SEC Regulation May be Coming for the Private Market

In for a Dime, In for a Dollar

It’s no secret that ZIRP has pushed most portfolio managers farther out on the risk spectrum than anyone could have imagined just a decade ago – with many managers diving into the realms of venture capital and private equity, beyond the protective hand of government watchdogs. As a consequence, the SEC seems to be increasingly interested in implementing a series of new regulations designed to rein in the animal spirits of the previously untouched private market. Securities law has long operated under the assumption that sophisticated investors within the private market do not require the same amount of protections afforded the broader range of investors in the public market. However, an increasing number of retail investors – through pension plans, hedge funds, and mutual funds – are becoming involved in private placements through venture capital and private equity funds. The SEC has not shied away from growing its footprint in this area through Dodd-Frank and the JOBS act and has now turned its attention towards establishing the frameworks and guidelines necessary to protect investors.

Recently, SEC Chair Mary Jo White gave a keynote speech to attendees of the SEC’s and Rock Center’s Silicon Valley Initiative, an event bringing together regulators, academics and entrepreneurs to discuss issues affecting venture capital and private equity within Silicon Valley. Although the audience may have been targeted, White’s speech provides insight into the SEC’s concern over the lack of transparency, governance and oversight in the PE and VC industries.

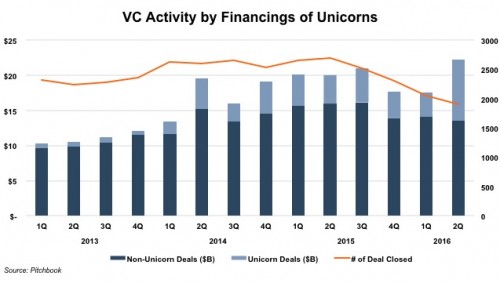

Both venture capital and private equity have witnessed an exponential growth in funding, due in part to a growing number of retail investors – guised as institutional platforms – accessing the private capital market. Combined with longer (i.e. indefinite) pre-IPO lifecycles creating more and more inflated “unicorns”, White has reason to worry. In the second quarter of 2016 alone, investors sank nearly $22.3 billion in venture capital, with unicorns receiving 39% of it. For venture capital firms, the amount of funding available in the private market as well as the poor track record and higher expenses associated with the public market leaves little incentive for an IPO. However, the risks associated with a high concentration of large amounts of capital within a relatively unregulated private market are a cause for concern.

In her speech, White focuses on a number of key concerns within venture capital and private equity:

1. Value Distortion

“In the unicorn context, there is a worry that the tail may wag the horn, so to speak, on valuation disclosures. The concern is whether the prestige associated with reaching a sky high valuation fast drives companies to try to appear more valuable than they actually are.”

Valuation can be subjective, especially within a speculative market such as venture capital in which reaching “unicorn” status brings publicity, prestige, and most importantly, funding. The SEC believes there is an endemic risk of distortion due to a lack of governance and internal controls, combined with a shift in investor sentiment that clearly favors bigger firms.

2. Fiduciary Responsibility

“Whether the source of the obligation is the federal securities laws or the fiduciary duty that is owed to shareholders, the resulting candor and fair dealing should be fundamentally the same. And beyond any specific regulatory requirements, some of the principles that characterize public companies – transparency with investors, controls on financial reporting, strong corporate governance – have applicability and relevance to private companies, especially those pre-IPO companies that aspire to go public, and should not be overlooked or avoided, whether or not mandated by federal law or an SEC regulation.“

Even without explicit legislation, White makes it clear that venture firms have a fiduciary (a newly loaded term these days) duty to their investors. Within the private market, several state courts have also decided that shareholders in closely held corporations, such as a private company, owe an additional level of fiduciary duty to each other. In this respect, shareholders are treated as partners. White is therefore making the case that the SEC is not being egregious by demanding fair dealing, transparency and governance, when companies are (or should be) doing so already.

3. Widespread Market Effects

“So, if those participants [sophisticated investors] choose – with eyes wide open – to invest in private companies at valuations that may be ethereal or overinflated, who loses when the truth behind inflated valuations is revealed? I think we all do. […] To better understand what I mean, we need to look more closely at how these deals are done and structured, as well as the downstream effects on other market participants.”

Ensuring that investors are not defrauded by a misrepresentation of value is an issue that affects all market participants. The venture capital industry is currently defined by a sort of herd mentality, in which one bad IPO can spook an entire industry while one big winner can drive a deluge of capital. It is clear that the SEC has begun to further scrutinize deals in the interest of getting ahead of any potential dislocation of value for the sake of protecting the entirety of the market and the exorbitant amount of capital invested therein.

4. Preventing Control Failures

“Rapidly growing enterprises present significant risks if the appropriate control structure is not in place. Time and again, we have seen companies go public and grow at a pace that exceeds their control structure.”

White is sure to make it clear that this is not the SEC’s first rodeo, and she doesn’t expect it to be the last. The question is no longer whether a failure of control will happen, but whether it will be great enough to both demand sweeping regulation of the venture capital and private equity industries.

Whether you are for or against increasing regulation in the private market, the SEC seems to be taking the stance that it’s better to be safe than sorry. The potential for regulation has become more of a reality with the burgeoning involvement of non-traditional investors and excess of dry powder in both venture capital and private equity. Venture capital and private equity firms are encouraged to take a hard look at both their internal (portfolio management) and external (investor reporting) valuation practices. Imagine this environment if we have a meltdown of funding and valuations in private equity – the SEC may just be looking ahead.

RIA Valuation Insights

RIA Valuation Insights