An All-Terrain Clause for your RIA’s Buy-Sell Agreement

Audi Ur-quattro pressing for the win (www.jalopnik.com)

Clients writing new buy-sell agreements or re-writing existing ones frequently ask us how often they should have their RIA valued. Like most things in life, it depends. We usually recommend having a firm valued annually, and most of our clients usually do just that. “Usually,” though, is subject to many specific considerations.

How many shareholders are there in the RIA? The more owners you have, the more transactions will occur and the more useful a semi-annual or quarterly valuation might be. Small firms with only a couple of owners typically don’t need to know their value on an annual basis, but checking in on some scheduled basis – such as every two or three years – is helpful to keep track of firm performance, update any life insurance coverage, and to plan for succession issues or sale of the firm.

Is your firm growing rapidly? If so, an annual valuation might become stale very quickly. Mature firms probably only need to look at their valuation metrics once per year to see how their performance and outlook compares with the greater market for investment management firms.

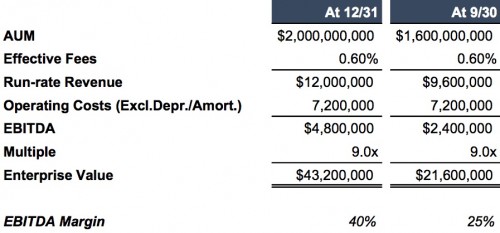

Even annual valuations can be inadequate, however, when an RIA experiences big increases or decreases in assets under management. Since we have been operating in a low volatility market (at least for U.S. equities) for some time, it’s easy to forget that normal, but nonetheless major, market swings can have a material impact on profitability and valuation. In the case of a market swoon, even a mature RIA with healthy margins can lose ground rapidly, and a valuation that looked reasonable six months earlier may no longer be practical. Consider an equity manager with $2 billion of AUM, realized fees of 60 basis points, and a 40% EBITDA margin. If the regular annual valuation is prepared at an effective EBITDA multiple of 9x, then enterprise value would come in at around $43 million.

One might expect that a valuation such as that would satisfy the needs of an investment management firm over the course of a year, until the time came for the next update. Markets are fickle, though. Imagine the same RIA endures a significant market downturn late in the summer, and then an event happens which triggers the buy-sell. AUM drops 20% versus the start of the year, nothing changes in the expense base, and the valuation multiple is steady. Because of the inherent operating leverage in the asset management business, the profit margin drops from 40% to 25% on 20% lower revenue, and because of that compounding effect value declines by half.

This example has more simplifying assumptions than not, and most firm valuations would not move so dramatically just because of a 20% downturn in AUM. That said, market events and client whims can have an outsized impact on RIA profits and, consequently, valuation, such that an annual valuation may not hold up over the course of a year.

So what’s a firm to do? One option, of course, is to accept the vagaries of the market – any unusual events during the course of the year may be just as temporary as conditions at the annual valuation date. One of the functions of the buy-sell agreement is to get the parties to agree to what they are willing to live with, and what they are willing to live without. Many firms do just that.

This brings me to the subject of the photo above. European rally car races have always fascinated me, although I’ve never been brave enough to actually attend one. During the 1980s Audi ruled the rally scene with the Ur-quattro. The Ur-quattro was a hatchback that Audi developed after the racing rules were changed in the late 1970s to allow four-wheel drive. The Audi could handle anything, and to underscore that point the manufacturer used both Italian (“quattro” for four wheel drive) and German (“Ur” for primordial or original) to name it. Regardless of snow, mud, gravel, flat curves or deep hills, the Ur-quattro couldn’t be beat. Audi’s rally reputation was such that they started to offer the quattro system in all of their passenger cars, and all-wheel drive has become commonplace today – from Subaru to Lamborghini.

A client of ours that is drafting a new buy-sell agreement recently brought us an idea which we think offers a similar level of preparation for any circumstance. In their agreement, they’ve added a provision which would call for an interim update to their otherwise annual valuation if 1) the prospect of a transaction arises and 2) AUM is more than 10% higher or lower than at the time of the previous valuation. The annual valuation is important to set a pattern of expectations for parties to the buy-sell of how they’ll be treated in a transaction, and most of the time will suffice when a transaction occurs. Adding the update provision is a simple way to prepare for the possibility of substantial changes in the financial performance of the RIA. Even if they never use the provision, having it offers peace of mind for parties to the agreement that they’ll be treated fairly if the company’s performance changes radically over the course of the year.

In the decades since the Ur-quattro was introduced, Audi has sold cars with quattro to millions of people whose morning commute is nothing like a rally race. Most people buy all-wheel drive cars for that “just-in-case” moment that will make the added expense worth it. Like all-wheel drive, you may never need an event-based update provision in your buy-sell agreement. It’s nice to know, though, that your buy-sell is all-terrain ready, no matter how rough the ride gets.

RIA Valuation Insights

RIA Valuation Insights