An Ontological Approach to Investment Management

Review of “Winning at Active Management” by William W. Priest et al.

Alfa Romeo 8c Competizione: often forgotten but nonetheless beautiful

When we started writing about investment management in 2007, my colleagues and I went looking for materials on practice management and, in general, found nothing. There was no shortage of books, papers, articles, blogs, and conference presentations on investing, some insights on the profession of a practicing financial advisor, a couple of good books on the value of an investment management business, and even materials on marketing oneself in the profession. But there was next to nothing out there about structuring and running an RIA.

Along the way, we missed the 2016 publication of “Winning at Active Management: The Essential Roles of Culture, Philosophy, and Technology” by Bill Priest and his colleagues at Epoch Investment Partners. This post is to correct that oversight. You probably recognize Priest’s name from his role on Barron’s Roundtable, and his present-day job is Vice-Chair of TD Wealth, having sold Epoch to TD Global Investment Solutions in 2013.

Priest’s book might typically be characterized as a book on investment management, but it is far more than a treatise on stock picking or portfolio construction. The starting point for the book is not a review of CAPM (that comes later) but rather a review of corporate culture. The book sets the table for a discussion on culture with a rather unforgettable commentary on how one’s place in the corporate hierarchy affects one’s experience of culture:

“An organization is like a tree full of monkeys, all on different limbs at different levels. The monkeys on top look down and see a tree full of smiling faces. The monkeys at the bottom look up and see an entirely different perspective.”

– Anonymous

As you can tell at this point, the progression of thinking in “Winning at Active Management” is an ontological approach to investment management: culture gathers talent within a productive framework that fosters good decision-making and, consequently, the best returns.

For centuries, most organizational models relied on “command-and-control” structures with layers of decision-making and staff, which were largely interchangeable. This made sense for capital-intensive businesses like manufacturing and distribution, in which low-skill labor mostly carried out the directives of their higher-ups. Priest makes a rather convincing case that this doesn’t work for knowledge-based businesses, which rely on the best intellectual contributions throughout the organizations and in which important ideas can come from anyone.

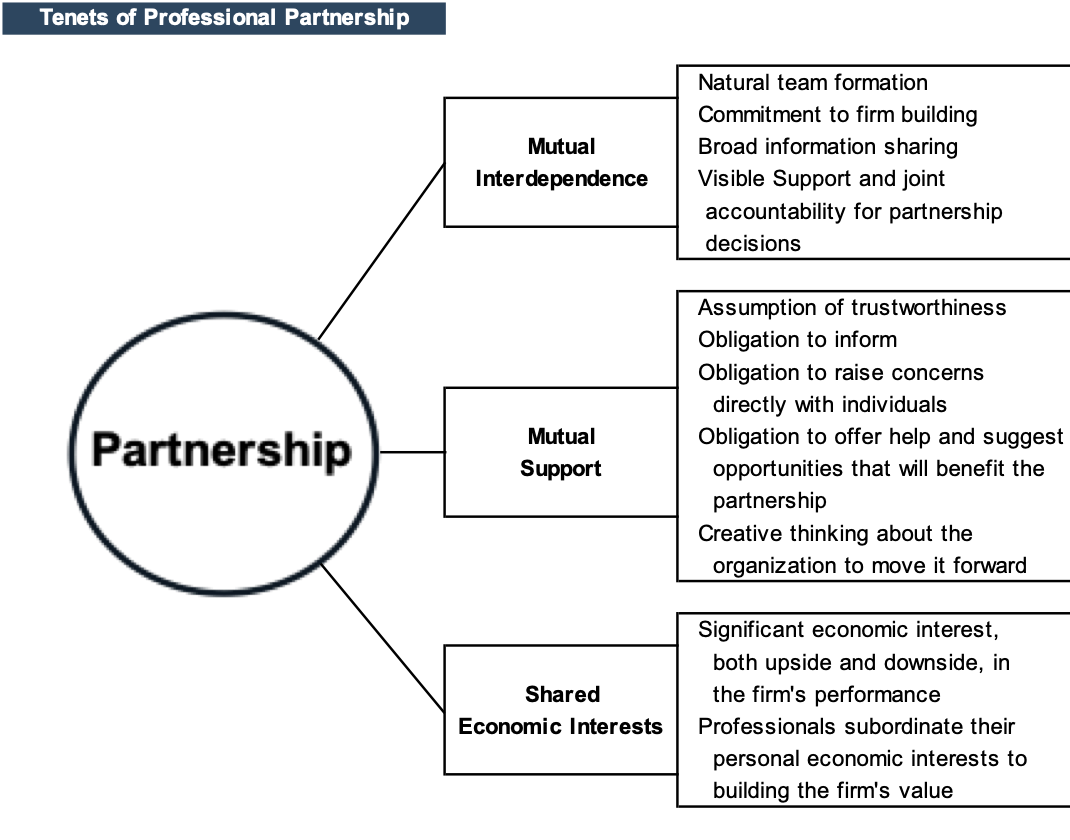

The book illustrates the difference between a command-and-control, pyramidal organizational structure and the partnership nature of most investment management firms with a diagram.

As recently as a few decades ago, investment management focused on the talents of a central figure who made daring investment calls and got them right often enough to be revered. Think about Benjamin Graham, Sir John Templeton, Peter Lynch, and Charlie Munger. The big managers of today are less celebrities and more people who build organizations to explore an investment thesis.

“For a professional firm to be viable for the long term… the shared interest of the partners has to transcend the financial rewards, and include the intangible achievement of helping to build a quality organization. This calls for assembling a group of partners with complementary values and temperaments who will be able to work together, and to understand each other, and to put up with each other during hard times over many years.”

Given the prominence of culture as the basis for an investment management firm, one would expect the book to cast a dim view of M&A activity. One would not be disappointed. The section on culture in acquisitions opens, “[a]side from market catastrophes, another class of stressful event for the culture of an investment manager is a merger or acquisition.”

Looking through the lens of culture, one can see why so many transactions in the investment management space underperform expectations. If an RIA with the typical partnership culture is acquired by a bank with a command and control culture, the inherent conflict won’t benefit either party.

In a transaction, money is traded for governance. Sellers are usually happy to take the money but would rather not be told what to do by the new ownership. Buyers, emboldened by their position as acquirers, can easily run roughshod over the very elements of the target entity which made it valuable to them in the first place. The importance of culture in investment management makes it hard to make deals successful.

If I find the time one day, I’m going to write a longer piece — maybe a whitepaper — on managing ownership. Most of the issues that clients bring us involve that topic. Ownership is commonly perceived as either the top of the food chain in the investment management community or simply a byproduct of corporate culture. Ideally, ownership has a symbiotic relationship with an RIA, and the best ownership structures serve the business model and, in return, receive the best returns from that business model. As such, ownership needs to be managed.

But that’s a topic for another day. For now, I’m very pleased to have found Bill Priest’s book on the practice of investment management, and highly recommend you find a copy and read it.

RIA Valuation Insights

RIA Valuation Insights