Another Tumultuous Quarter for RIA Stocks Puts the Industry Firmly in Bear Market Territory

Publicly Traded Alt Managers and RIA Aggregators Have Lost Nearly Half Their Value Since Peaking Last November

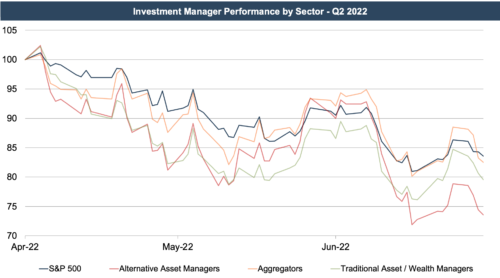

The RIA industry extended its losing streak last quarter with all classes underperforming the S&P, which also continued its decline.

The market is part of the problem as this industry is mostly invested in stocks and bonds, which have decreased considerably over the last six months. The additional underperformance for asset and wealth managers is likely attributable to lower industry margins as AUM and revenue falls with the market while labor costs continue to rise. Rising interest rates have exacerbated this decline for alternative asset managers and RIA aggregators, who frequently employ leverage to make investments.

The one bright spot for the industry is the group of smaller (under $10 billion in AUM) publicly traded RIAs, which is the only segment to outperform the market last quarter. This group is still down over the last three months but is holding up relatively well due to the lack of aggregator firms in its composition.

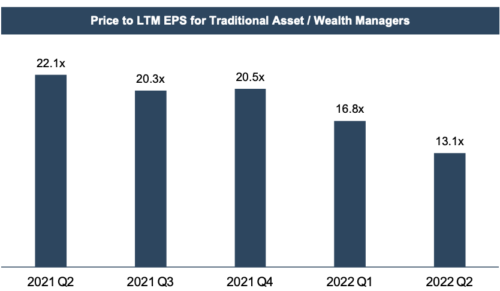

As valuation analysts, we’re often interested in how earnings multiples have evolved over time since these multiples can reflect market sentiment for the asset class. After steadily increasing over the second half of 2020 and first quarter of 2021, LTM earnings multiples for publicly traded asset and wealth managers declined modestly in the back half of last year before dropping nearly 40% so far this year, reflecting investor anticipation of lower revenue and earnings from the recent market decline.

Implications For Your RIA

The value of public asset and wealth managers provides some perspective on investor sentiment towards the asset class, but strict comparisons with closely held RIAs should be made with caution. Many of the smaller publics are focused on active asset management, which has been particularly vulnerable to the headwinds such as fee pressure and asset outflows to passive products.

In contrast to public asset/wealth managers, much smaller, private RIAs, particularly those focused on wealth management for HNW and UHNW individuals, have been more insulated from industry headwinds, and the fee structures asset flows, and deal activity for these companies have reflected this.

Notably, the market for privately held RIAs remained strong in 2021 as investors flocked to the recurring revenue, sticky client base, low capex needs, and high margins that these businesses offer. Deal activity for these businesses continued to be significant in 2021, and multiples for privately held RIAs tested new highs due to buyer competition and a shortage of firms on the market. As these dynamics continue into 2022, the outlook for continued multiple expansion and robust deal activity remains favorable, assuming interest rates and market conditions stabilize in the near future.

RIA Valuation Insights

RIA Valuation Insights