Are Difficult Partner Discounts Applicable to RIAs?

Harry and Marv’s ineffective partnership as the Wet Bandits was likely a contributing factor in being thwarted (and badly beaten) by eight-year-old Kevin McCallister (Macaulay Culkin) in Home Alone.

A few months ago, I attended a business appraisal conference in Portland, Oregon, where I learned about a case involving a “Difficult Partner Discount.” Since we’re often hired when business owners can’t agree on price, we’re well aware of partnership disputes, but I’m pretty confident I’ve never directly applied a “Difficult Partner Discount” to the value of a business or interest therein. That doesn’t mean that partner disputes and departures can’t significantly impair the value of a company, which we address in this post.

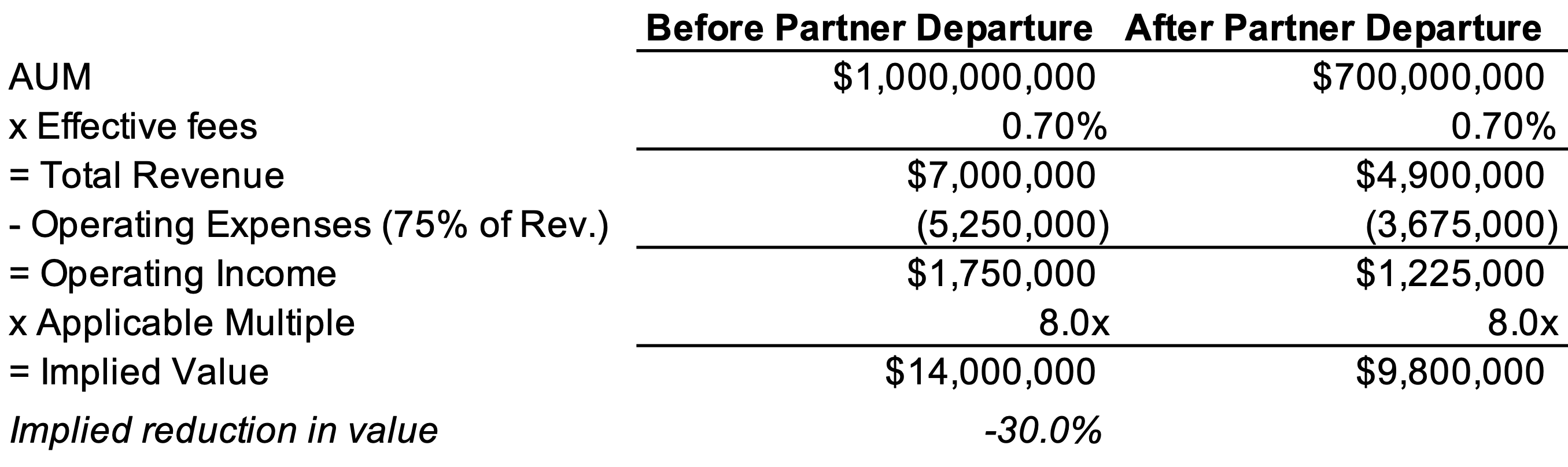

The case in question did not involve an investment management firm but arose out of “a fundamental breakdown in the relationship between…partners,” which is fairly common in RIAs. These disputes can significantly reduce the value of an investment management firm because RIAs are relationship businesses, and a dissenting partner can often take all of their clients with them to a competing firm or start their own company. The value of the remaining business has been impaired by the lost revenue and cash flows that left the company with the departing shareholder. The example below depicts this scenario when a partner takes $300 million in AUM from a $1 billion RIA:

It is more common for us to be involved in scenarios where the RIA has a dependency on a certain partner (or partners) for client relationships, firm management, investing acumen, or business development, and this phenomenon is known as key person risk. In this instance, none of the partners are threatening to leave the firm, but there remains the possibility that one or more of them could do so, and the business would be devoid of their contributions to revenue and overall firm management.

