, the current environment has highlighted the benefits of diversification that alt assets can provide. According to an April 2020 survey of institutional investors by Preqin, 63% of respondents indicated that COVID-19 would have no effect on their long-term alternative investment strategy, while 29% indicated that their long-term allocation to alternative investments would increase as a result of COVID-19.

The current environment has highlighted the benefits of diversification that alt assets can provide.

In the near-term, however, alt managers are likely to feel the effects of declining asset values. While public equity markets recovered significantly in the second quarter, the recovery was led by a handful of large-cap tech stocks while small-caps lagged behind significantly. For PE firms, this means that most portfolio company valuations are likely down (and performance fees are jeopardized), but it also represents an opportunity to deploy capital at attractive valuations.

Furthermore, while long-term investing strategies may be unchanged, capital commitments for the remainder of 2020 are likely to decline. According to the Preqin survey, only 9% indicated that COVID-19 has increased their planned commitments to alternatives in 2020, while 58% indicated that their planned commitments have decreased (33% indicated no change).

Of those commitments that are being made, they are likely to be concentrated in asset classes that are poised to benefit from the current environment. The brunt of the economic fallout from COVID-19 has been borne by a handful of industries, and given the severe short-term impact (and possible longer-term impact) that COVID has had on sectors like hospitality, energy, travel, retail, and restaurants, many investors are exercising caution and reducing exposure to these sectors, at least until there is more clarity about the timeline of the pandemic and the potential long-run consequences. According to the Preqin survey, 34% of investors plan to avoid retail-focused real estate in 2020, while 28% plan to avoid conventional energy-focused natural resources, and 26% plan to avoid retail-focused private equity.

On the other hand, certain alt asset categories like distressed debt and tech-focused venture capital are poised to see increased investor interest. Distressed debt funds are raising record amounts of capital in anticipation of a rising number of investment opportunities. According to the Preqin survey, investors are planning to increase allocations to healthcare-focused private equity, distressed debt, logistics, software-focused venture capital, and defensive hedge funds.

When it comes to maintaining existing assets, alt managers are often better positioned during a market downturn than traditional asset managers.

When it comes to maintaining existing assets, alt managers are often better positioned during a market downturn than their traditional asset management counterparts. The investor base for alt managers tends to be largely institutional investors with long time horizons and perhaps less propensity to knee jerk reactions than retail investors. Also, since alt assets tend to be held in illiquid investment vehicles, investors are locked up for years at a time and can’t withdraw funds as easily as if the assets were in a mutual fund or an ETF.

While sticky assets can provide cushion for alt managers in a downturn, the longer-term performance of these managers depends on their ability to raise new funds and put that money to work. Raising institutional capital is often a long and involved process in the best of circumstances. For many managers, the economic interruption of a global shutdown has presented challenges to a fundraising process that often involves extensive in-person due diligence (35% of respondents in the Preqin survey indicated that face-t0-face meetings are essential for decision making). And if new funds are raised, there is the question of whether or not managers can put that money to work. M&A transaction activity has declined significantly over the last several months, leaving deal teams at many PE firms on the sidelines. It is likely that there will be a huge backlog of transaction activity that will materialize at some point in the coming months/years, but the timeline is uncertain.

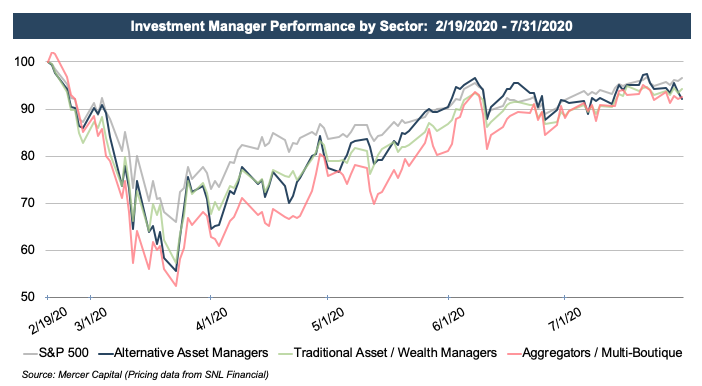

Public alt managers were particularly affected during the selloff in March, reflecting the decline in portfolio asset values and expectations for realizing performance fees. Measured from February 19, 2020—the day the S&P 500 peaked—our index of alt managers declined nearly 45% by late March. Since then, an outsized recovery has left the index down just 8.0% from the market peak. Of the nine alt asset managers in the index, six were down over the period while three saw price increases, which reflects the varied outlook for the sector depending on asset class focus, among other things.

The big winners in the sector were Apollo Global Management (APO) which was up 6.5% between the S&P 500 peak on February 19 and July 31 and KKR & Co. (KKR) which was up 4.8% over the same time period. APO saw credit AUM increase 43% over the second quarter, positioning the company to deploy capital as a robust pipeline of private credit opportunities emerges in the wake of COVID. Additionally, Apollo’s recent focus on responsible investing likely contributed to its superior performance as ESG funds outperformed traditional funds in the wake of COVID. KKR has also been successful at fundraising, adding $10 billion in capital commitments to its already substantial dry powder across its private equity and credit business during March and April. Those firms with large exposures to affected industries typically saw negative performance over the period. One of the worst-performing companies in the index was Cohen & Steers (CNS), which was down 22% between February 19 and July 31, reflecting its vulnerability due to its asset class focus (real estate) and predominately retail client base.

The observations about the divergence of performance among the public alt managers are likely to apply to privately held alt managers as well. In the near term, those managers with large exposures to highly affected industries, or those that have seen large asset outflows, are likely to see their valuations decline. Those managers with less exposure to highly affected industries and those whose strategies and fundraising are poised to benefit from the current environment are likely to see valuations increase. Over the longer-term, we expect to see alt asset allocations accelerate in the aftermath of COVID-19 as investors seek diversification before the next downturn, which should be a boon for most alt asset managers—particularly those who deliver outsized performance in the current environment.

RIA Valuation Insights

RIA Valuation Insights