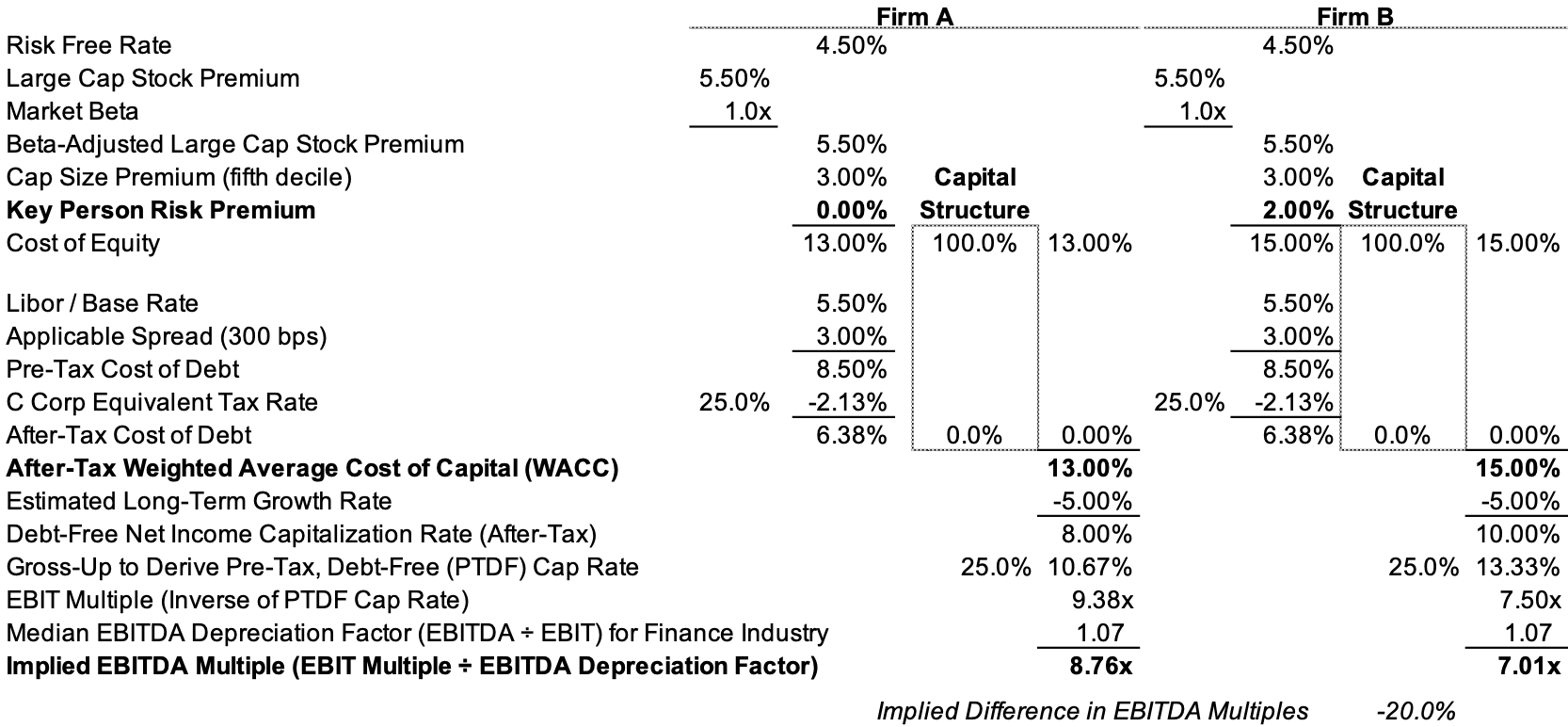

In the example below, we examine the impact of key person risk on a firm’s cost of capital and valuation multiple. Firm A, in this instance, has clients served by a team of advisors with firm management and business development responsibilities shared by a group of senior employees, while Firm B is dependent on a couple of key individuals for a substantial portion of the firm’s revenue and managerial duties.

Click here to expand the image above

So, how can you take steps to minimize key person risk or departure? One solution is to include a non-compete or (more commonly used) non-solicitation agreement in every advisor’s employment contract to restrict a partner’s ability to compete or recruit clients if they decide to leave the business. We’ve also seen buy-sell and operating agreements that mandate a predetermined discount be applied to the value of a departing member’s interest in the business if they leave the company within a certain amount of time.

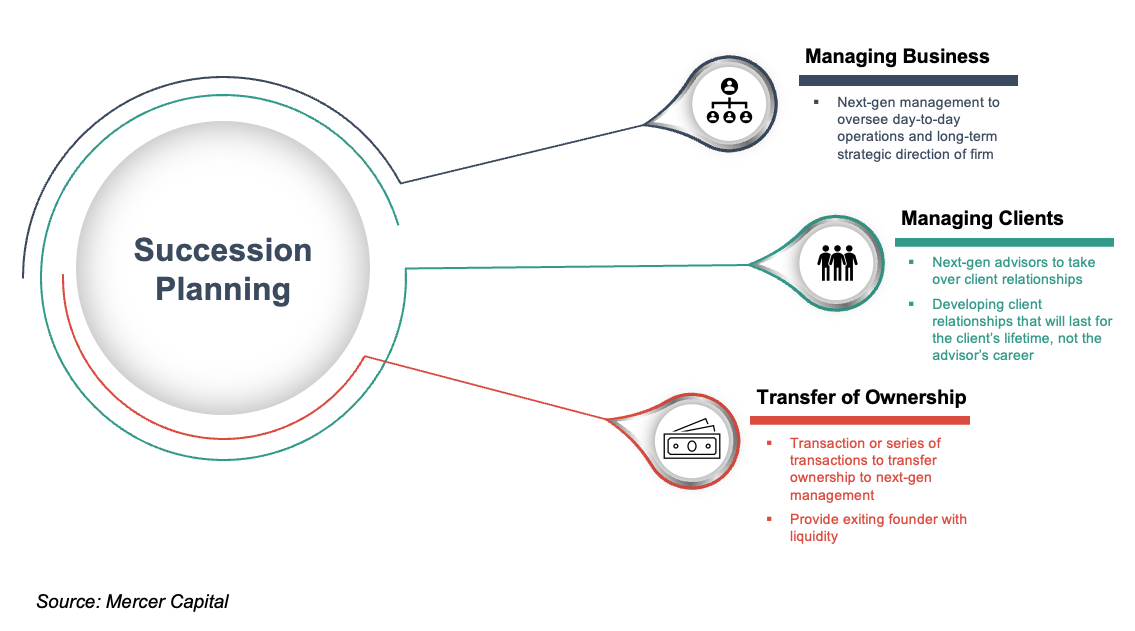

Perhaps the most viable and frequently employed option to minimize key person risk and departure is developing a viable succession plan that gradually transitions firm management, client relationships, and ownership to the next generation of company leadership.

Click here to expand the image above

Succession plans detailing how client relationships and firm ownership are transferred internally to the next generation of management are critical to the investment management industry since most RIA owners prefer working for themselves, and their clients prefer working with an independent advisor. Internal transitions allow RIAs to maintain independence over the long term and provide clients with a sense of continuity and comfort that their advisor is in it for the long haul. Further, a gradual transition of responsibilities and ownership to the next generation is usually one of the best ways to align your employees’ interests and grow the firm to everyone’s benefit. While this option typically requires the most preparation and patience, it allows the founding shareholders to handpick their successors and future leadership.

Turnover at RIAs often occurs when contributing employees don’t see a clear path to firm management or equity ownership that is increasingly available at competing firms. Without a viable succession plan or non-compete agreements, you could find yourself home alone in your RIA next holiday season.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, RIAs, trust companies, broker-dealers, PE firms, and alternative managers.

RIA Valuation Insights

RIA Valuation Insights